JetBlue Airlines 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

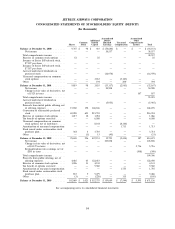

Note 4—Stockholders’ Equity (Continued)

participating preferred stock at an exercise price of $53.33, subject to adjustment. The rights become

exercisable only after any person or group acquires beneficial ownership of 15% or more (25% or more

in the case of certain Investors) of the Company’s outstanding common stock or commences a tender

or exchange offer that would result in such person or group acquiring beneficial ownership of 15% or

more (25% or more in the case of certain Investors) of the Company’s common stock. If after the

rights become exercisable, the Company is involved in a merger or other business combination or sells

more than 50% of its assets or earning power, each right will entitle its holder (other than the

acquiring person or group) to receive common stock of the acquiring company having a market value

of twice the exercise price of the rights. The rights expire on April 17, 2012 and may be redeemed by

the Company at a price of $.01 per right prior to the time they become exercisable.

As of December 31, 2003, we had a total of 25.4 million shares of our common stock reserved for

issuance under our Crewmember Stock Purchase Plan, our Stock Incentive Plan and for our 31⁄2%

convertible notes.

Note 5—Convertible Redeemable Preferred Stock

From our inception through November 2001, we sold 30.7 million shares of convertible redeemable

preferred stock generating proceeds of $188.8 million. Upon the closing of our initial public offering on

April 17, 2002, all outstanding shares of our convertible redeemable preferred stock were automatically

converted into 69.1 million shares of common stock.

Holders of our convertible redeemable preferred stock were entitled to cash dividends, which were

accrued and accumulated if not paid, before any dividends were declared and paid or set aside for the

common stock. No dividends had been declared and concurrent with our initial public offering, the

Company’s obligation to pay accrued dividends was canceled upon automatic conversion of the

convertible redeemable preferred stock into common stock. No preferred stock has been issued since

this date.

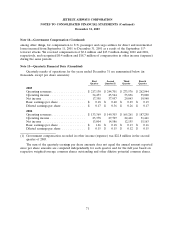

Note 6—LiveTV

On September 27, 2002, we paid $80.3 million in cash to acquire the membership interests of

LiveTV and to retire $39.0 million of its outstanding debt. The primary reason for the acquisition was

to control the execution and marketing of an important aspect of our product.

Purchased technology, which is an intangible asset related to our acquisition of the membership

interests of LiveTV, is being amortized over seven years based on the average number of aircraft

expected to be in service as of the date of acquisition. Projected amortization expense is $7.3 million in

2004, $9.2 million in 2005, $11.0 million in 2006, $12.7 million in 2007 and $14.4 million in 2008.

Through December 31, 2003, LiveTV had installed satellite television systems for other airlines on

24 aircraft and had firm commitments for installations on 52 additional aircraft scheduled to be

installed through 2005, with options for 64 additional installations.

61