JetBlue Airlines 2003 Annual Report Download - page 49

Download and view the complete annual report

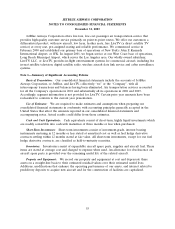

Please find page 49 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.airports, which expired on December 31, 2003. The impact on us of these new agreements is currently

unknown, but could result in significantly increased operating costs at JFK.

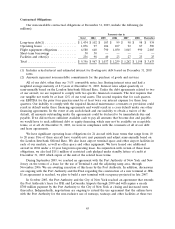

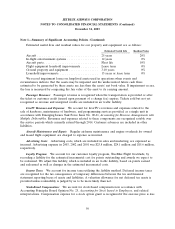

Our firm aircraft orders at December 31, 2003 consisted of 99 Airbus A320 aircraft and 100

EMBRAER 190 aircraft scheduled for delivery as follows: 15 in 2004, 22 in 2005, 33 in each year in

2006 and 2007, 31 in 2008, 28 in each year in 2009 and 2010, and nine in 2011. We currently meet our

predelivery deposit requirements for our Airbus A320 aircraft by paying cash, or by using a short-term

borrowing facility, for deposits required 24 and 12 months prior to delivery. Any Airbus A320

predelivery deposits paid by the issuance of notes are fully repaid at the time of delivery of the related

aircraft. Predelivery deposits for our EMBRAER 190 aircraft are required 15, 12 and six months prior

to delivery. We do not have a borrowing facility secured for these deposits.

We also have options to acquire 50 additional Airbus A320 aircraft for delivery from 2006 through

2012 and 100 additional EMBRAER 190 aircraft for delivery from 2011 through 2016. We can elect to

substitute Airbus A321 aircraft or A319 aircraft for the A320 aircraft until 21 months prior to the

scheduled delivery date for those aircraft not on firm order.

We currently have approval from the FAA and the DOT to operate 70 aircraft through

March 2005. Our growth plans and aircraft purchase commitments contemplate operating considerably

more than 70 aircraft. As the number of our operating aircraft grows nearer this 70-aircraft restriction,

we will need to submit an application to the DOT for authorization to increase the size of our fleet

beyond 70 aircraft. We cannot assure you that such authorization, when it is applied for, will be granted

to us.

In August 2003, we committed to the construction of several new facilities. We began construction

of an aircraft maintenance hangar and an adjacent office facility at JFK. We also announced the

construction of a flight training center as well as a new hangar for installation and maintenance of our

LiveTV in-flight satellite television system and aircraft maintenance at Orlando International Airport.

Total investment for all of these new facilities is projected to be approximately $100 million, of which

$6.5 million was spent during 2003. Anticipated capital expenditures for spare parts, ground purchases

and facility improvements for 2004 are projected to be approximately $110 million in the aggregate.

In September 2003, we agreed to purchase six full-flight simulators, with options to purchase seven

additional simulators. The commitments related to the four Airbus A320 and two EMBRAER 190

simulators are included in flight equipment obligations in the table above. The simulators are expected

to be financed with our working capital and are scheduled to be delivered and installed at our new

training facility in Orlando in 2005.

Our commitments also include those of LiveTV which has several noncancelable long-term

purchase agreements with its suppliers to provide equipment to be installed on its customers’ aircraft,

including JetBlue’s aircraft.

We enter into individual employment agreements with each of our FAA-licensed employees. Each

employment agreement is for a term of five years and automatically renews for an additional five-year

term unless either the employee or we elect not to renew it. Pursuant to these agreements, these

employees can only be terminated for cause. In the event of a downturn in our business, we are

obligated to pay these employees a guaranteed level of income and to continue their benefits if they do

not obtain other aviation employment. As we are not currently obligated to pay this guaranteed income

and benefits, no amounts related to these guarantees are included in the table above.

Off-Balance Sheet Arrangements

None of our operating lease obligations are reflected on our balance sheet. Although some of our

aircraft lease arrangements are variable interest entities as defined by FASB Interpretation No. 46,

Consolidation of Variable Interest Entities, or FIN 46, none of them require consolidation in our financial

46