JetBlue Airlines 2003 Annual Report Download - page 42

Download and view the complete annual report

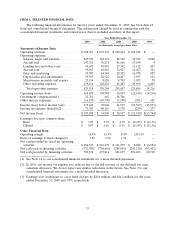

Please find page 42 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Salaries, wages and benefits increased 64.8%, or $105.2 million, due to an increase in average

full-time equivalent employees of 55.9%, higher wage rates, higher medical costs and a $14.2 million

higher provision for our profit sharing plan in 2003 compared to 2002. Cost per available seat mile

remained constant as a result of higher capacity.

Aircraft fuel expense increased 93.1%, or $71.0 million, due to 67.6 million more gallons of aircraft

fuel consumed resulting in $48.9 million of additional fuel expense and a 17.7% increase in average

fuel cost per gallon, or $22.1 million. Realized gains on our derivative contracts of $3.6 million were

recorded as an offset to fuel expense in 2003 compared to a gain of $1.2 million in 2002. Cost per

available seat mile increased 16.7% due to the increase in average fuel cost per gallon.

Landing fees and other rents increased 56.5%, or $24.8 million, due to a 51.6% increase in

departures. Cost per available seat mile decreased 5.4% due to higher capacity and an increase in

average stage length.

Aircraft rent increased 46.8%, or $19.2 million, due to having an average of 20.8 aircraft operated

under operating leases during 2003 compared to 13.0 in 2002. Cost per available seat mile decreased

11.3% due to longer lease terms and lower lease rates.

Sales and marketing expense increased 20.8%, or $9.2 million, due to increased advertising and

higher credit card fees resulting from increased passenger revenues. These increases were offset by

lower travel agent commissions following their elimination in April 2002. On a cost per available seat

mile basis, sales and marketing expense decreased 27.0% primarily due to the increase in available seat

miles and lower commissions. We book the majority of our reservations through a combination of our

website (73.0% in 2003) and our own reservation agents (24.6% in 2003).

Depreciation and amortization increased 87.2%, or $23.5 million, primarily due to having an

average of 23.2 owned aircraft in 2003 compared to 14.0 in 2002. We also recorded $4.3 million more

in amortization of the LiveTV purchased technology in 2003 than we did in 2002. Cost per available

seat mile increased 13.1% as a result of the amortization of purchased technology.

Maintenance materials and repairs increased 159%, or $14.2 million, due to 17.0 more average

aircraft in operation as well as the completion of 15 more scheduled airframe checks and our first nine

engine repairs in 2003 compared to 2002. The cost per available seat mile increased 56.4%

year-over-year due to aircraft and components coming off warranties and the start of engine repairs,

and is expected to increase significantly as our fleet ages.

Other operating expenses increased 25.5%, or $32.3 million, primarily due to higher variable costs

associated with increased capacity and number of passengers served. Cost per available seat mile

decreased 24.2% as a result of our fixed costs being spread over higher capacity, better bad debt

experience and the consolidation of LiveTV’s operations in 2003.

Other Income (Expense). Interest expense increased 37.5%, or $7.9 million, due to the debt

financing of eight additional aircraft and interest on our 31⁄2% convertible notes resulting in

$11.2 million of additional interest expense, offset by $3.3 million due to lower interest rates.

Interest income increased by $2.2 million due to higher cash and investment balances offset by lower

interest rates. Other income also includes unrealized gains and losses on our derivative contracts, which

resulted in gains of $2.2 million in 2003 and $0.7 million in 2002.

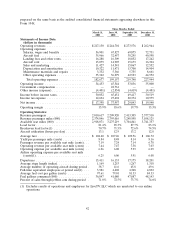

Year 2002 Compared to Year 2001

Our net income for the year 2002 increased to $54.9 million from $38.5 million for the year 2001.

We had operating income of $105.0 million, an increase of $78.2 million over 2001, and our operating

margin was 16.5%, up 8.1 points from 2001. Our effective tax rate was 42.2% in 2002 compared to

8.1% in 2001 due to the full reversal of our deferred tax asset valuation allowance in 2001. Diluted

earnings per share was $0.56 and $0.51 for the years ended 2002 and 2001, respectively. Our earnings

39