JetBlue Airlines 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

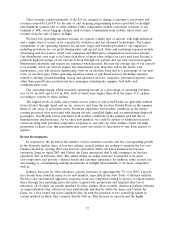

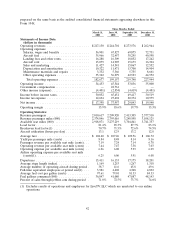

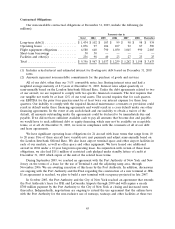

Contractual Obligations

Our noncancelable contractual obligations at December 31, 2003, include the following (in

millions):

Payments due in

Total 2004 2005 2006 2007 2008 Thereafter

Long-term debt(1) .................. $ 1,434 $ 102 $ 103 $ 99 $ 98 $ 98 $ 934

Operating leases ................... 1,076 97 104 107 92 87 589

Flight equipment obligations ........... 6,580 640 790 1,030 1,045 990 2,085

Short-term borrowings ............... 30 30———— —

Facilities and other(2) ............... 236 98 40 23 27 23 25

Total ............................ $ 9,356 $ 967 $ 1,037 $ 1,259 $ 1,262 $ 1,198 $ 3,633

(1) Includes actual interest and estimated interest for floating-rate debt based on December 31, 2003

rates.

(2) Amounts represent noncancelable commitments for the purchase of goods and services.

All of our debt, other than our 31⁄2% convertible notes, has floating interest rates and had a

weighted average maturity of 8.9 years at December 31, 2003. Interest rates adjust quarterly or

semi-annually based on the London Interbank Offered Rate. Under the debt agreements related to two

of our aircraft, we are required to comply with two specific financial covenants. The first requires that

our tangible net worth be at least 12% of our total assets. The second requires that for each quarter,

our EBITDA for the prior four quarters must be at least twice our interest expense for those four

quarters. Our inability to comply with the required financial maintenance covenants or provisions could

result in default under these financing agreements and would result in a cross default under our other

financing agreements. In the event of any such default and our inability to obtain a waiver of the

default, all amounts outstanding under the agreements could be declared to be immediately due and

payable. If we did not have sufficient available cash to pay all amounts that become due and payable,

we would have to seek additional debt or equity financing, which may not be available on acceptable

terms, or at all. At December 31, 2003, we were in compliance with the covenants of all of our debt

and lease agreements.

We have significant operating lease obligations for 24 aircraft with lease terms that range from 10

to 20 years. Five of these aircraft have variable-rate rent payments and adjust semi-annually based on

the London Interbank Offered Rate. We also lease airport terminal space and other airport facilities in

each of our markets, as well as office space and other equipment. We have leased one additional

aircraft in 2004 under a 12-year long-term operating lease. In conjunction with certain of these lease

obligations, we also had $15.1 million of restricted cash pledged under standby letters of credit at

December 31, 2003 which expire at the end of the related lease terms.

During September 2003, we reached an agreement with the Port Authority of New York and New

Jersey on the terms of a lease for the use of Terminal 6 and the adjoining ramp area, through

November 2006. We are awaiting execution of this lease by the Port Authority. In addition, discussions

are ongoing with the Port Authority and the FAA regarding the construction of a new terminal at JFK.

If an agreement is reached, we plan to build a new terminal with occupancy projected in late 2007.

In October 2003, the Port Authority and the City of New York reached an agreement that extends

the Port Authority’s lease for JFK and LaGuardia Airports through 2050 and will require a nearly

$700 million payment by the Port Authority to the City of New York at closing and increased rents

thereafter. Independently, negotiations are ongoing to extend the use agreement that the airlines have

with the Port Authority for the non-exclusive use of runways, taxiways and other facilities at these two

45