Hyundai 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

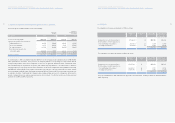

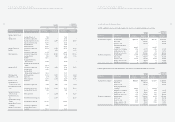

26. DISPOSAL OF RECEIVABLES IN FINANCIAL SUBSIDIARIES:

Hyundai Capital Service Inc., Hyundai Card Co., Ltd. and Hyundai Motor Finance Company dispose their finance receivable

assets to special purpose companies or financial intermediaries for the purpose of funding its operating capital. Hyundai

Capital Service Inc. disposed such assets of ₩2,611,236 million (US$2,577,726 thousand) and ₩4,366,544 million

(US$4,310,507 thousand) in 2005 and 2004, respectively, with a resultant net gain of ₩13,635 million (US$13,460 thousand)

and ₩24,180 million (US$23,870 thousand) in 2005 and 2004, respectively. Also, Hyundai Card Co., Ltd. disposed its finance

receivable assets of ₩433,982 million (US$428,413 thousand) and ₩294,078 million (US$290,304 thousand) in 2005 and

2004, respectively, on a basis of the carrying amount. The gain on disposal of finance receivables assets were accounted for

as operating income and included in sales in the consolidated financial statements.

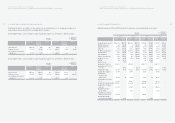

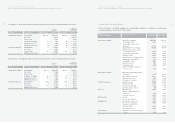

27. MERGER AND SIGNIFICANT TRANSACTIONS OF BUSINESS OR ASSETS:

(1) Effective April 11, 2005, METIA Co., Ltd. acquired receivables and security rights from ISU Casting Co., Ltd. for ₩22,500

million (US$22,211 thousand). On April 22, 2005, METIA also made a successful bid for plant site and main facilities

through public sale of Chang-won District Court by the bid amount of ₩26,000 million (US$25,666 thousand) and gain on

recovery of secured debts with the amount of ₩3,748 million (US$3,700 thousand) was accounted for as non-operating

income. METIA Co., Ltd. also acquired the business with assets and liabilities from Samjoo Machinery Co., Ltd. for ₩2,350

million (US$2,320 thousand). The excess amount of ₩5,609 million(US$5,537 thousand) of the investment over the

recognizable fair value was recorded as goodwill.

(2) Effective January 1, 2005, WIA Corporation acquired both Machine Tool Engineering department of HMC with assets and

liabilities and the equity of Hyundai Machine Tools Europe Gmbh (HYME) for ₩46,124 million (US$45,532 thousand). In

addition, HYME changed its firm name to Hyundai-Kia Machine Europe Gmbh (HKME).

(3) Effective November 5, 2004, the Company merged with Hyundai Commercial Vehicle Engine Co., Ltd. (HCVE) with assets

of ₩125,110 million (US$123,504 thousand) and liabilities of ₩127,418 million (US$125,783 thousand) without issuing new

common stock for its shareholders (the exchange rate for merger – the Company : HCVE = 1 : 0). Since HCVE was a

subsidiary of the Company and in accordance with the Accounting Standards for Business Combination in the Republic of

Korea, the excess amount of ₩32,915 million (US$32,496 thousand) of the investment securities in HCVE over the carrying

amount of acquired net assets of the HCVE is accounted for as deduction in capital surplus.

(4) Effective February 1, 2004, ROTEM acquired the Aircraft Business division from Hyundai MOBIS with assets and liabilities of

₩15,399 million (US$15,201 thousand) and ₩504 million (US$498 thousand), respectively, for ₩14,895 million (US$14,704

thousand).

(5) Effective March 5, 2004, WIA Corporation acquired plant equipments for ₩22,258 million (US$21,972 thousand) from

Kovico. Ltd. in accordance with the decision of the board of directors on February 28, 2004. The excess cost of the

acquisition over the fair value of the plant equipments, amounting to ₩5,151 million (US$5,085 thousand), was recorded as

goodwill.

117

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

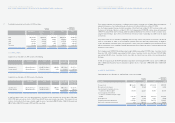

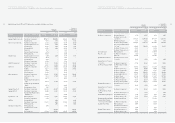

Domestic North Asia Europe Consolidation Consolidated

America adjustments amounts

Total sales ₩56,370,908 ₩14,161,711 ₩3,910,992 ₩8,594,056 ₩(24,207,035) ₩58,830,632

Inter-company sales (23,670,050) (147,223) (168,514) (221,248) 24,207,035 -

Net sales 32,700,858 14,014,488 3,742,478 8,372,808 - 58,830,632

Operating income 2,096,940 (4,133) 122,172 (160,681) 237,142 2,291,440

Total assets 59,330,969 8,746,236 1,950,654 4,247,009 (8,383,522) 65,891,346

(2) Regional Results of Operations

Results of operations, by region where the Company and its subsidiaries in 2005 are located, are as follows:

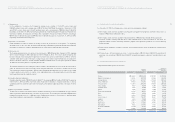

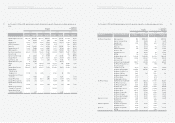

Results of operations, by region where the Company and its subsidiaries in 2004 are located, are as follows:

Korean Won

(In millions)

Domestic North Asia Europe Consolidation Consolidated

America adjustments amounts

Total sales ₩52,535,991 ₩13,383,736 ₩3,030,102 ₩6,718,250 ₩(22,567,458) ₩53,100,621

Inter-company sales (21,921,418) (68,512) (15,037) (562,491) 22,567,458 -

Net sales 30,614,573 13,315,224 3,015,065 6,155,759 - 53,100,621

Operating income 2,202,845 (57,311) 130,071 (1,513) 107,926 2,382,018

Total assets 57,138,560 4,337,373 1,872,023 507,140 (5,831,965) 58,023,131

Korean Won

(In millions)