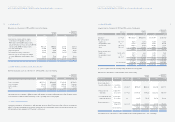

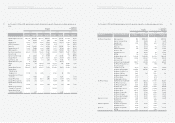

Hyundai 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

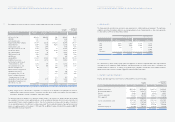

88

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

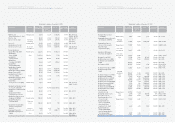

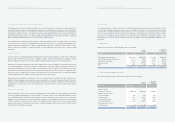

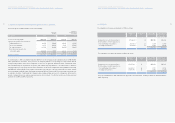

(5) Debt securities included in held-to-maturity of long-term investment securities as of December 31, 2005 consist of the

following:

Description Acquisition Book value Book value

cost

Government bonds ₩12,545 ₩12,545 $12,384

Corporate bonds 49,200 49,200 48,568

₩61,745 ₩61,745 $60,952

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Debt securities included in held-to-maturity of long-term investment securities as of December 31, 2004 consist of the following:

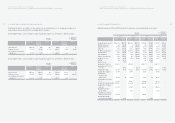

(6) Maturity of debt securities as of December 31, 2005 and 2004 consist of the following:

Description Acquisition Book value Book value

cost

Government bonds ₩12,612 ₩12,612 $12,450

Corporate bonds 689 689 681

₩13,301 ₩13,301 $13,131

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

2005 2004 2005 2004

Maturity Book value Book value Book value Book value

1 year ~ 5 years ₩1,426,206 ₩1,760,504 $1,407,903 $1,737,911

6 years ~ 10 years 142,206 372,337 140,381 367,559

Over 10 years 500 500 493 493

₩1,568,912 ₩2,133,341 $1,548,777 $2,105,963

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

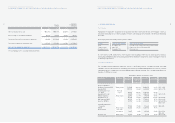

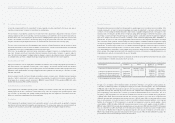

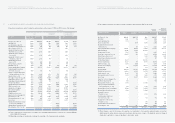

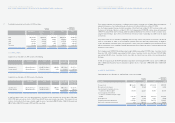

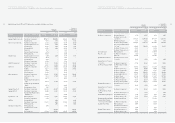

87

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

Description Acquisition Book value Book value

cost

Government bonds ₩24,797 ₩28,548 $28,182

Corporate bonds 9,951 10,167 10,037

Asset backed securities 1,469,359 1,468,359 1,449,515

Other 86 93 91

₩1,504,193 ₩1,507,167 $1,487,825

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Debt securities, classified into available-for-sale securities, included in long-term investment securities as of December 31, 2004

consist of the following:

Description Acquisition Book value Book value

cost

Government bonds ₩6,046 ₩6,501 $6,418

Corporate bonds 6,085 6,085 6,007

Asset backed securities 2,302,323 2,107,097 2,080,056

Other 1,153 357 352

₩2,315,607 ₩2,120,040 $2,092,833

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

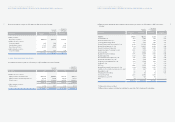

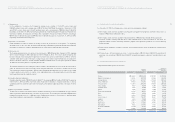

The Korea Economy Daily Co., Ltd. 168 168 166 0.22

Daewoo Motor Co., Ltd. 2,213 - - 0.02

Pilot beneficiary certificates 10,786 10,786 10,648 -

Machinery Insurance Cooperative 10,501 10,501 10,366 -

Badbank Harmony Co., Ltd. 13,905 - - -

Korea Defense Industry Association 4,890 4,890 4,827 -

Other 5,530 3,011 2,969 -

₩251,013 ₩192,608 $190,136

(*1) The equity securities of these affiliates were excluded from using the equity method since the Company believes the changes

in the investment value due to the changes in the net assets of the investee, whose individual beginning balance of total

assets or paid-in capital at the date of its establishment is less than ₩7,000 million (US$6,910 thousand), are not material.

(*2) This investment security was excluded from using the equity method despite its ownership percentage exceeding twenty

percentages, since there is no significant influence on the investee.

(*3) Ownership percentage is calculated by combining the ownership of the Company and its subsidiaries.

(4) Debt securities, classified into available-for-sale securities, included in long-term investment securities as of December 31,

2005 consist of the following:

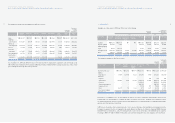

Companies Acquisition Book value Book value Ownership

cost percentage (*2)

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands) (%)