JetBlue Airlines 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Mr. Anderson was with Boeing Commercial Airplane Group where his positions included Sales

Director. He joined JetBlue in early 1999 as Director, Aircraft Programs.

Tim Claydon, age 39, is our Senior Vice President Sales, Marketing and Information Technology.

He has served in this capacity since July 2003 when he was promoted from Vice President Sales and

Business Development, a position he had held since February 2001. Mr. Claydon served as Senior

Manager Supplier Relations with Expedia Inc. from 1999 to 2001. From 1988 to 1999, he held various

sales and marketing management roles at Virgin Atlantic Airways, both in the UK and US, including

Vice President Sales and Marketing, North America.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

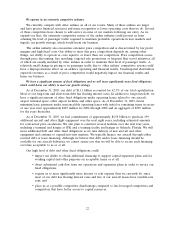

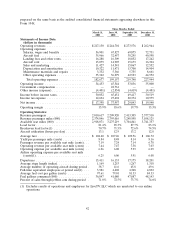

On April 12, 2002, our common stock began trading on the Nasdaq National Market under the

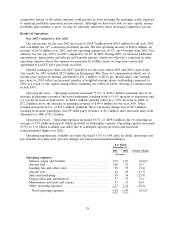

symbol JBLU. Prior to that time, there was no public trading market for our common stock. The table

below shows the high and low sales prices for our common stock, as adjusted for our November 2003

and December 2002 three-for-two stock splits:

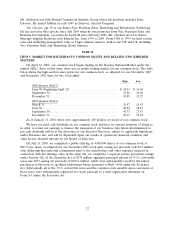

High Low

2002 Quarter Ended

June 30 (beginning April 12) ........................... $ 24.51 $ 16.65

September 30 ...................................... 21.58 16.02

December 31 ...................................... 18.89 13.22

2003 Quarter Ended

March 31 ......................................... 19.97 15.43

June 30 .......................................... 28.54 18.16

September 30 ...................................... 41.73 27.55

December 31 ...................................... 47.15 25.44

As of January 31, 2004, there were approximately 450 holders of record of our common stock.

We have not paid cash dividends on our common stock and have no current intention of doing so,

in order to retain our earnings to finance the expansion of our business. Any future determination to

pay cash dividends will be at the discretion of our Board of Directors, subject to applicable limitations

under Delaware law, and will be dependent upon our results of operations, financial condition and

other factors deemed relevant by our Board of Directors.

On July 15, 2003, we completed a public offering of 4,485,000 shares of our common stock at

$28.33 per share, as adjusted for our November 2003 stock split, raising net proceeds of $122.5 million,

after deducting discounts and commissions paid to the underwriters and other expenses incurred in

connection with the offering. Also on the same day, we completed a separate private placement exempt

under Section 4(2) of the Securities Act of $175 million aggregate principal amount of 31⁄2% convertible

notes due 2033 raising net proceeds of $170.4 million, which were subsequently resold by the initial

purchasers of the notes to qualified institutional buyers pursuant to Rule 144A under the Securities

Act. Substantially all of the 31⁄2% convertible notes and the common stock issuable upon conversion of

those notes were subsequently registered for resale pursuant to a shelf registration statement on

Form S-3 under the Securities Act.

32