Hyundai 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

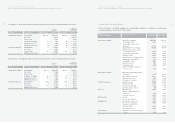

98

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

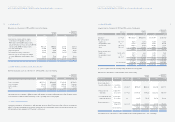

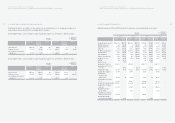

The Company completed stock retirement of 1,320,000 common shares of treasury stock on May 4, 2004, which had been

acquired for the purpose of such retirement based on the decision of the Board of Directors on March 12, 2004.

Also, the Company acquired treasury stock after cancellation of Trust Cash Fund on March 2, 2001, and in accordance with

the decision of the Board of Directors, on March 5, 2001, the Company retired 10,000,000 common shares in treasury and

1,000,000 second preferred shares in treasury, which had additional dividend rate of 2 percent to the rate of common stock,

using the retained earnings. Due to these stock retirements, the total face value of outstanding stock differs from the capital

stock amount.

The preferred shares are non-cumulative, participating and non-voting. Of the total preferred stock issued of 65,202,146

shares as of December 31, 2005, a total of 27,588,281 preferred shares (First and Third preferred shares) are eligible to

receive cash dividends, if declared, equal to that declared for common shares plus an additional 1 percent minimum increase

while the dividend rate for the remaining 37,613,865 preferred shares (Second preferred shares) is 2 percent higher than that

declared for common shares.

The Company issued 10,000,000 Global Depositary Receipts (GDRs) representing 5,000,000 shares of preferred stock in

November 1992, 4,675,324 GDRs representing 2,337,662 shares of preferred stock in June 1995 and 7,812,500 GDRs

representing 3,906,250 shares of preferred stock in June 1996, all of which have been listed on the Luxembourg Stock

Exchange.

In 1999, the Company issued 45,788,000 Global Depositary Shares representing 22,894,000 common shares for ₩601,356

million (US$593,639 thousand), which include paid-in capital in excess of par value of ₩486,886 million (US$480,638

thousand).

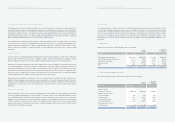

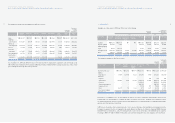

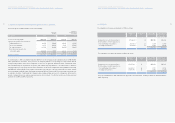

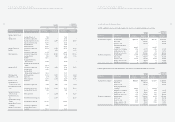

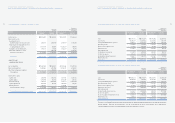

16. CAPITAL ADJUSTMENTS:

Capital adjustments as of December 31, 2005 and 2004 consist of the following:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description 2005 2004 2005 2004

Treasury stock ₩(743,692) ₩(98,341) $(734,149) $(97,079)

Discounts on stock issuance (1,688) (3,244) (1,666) (3,202)

Gain on valuation of available-for- sale

securities (See Notes 4 and 5) 358,400 443,221 353,801 437,533

Loss on valuation of investment

securities accounted for using the equity

method (310,141) (335,148) (306,162) (330,847)

Stock option cost 14,528 19,130 14,342 18,885

Cumulative translation adjustments (292,525) (213,608) (288,771) (210,867)

Gain (Loss) on valuation of derivatives 9,000 (28,463) 8,885 (28,098)

₩(966,118) ₩(216,453) $(953,720) $(213,675)

97

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

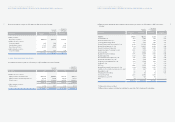

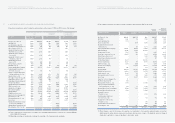

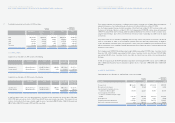

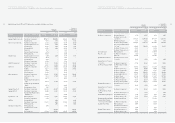

The maturity of long-term debt as of December 31, 2005 is as follows:

Debentures Local Foreign Total Total

currency currency

loans loans

2006 ₩3,172,269 ₩238,647 ₩61,880 ₩3,472,796 $3,428,229

2007 3,412,920 340,321 727,569 4,480,810 4,423,307

2008 2,840,738 210,454 146,067 3,197,259 3,156,228

2009 846,594 44,057 2,859 893,510 882,043

Thereafter 1,703,400 26,395 298,383 2,028,178 2,002,150

₩11,975,921 ₩859,874 ₩1,236,758 ₩14,072,553 $13,891,957

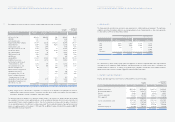

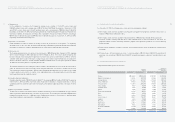

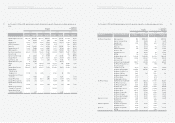

15. CAPITAL STOCK:

Capital stock as of December 31, 2005 consists of the following:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Authorized Issued Par value Korean Won

Translation into

(In millions)

U.S. Dollars(Note 2)

(In thousands)

Common stock 450,000,000 shares 219,058,702 shares ₩5,000 ₩1,151,894 $1,137,112

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 326,763

₩1,482,905 $1,463,875

Capital stock as of December 31, 2004 consists of the following:

Authorized Issued Par value Korean Won

Translation into

(In millions)

U.S. Dollars(Note 2)

(In thousands)

Common stock 450,000,000 shares 218,628,302 shares ₩5,000 ₩1,149,741 $1,134,986

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 326,763

₩1,480,752 $1,461,749

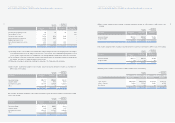

In 2005 and 2004, a part of the stock options granted to the directors were exercised at an exercise price of ₩14,900

(US$14,709) and new common stock of 430,400 and 429,800 shares were issued, respectively. This issuance of new

common stock resulted in the increase of paid-in capital in excess of par value by ₩8,209 million (US$8,104 thousand) and

₩8,197 million (US$8,092 thousand) in 2005 and 2004, respectively.