JetBlue Airlines 2003 Annual Report Download - page 51

Download and view the complete annual report

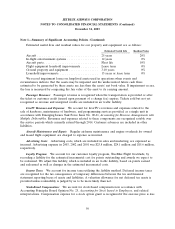

Please find page 51 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.instruments was $11.0 million. As the majority of our financial derivative instruments are not traded on

a market exchange, we estimate their fair values with the assistance of third parties determined by the

use of present value methods or standard option value models, with assumptions about commodity

prices based on those observed in underlying markets. In addition, as there is not a reliable forward

market for jet fuel, we must estimate the future prices of jet fuel in order to measure the effectiveness

of the hedging instruments in offsetting changes to those prices, as required by SFAS No. 133,

Accounting for Derivative Instruments and Hedging Activities. Forward jet fuel prices are estimated

through the observation of similar commodity futures prices (such as crude oil) and adjusted based on

variations to those like commodities. As the majority of our hedges settle within 22 months, the

variation between estimates and actuals are recognized in a short period of time.

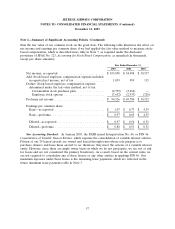

Frequent flyer accounting. We utilize a number of estimates in accounting for our TrueBlue

customer loyalty program, which are consistent with industry practices. We record a liability, which was

$0.6 million as of December 31, 2003, for the estimated incremental cost of providing free travel

awards, including an estimate for partially earned awards. The estimated cost includes incremental fuel,

insurance, passenger food and supplies, and reservation fees. In estimating the liability, we currently

assume that 100% of earned awards will be redeemed and that 35% of our outstanding points, based

on our limited experience since the inception of the program, will ultimately result in awards.

Periodically, we evaluate our assumptions for appropriateness, including comparison of the cost

estimates to actual costs incurred and the redemption assumptions to actual redemption experience.

Changes in the minimum award levels or in the lives of the awards would also require us to reevaluate

the liability, potentially resulting in a significant impact in the year of change as well as in future years.

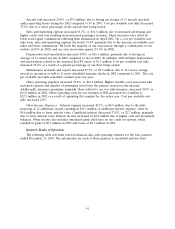

Outlook for 2004

We expect our operating capacity to increase approximately 35% to 37% over 2003 with the

addition of 16 new Airbus A320 aircraft in 2004. Average stage length is expected to increase to

approximately 1,400 miles in 2004 and, together with the current competitive revenue environment, is

expected to result in lower passenger revenues per available seat mile. Further actions by our

competitors could also impact our revenues. Unit costs, on a fuel neutral basis, are expected to be

slightly higher than 2003. Higher maintenance costs are expected to be partially offset by our fixed

costs being spread over higher projected available seat miles. Operating margin on a fuel neutral basis

is expected to be between 13% to 15% for 2004. Our effective tax rate is not expected to change

significantly from 2003.

Fuel costs have risen sharply since early December 2003 and may increase further. Although we

have hedged approximately 45% of our fuel requirements for the first quarter of 2004 and 40% for the

full year, we expect to incur higher fuel costs in the first quarter of 2004 than we have recently.

We continue to add service, as indicated by our new daily non-stop service between New York and

Sacramento, CA scheduled to begin in March 2004 and the recent announcement of our intention to

begin service out of New York’s LaGuardia Airport this spring. We believe that we are well-positioned

to continue to grow and be successful in this environment, absent factors outside of our control.

48