Hyundai 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

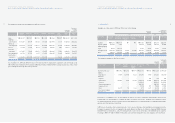

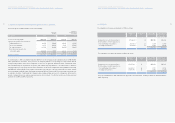

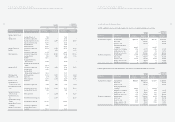

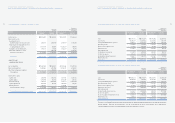

25. SEGMENT INFORMATION:

(1) Consolidated financial statements by industry

The consolidated balance sheets as of December 31, 2005 and 2004, and consolidated statements of income for the years

then ended, by industry under which the Company and its subsidiaries’ business are classified, are as follows:

Consolidated Balance Sheet as of December 31, 2005

ASSETS Non-financial Financial Non-financial Financial

industry industry industry industry

Current assets: ₩23,410,682 ₩1,552,756 $23,110,249 $1,532,829

Non-current assets:

Investments, net of

unamortized present value discount 4,735,303 2,608,660 4,674,534 2,575,183

Property, plant and equipment, net of

accumulated depreciation 21,211,029 130,657 20,938,824 128,980

Intangibles, net of amortization 2,254,645 74,735 2,225,711 73,776

Other financial business assets - 11,295,391 - 11,150,435

Total non-current assets 28,200,977 14,109,443 27,839,069 13,928,374

Total assets ₩51,611,659 ₩15,662,199 $50,949,318 $15,461,203

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Current liabilities ₩22,709,571 ₩7,572,708 $22,418,135 $7,475,526

Non-current liabilities 9,746,884 6,245,002 9,621,801 6,164,859

Other financial business liabilities - 286,329 - 282,654

Total liabilities 32,456,455 14,104,039 32,039,936 13,923,039

Shareholders’ equity:

Capital stock 1,482,905 1,283,800 1,463,875 1,267,325

Capital surplus 5,038,670 866,340 4,974,008 855,222

Retained earnings 9,280,764 (666,721) 9,161,662 (658,165)

Capital adjustments (791,672) 74,741 (781,512) 73,782

Minority interests 4,144,537 - 4,091,349 -

Total shareholders’ equity 19,155,204 1,558,160 18,909,382 1,538,164

Total liabilities and shareholders’ equity ₩51,611,659 ₩15,662,199 $50,949,318 $15,461,203

Korean Won

(in millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

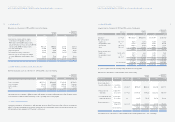

113

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

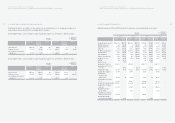

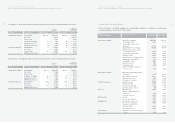

(2) As of December 31, 2005, the outstanding balance of accounts receivable discounted with recourse and transferred by the

Company and its subsidiaries amounts to ₩110,518 million (US$109,100 thousand).

(3) The Company and its subsidiaries have used a customer financing system related to a long-term installment sales system

and have provided guarantees to related banks amounting to ₩136,527 million (US$190,112 thousand) as of December

31, 2005. These guarantees are all covered by insurance contracts, which specify the customer and the Company and its

subsidiaries as contractor and beneficiary, respectively.

(4) The Company accrues estimated product liabilities expenses and carries the products and completed operations liability

insurance (See Note 8) in order to cover the potential loss, which may occur due to the lawsuits related to its operation such

as product liabilities. The Company expects that the resolution of cases pending against the Company as of December 31,

2005 will not have any material effect on its financial position.

Kia Motors Corporation, a domestic subsidiary, is a defendant pertaining to its claim in the in-court reorganization proceeding,

the lawsuits related to its operation such as product liabilities, lawsuits for compensation of losses or damages. KIA also has a

pending lawsuit in a Brazilian court pertaining to the disputes with the Brazilian Government and the Brazilian shareholders of

Asia Motors Do Brasil S.A. (AMB), which was established as a joint venture by Asia Motors with a Brazilian investor. Also, in

2001, KIA brought the case to the International Court of Arbitration to settle the disputes. KIA, a stockholder of AMB, had

already written off its investment of ₩14,057 million (US$13,877 thousand) and estimates that the above matter does not and

will not affect its financial statements at this time. The outcome of the creditors’ claims in relation to KIA’s denial of their claims

in the in-court reorganization proceedings is not currently determinable.

(5) As of December 31, 2005, the Company’s consolidated subsidiaries have been provided for payment guarantee by other

companies as follows:

Consolidated Subsidiaries Company providing Amounts of Translation into

guarantee of indebtedness guarantee U.S. Dollars (Note 2)

(In thousands) (In thousands)

Dymos Inc. Korea Exchange Bank & other KRW 25,050,000 $24,729

KEFICO Corporation Korea Exchange Bank USD 629 629

and other JPY 524,318 4,451

EUR 187 222

KRW 105,000 104

ROTEM Machinery Insurance Cooperative KRW 799,410,000 789,151

and other USD 72,397 72,397

EUR 131,513 155,810

NTD 8,084 311

CAD 8,033 6,909

HKD 45,138 5,821