JetBlue Airlines 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

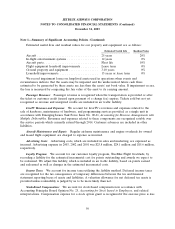

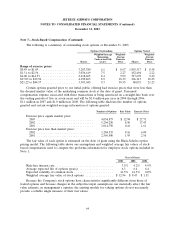

Note 7—Stock-Based Compensation (Continued)

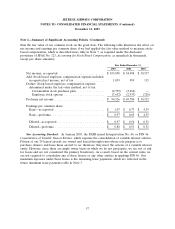

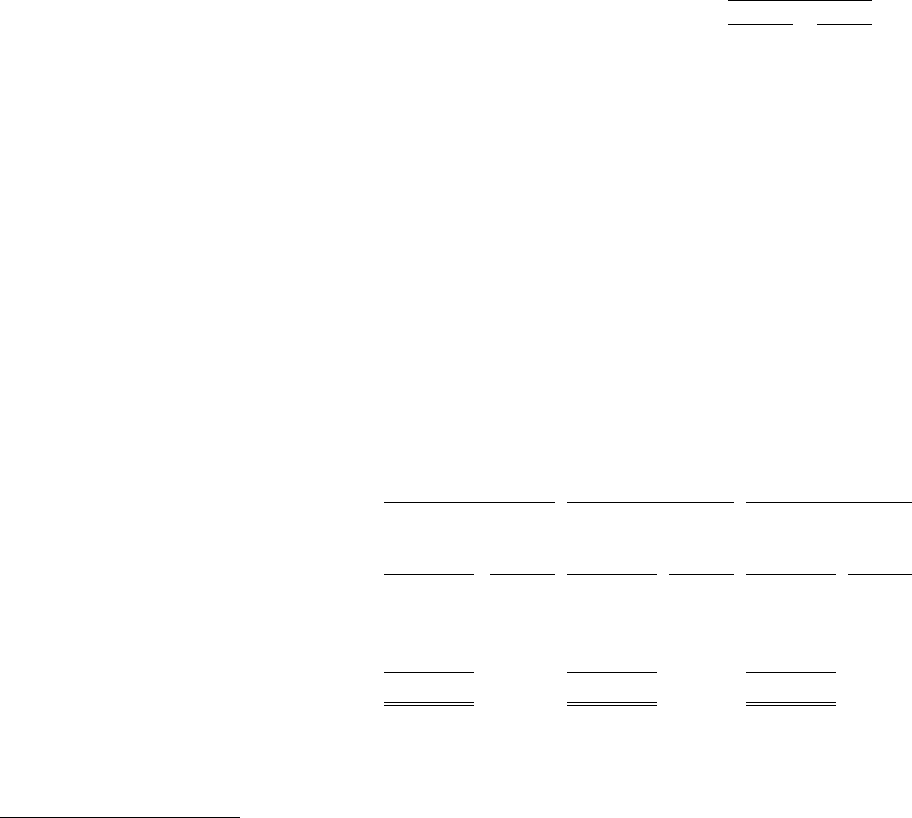

average fair values of stock-based compensation used to compute the proforma information for CSPP

purchase rights included in Note 1:

Year of Purchase

Right

2003 2002

Risk-free interest rate ....................................... 1.3% 2.7%

Average expected life (years) .................................. 1.25 1.25

Expected volatility of common stock ............................. 41.5% 41.3%

Weighted average fair value of purchase rights ..................... $ 11.44 $ 5.44

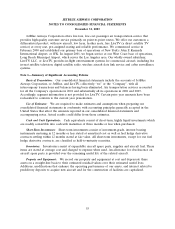

Stock Incentive Plan: The 2002 Stock Incentive Plan, or the 2002 Plan, provides for incentive and

non-qualified stock options to be granted to certain employees and members of the Board of Directors.

The 2002 Plan became effective following our initial public offering and provided that all outstanding

options under the 1999 Stock Option/Stock Issuance Plan, or the 1999 Plan, be transferred to the 2002

Plan. No further option grants will be made under the 1999 Plan. The transferred options will continue

to be governed by their existing terms. Stock options under the 2002 Plan become exercisable when

vested, which occurs in annual installments of three to seven years or upon the occurrence of a change

in control, and expire 10 years from the date of grant. Our policy is to grant options with the exercise

price equal to the market price of the underlying common stock on the date of grant. The number of

shares reserved for issuance will automatically increase each January by an amount equal to 4% of the

total number of shares of our common stock outstanding on the last trading day in December of the

prior calendar year. In no event will any such annual increase exceed 8.1 million shares.

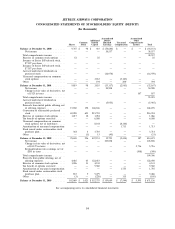

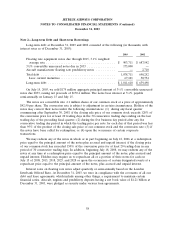

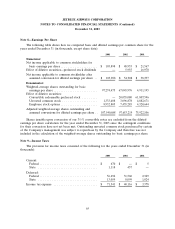

The following is a summary of stock option activity for the years ended December 31:

2003 2002 2001

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

Shares Price Shares Price Shares Price

Outstanding at beginning of year ....... 13,439,631 $ 7.87 8,544,780 $ 1.33 5,255,505 $ 0.67

Granted ......................... 4,054,875 27.71 6,488,785 15.16 3,584,250 2.29

Exercised ........................ (1,096,199) 3.78 (1,217,437) 0.87 (52,200) 0.49

Forfeited ........................ (245,295) 11.65 (376,497) 7.49 (242,775) 1.45

Outstanding at end of year ........... 16,153,012 13.08 13,439,631 7.87 8,544,780 1.33

Vested at end of year ............... 2,971,637 3.90 2,632,770 1.05 1,871,201 0.57

Reserved for issuance ............... 18,436,107(1) 14,610,603 11,542,428

Available for future grants ............ 57,209 41,285 2,778,573

(1) On January 1, 2004, the number of shares reserved for issuance was increased by 4,082,764 shares.

63