JetBlue Airlines 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

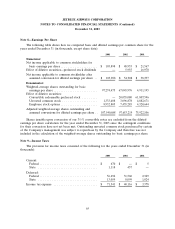

Note 9—Income Taxes (Continued)

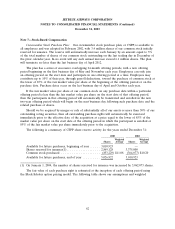

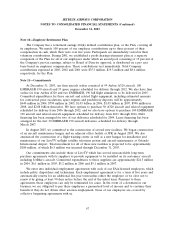

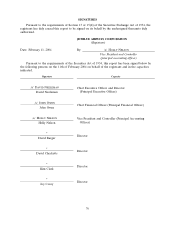

The effective tax rate on income before income taxes differed from the federal income tax

statutory rate for the years ended December 31 for the following reasons (in thousands):

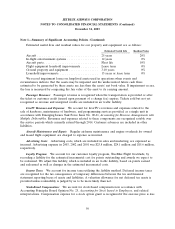

2003 2002 2001

Income tax expense at statutory rate .................. $ 61,404 $ 33,258 $ 14,251

Increase (reduction) resulting from:

Decrease in valuation allowance ................... — — (14,659)

State income tax, net of federal benefit .............. 8,935 5,791 3,297

Other, net ................................... 1,202 1,067 489

Total income tax expense .......................... $ 71,541 $ 40,116 $ 3,378

Cash payments for income taxes were $2.2 million, $0.6 million and $55,000 in 2003, 2002 and

2001, respectively.

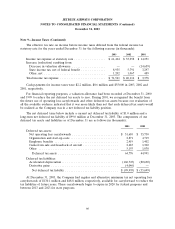

For financial reporting purposes, a valuation allowance had been recorded at December 31, 2000

and 1999 to reduce the net deferred tax assets to zero. During 2001, we recognized the benefit from

the future use of operating loss carryforwards and other deferred tax assets because our evaluation of

all the available evidence indicated that it was more likely than not that such deferred tax assets would

be realized as the Company was in a net deferred tax liability position.

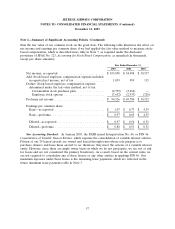

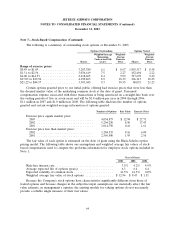

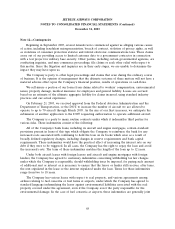

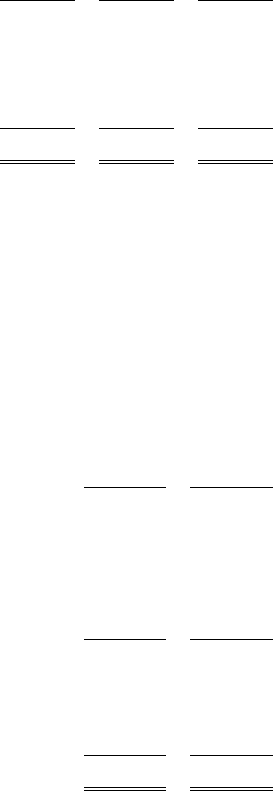

The net deferred taxes below include a current net deferred tax liability of $1.0 million and a

long-term net deferred tax liability of $99.0 million at December 31, 2003. The components of our

deferred tax assets and liabilities as of December 31 are as follows (in thousands):

2003 2002

Deferred tax assets:

Net operating loss carryforwards .......................... $ 51,610 $ 35,730

Organization and start-up costs ........................... 2,871 4,719

Employee benefits .................................... 2,419 1,402

Gains from sale and leaseback of aircraft .................... 2,683 1,302

Other ............................................. 5,193 1,838

Deferred tax assets .................................. 64,776 44,991

Deferred tax liabilities:

Accelerated depreciation ................................ (160,723) (80,690)

Derivative gains ...................................... (4,046) —

Net deferred tax liability .............................. $ (99,993) $ (35,699)

At December 31, 2003, the Company had regular and alternative minimum tax net operating loss

carryforwards of $130.1 million and $48.8 million, respectively, available for carryforward to reduce the

tax liabilities of future years. These carryforwards begin to expire in 2020 for federal purposes and

between 2013 and 2023 for state purposes.

66