JetBlue Airlines 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

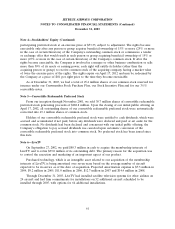

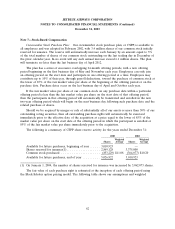

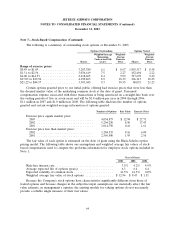

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

Note 13—Financial Instruments and Risk Management (Continued)

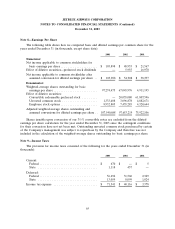

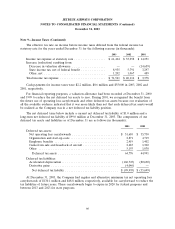

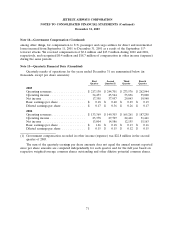

amount. The following is a summary of our derivative contracts (in thousands, except as otherwise

indicated):

2003 2002

At December 31:

Fair value of derivative instruments at year end ................... $ 10,992 $ 2,013

Estimated hedged position during the next 12 months .............. 40% 45%

Longest remaining term (months) ............................. 12 15

Hedged volume (barrels) ................................... 2,385 2,058

Year ended December 31:

Hedge effectiveness recognized in aircraft fuel expense ............. $ 3,605 $ 1,158

Hedge ineffectiveness gains recognized in other income (expense) ..... $ 2,188 $ 44

Percentage of actual consumption hedged ....................... 72% 52%

In December 2002, we designated our outstanding derivative contracts as cash flow hedges for

accounting purposes and have similarly designated all new contracts executed since. While outstanding,

these contracts are recorded at fair value on the balance sheet with the effective portion of the change

in their fair value being reflected in other comprehensive income. Ineffectiveness, the extent to which

the change in fair value of the crude oil derivatives exceeds the change in the fair value of the aircraft

fuel being hedged, is recognized in other income (expense) immediately. When aircraft fuel is

consumed and the related derivative contract settles, any gain or loss previously deferred in other

comprehensive income is recognized as an offset to aircraft fuel expense.

Any outstanding financial derivative instruments expose us to credit loss in the event of

nonperformance by the counterparties to the agreements, but we do not expect any of our four

counterparties to fail to meet their obligations. The amount of such credit exposure is generally the

unrealized gains, if any, in such contracts. To manage credit risks, we select counterparties based on

credit assessments, limit overall exposure to any single counterparty and monitor the market position

with each counterparty. We do not use derivative instruments for trading purposes.

Note 14—Government Compensation

Emergency War Time Act: On April 16, 2003, the President signed into law the Emergency War

Time Supplemental Appropriations Act of 2003, which provides for compensation to domestic air

carriers based on their proportional share of passenger security and air carrier infrastructure security

fees paid by those carriers through the date of enactment of the legislation. On May 15, 2003, we

received $22.8 million in compensation pursuant to this legislation, which is recorded in other income

(expense). This legislation also provided for (1) the suspension of passenger security fees and air carrier

infrastructure security fees from June 1, 2003 through September 30, 2003, (2) additional

reimbursement to all carriers for the direct costs associated with installing strengthened flight deck

doors, and (3) an extension of the aviation war risk insurance provided by the government for one year

to August 2004, with the potential for extension through December 31, 2004.

Airline Stabilization Act: On September 22, 2001, the President signed into law the Air

Transportation Safety and System Stabilization Act, or the Airline Stabilization Act, which provided,

70