JetBlue Airlines 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

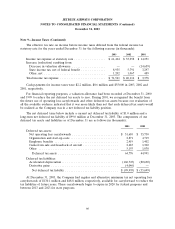

Note 10—Employee Retirement Plan

The Company has a retirement savings 401(k) defined contribution plan, or the Plan, covering all

its employees. We match 100 percent of our employee contributions up to three percent of their

compensation in cash, which then vests over five years. Participants are immediately vested in their

voluntary contributions. During 2001, we established a profit sharing retirement plan as a separate

component of the Plan for all of our employees under which an award pool consisting of 15 percent of

the Company’s pre-tax earnings, subject to Board of Director approval, is distributed on a pro rata

basis based on employee compensation. These contributions vest immediately. Total Company

contributions expensed in 2003, 2002 and 2001 were $35.3 million, $19.3 million and $8.6 million,

respectively, for the Plan.

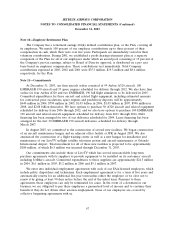

Note 11—Commitments

At December 31, 2003, our firm aircraft orders consisted of 99 Airbus A320 aircraft, 100

EMBRAER 190 aircraft and 33 spare engines scheduled for delivery through 2012. We also have firm

orders for four Airbus A320 and two EMBRAER 190 full flight simulators to be delivered in 2005.

Committed expenditures for these aircraft and related flight equipment, including estimated amounts

for contractual price escalations, spare engines and predelivery deposits, will be approximately

$640 million in 2004, $790 million in 2005, $1.03 billion in 2006, $1.05 billion in 2007, $990 million in

2008, and $2.08 billion thereafter. We have options to purchase 50 A320 aircraft and related equipment

scheduled for delivery from 2006 through 2012, and we also have options to purchase 100 EMBRAER

190 aircraft and related aircraft equipment scheduled for delivery from 2011 through 2016. Debt

financing has been arranged for two of our deliveries scheduled for 2004. Lease financing has been

arranged for the first 30 EMBRAER 190 aircraft deliveries, scheduled for delivery through

March 2007.

In August 2003, we committed to the construction of several new facilities. We began construction

of an aircraft maintenance hangar and an adjacent office facility at JFK in August 2003. We also

announced the construction of a flight training center as well as a new hangar for installation and

maintenance of our LiveTV in-flight satellite television system and aircraft maintenance at Orlando

International Airport. Total investment for all of these new facilities is projected to be approximately

$100 million, of which $6.5 million was incurred through December 31, 2003.

Our commitments also include those of LiveTV which has several noncancelable long-term

purchase agreements with its suppliers to provide equipment to be installed on its customers’ aircraft

including JetBlue’s aircraft. Committed expenditures to these suppliers are approximately $24.3 million

in 2004, $6.1 million in 2005, $5.2 million in 2006 and $5.1 million in 2007.

We enter into individual employment agreements with each of our FAA-licensed employees, which

include pilots, dispatchers and technicians. Each employment agreement is for a term of five years and

automatically renews for an additional five-year term unless either the employee or we elect not to

renew it by giving at least 90 days notice before the end of the initial term. Pursuant to these

agreements, these employees can only be terminated for cause. In the event of a downturn in our

business, we are obligated to pay these employees a guaranteed level of income and to continue their

benefits if they do not obtain other aviation employment. None of our employees are covered by

collective bargaining agreements with us.

67