Hyundai 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

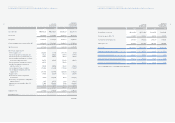

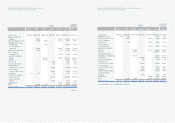

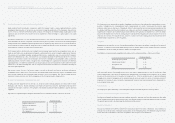

ASSETS 2005 2004 2005 2004

Current assets:

Cash and cash equivalents ₩4,397,808 ₩3,187,954 $4,341,370 $3,147,042

Short-term financial instruments (Note 17) 4,399,626 5,540,454 4,343,165 5,469,352

Short-term investment securities (Note 4) 859,774 471,218 848,740 465,171

Trade notes and accounts receivable, less

allowance for doubtful accounts of ₩219,056

million in 2005 and ₩258,146 million in 2004,

and unamortized present value discount of

₩2,743 million in 2005 and ₩1,269 million

in 2004 (Note 17) 4,327,963 2,755,645 4,272,422 2,720,281

Inventories (Notes 3 and 17) 7,976,723 6,940,542 7,874,356 6,851,473

Advances and other, net of allowance for

doubtful accounts of ₩353,466 million in 2005

and ₩98,855 million in 2004 2,964,964 3,317,974 2,926,914 3,275,394

Total current assets 24,926,858 22,213,787 24,606,967 21,928,713

Non-current assets:

Long-term financial instruments (Note 17) 71,653 135,385 70,733 133,648

Long-term investment securities (Notes 5 and 17) 2,346,863 2,884,751 2,316,745 2,847,731

Investment securities accounted for using

the equity method (Notes 6 and 17) 1,620,167 1,119,085 1,599,375 1,104,724

Property, plant and equipment, net of

accumulated depreciation of ₩9,891,942

million in 2005 and ₩8,523,304 million

in 2004 (Notes 7, 8, 9 and 17) 21,448,039 19,802,286 21,172,793 19,548,160

Intangibles (Note 10) 2,330,122 1,812,495 2,300,219 1,789,235

Deferred income tax assets (Note 19) 452,915 1,351,434 447,103 1,334,091

Other assets (Notes 11 and 17) 1,638,298 1,079,972 1,617,274 1,066,111

Total non-current assets 29,908,057 28,185,408 29,524,242 27,823,700

Other financial business assets (Note 12) 11,056,431 7,623,936 10,914,542 7,526,097

Total assets ₩65,891,346 ₩58,023,131 $65,045,751 $57,278,510

(continued)

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 31, 2005 AND 2004

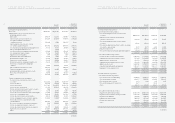

57 Independent Auditors’ Report

English Translation of a Report Originally Issued in Korean

To the Shareholders and Board of Directors of

Hyundai Motor Company:

We have audited the accompanying consolidated balance sheets of Hyundai Motor Company (the “Company”) and its subsidiaries as of

December 31, 2005 and 2004, and the related consolidated statements of income, changes in shareholders’ equity and cash flows for the

years then ended, all expressed in Korean. These financial statements are the responsibility of the Company's management. Our

responsibility is to express an opinion on these financial statements based on our audits. In 2005 and 2004, we did not audit the financial

statements of certain subsidiaries, which statements reflect total assets of ₩22,393,490 million (US$22,106,111 thousand) and

₩17,125,773 million (US$16,905,995 thousand), respectively, and total revenues of ₩33,279,134 million (US$32,852,057 thousand) and

₩27,558,371 million (US$27,204,710 thousand), respectively. Those statements were audited by other auditors whose reports have been

furnished to us, and our opinion, insofar as it relates to the amounts included for those entities, is based solely on the reports of other

auditors.

We conducted our audits in accordance with auditing standards generally accepted in the Republic of Korea. Those standards require that

we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An

audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also

includes assessing the accounting standards used and significant estimates made by management, as well as evaluating the overall

financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, based on our audits and the reports of other auditors, the financial statements referred to above present fairly, in all material

respects, the financial position of Hyundai Motor Company and its subsidiaries as of December 31, 2005 and 2004, and the results of their

operations and changes in the shareholders’ equity and their cash flows for the years then ended in conformity with accounting principles

generally accepted in the Republic of Korea (See Note 2).

Our audits also comprehended the translation of Korean Won amounts into U.S. dollar amounts and, in our opinion, such translation has

been made in conformity with the basis in Note 2. Such U.S. dollar amounts are presented solely for the convenience of readers outside of

Korea.

Accounting principles and auditing standards and their application in practice vary among countries. The accompanying financial

statements are not intended to present the financial position, results of operations and cash flows in accordance with accounting principles

and practices generally accepted in countries other than the Republic of Korea. In addition, the procedures and practices utilized in the

Republic of Korea to audit such financial statements may differ from those generally accepted and applied in other countries. Accordingly,

this report and the accompanying financial statements are for use by those knowledgeable about Korean accounting procedures and

auditing standards and their application in practice.

April 7, 2006

Notice to Readers

This report is effective as of April 7, 2006, the auditors’ report date. Certain subsequent events or circumstances may have occurred

between the auditors' report date and the time the auditors’ report is read. Such events or circumstances could significantly affect the

accompanying financial statements and may result in modifications to the auditors’ report.

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED

DECEMBER 31, 2005 AND 2004

AND INDEPENDENT AUDITORS’ REPORT