JetBlue Airlines 2003 Annual Report Download - page 62

Download and view the complete annual report

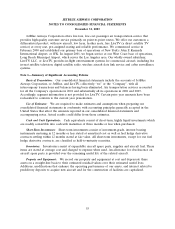

Please find page 62 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

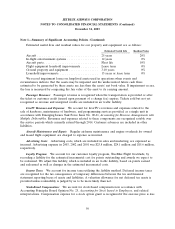

Note 2—Long-term Debt and Short-term Borrowings (Continued)

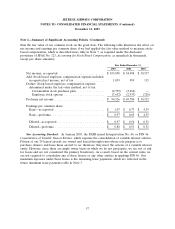

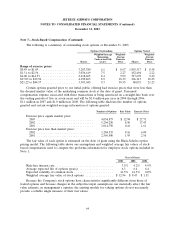

Maturities of long-term debt for the next five years are as follows (in thousands):

2004 .................................................. $ 67,101

2005 .................................................. 69,840

2006 .................................................. 69,802

2007 .................................................. 70,515

2008 .................................................. 72,623

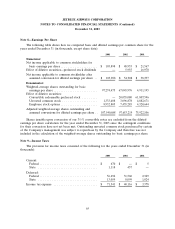

Cash payments of interest, net of capitalized interest, aggregated $19.7 million, $14.2 million and

$4.8 million in 2003, 2002 and 2001, respectively. Non-cash predelivery financing obtained in connection

with the acquisition of new aircraft was $34.0 million in 2001.

In November 2000, we entered into a funding facility to finance aircraft predelivery deposits. The

facility, as amended in September 2003, allows for borrowings up to $34.0 million through

November 2005. Commitment fees are .35% per annum on the average unused portion of the facility.

At December 31, 2003, $4.1 million was available under this facility. The weighted average interest rate

on these outstanding short-term borrowings at December 31, 2003 and 2002 was 2.7% and 2.9%,

respectively.

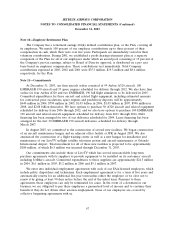

On October 7, 2003, we filed a registration statement on Form S-3 with the SEC, File

No. 333-109546, which, when effective, will permit us to offer up to $750 million aggregate amount of

common stock, preferred stock, debt securities and/or pass through certificates. This registration

statement has not yet become effective and we have not issued nor offered any securities related to it.

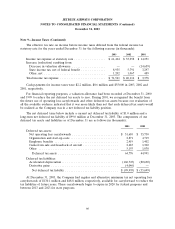

Note 3—Leases

We lease aircraft, as well as airport terminal space, other airport facilities, office space and other

equipment, which expire in various years through 2024. Total rental expense for all operating leases in

2003, 2002 and 2001 was $99.1 million, $64.5 million and $49.7 million, respectively. We have

$15.1 million of restricted cash pledged under standby letters of credit related to these leases which is

included in other assets.

At December 31, 2003, 24 of the 53 aircraft we operated were leased under operating leases, with

initial lease term expiration dates ranging from 2009 to 2023. Five of the 24 aircraft leases have

variable-rate rent payments based on the London Interbank Offered Rate. Seventeen aircraft leases

generally can be renewed at rates based on fair market value at the end of the lease term for one, two

or four years and 15 aircraft leases have purchase options after five or 12 years at amounts that are

expected to approximate fair market value or at the end of the lease term at fair market value. We

entered into sale and leaseback transactions for seven aircraft which we had acquired during 2003.

Gains associated with these operating leases have been deferred and are being recognized on a

straight-line basis over the lease term as a reduction to rent expense.

59