Hyundai 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9291

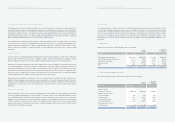

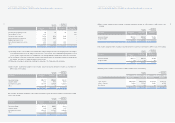

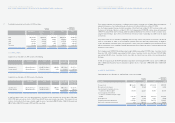

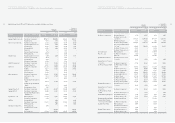

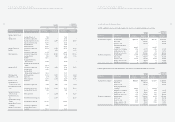

9. PROPERTY, PLANT AND EQUIPMENT:

Property, plant and equipment as of December 31, 2005 and 2004 consist of the following:

Description 2005 2004 2005 2004

Buildings and structures ₩7,078,546 ₩6,518,904 $6,987,706 $6,435,246

Machinery and equipment 11,508,182 10,290,771 11,360,496 10,158,708

Vehicles 212,382 183,877 209,656 181,517

Tools, dies and molds 4,392,993 4,017,552 4,336,617 3,965,994

Other equipment 1,310,013 1,279,070 1,293,201 1,262,655

24,502,116 22,290,174 24,187,676 22,004,120

Less: Accumulated depreciation (9,891,942) (8,523,304) (9,764,997) (8,413,923)

14,610,174 13,766,870 14,422,679 13,590,197

Land 4,165,180 4,084,137 4,111,728 4,031,725

Construction in progress 2,672,685 1,951,279 2,638,386 1,926,238

₩21,448,039 ₩19,802,286 $21,172,793 $19,548,160

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

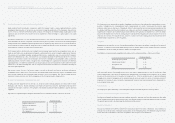

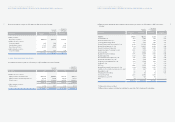

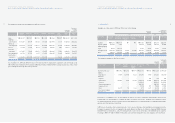

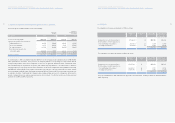

7. LEASED ASSETS:

The Company and its subsidiaries have entered into lease agreements for certain machinery and equipment. The capital lease

obligations are included in long-term debt in the accompanying balance sheets. Annual payments on these lease agreements

as of December 31, 2005 are as follows (Won in millions):

Lease Interest Lease Lease

payments portion obligation payments

2006 55,760 4,379 51,381 22,362

2007 34,929 1,065 33,864 20,811

2008 114 3 111 19,978

2009 - - - 16,581

Thereafter - - - 74,889

₩90,803 ₩5,447 ₩85,356 ₩154,621

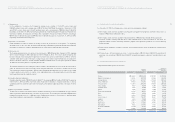

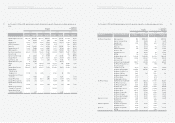

8. INSURED ASSETS:

As of December 31, 2005, certain property, plant and equipment are insured for ₩12,267,408 million (US$12,109,978

thousand) and the Company and certain subsidiaries carry general insurance for vehicles and workers’ compensation and

casualty insurance for employees. In addition, the Company and its subsidiaries carry products and completed operations

liability insurance with a maximum coverage of ₩280,575 million (US$276,974 thousand).

Financing leases Operating leases

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

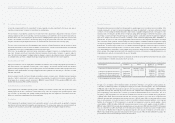

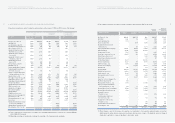

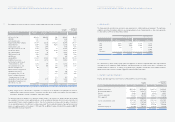

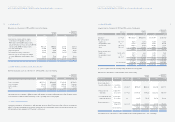

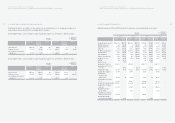

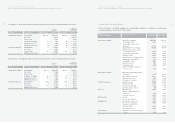

The changes in investment securities accounted for using the equity method in 2004 are as follows:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Kia Tigers Co., Ltd. ₩10,090 ₩(4,066) ₩-₩6,024 $5,947

HMJ R&D 2,391 88 (234) 2,245 2,216

Yan Ji Kia Motors A/S 1,792 - - 1,792 1,769

Beijing-Hyundai Motor Company 281,997 120,120 (109,221) 292,896 289,137

HAOSVT (Turkey) 25,859 7,165 (8,259) 24,765 24,447

Donghui Auto Co., Ltd. 5,608 2,087 - 7,695 7,596

Korea Space & Aircraft Co., Ltd. 79,312 2,516 (1) 81,827 80,777

PT. Kia Timor Motors 12,865 201 (2,729) 10,337 10,204

Korea Economy Daily 14,129 98 20 14,247 14,064

TRW Steering Co., Ltd. 8,254 (656) - 7,598 7,500

NGVTEK.com 250 - - 250 247

Hyundai MOBIS 310,060 121,862 115,001 546,923 539,904

EUKOR Car Carriers, Inc. 53,323 28,196 (710) 80,809 79,772

Iljin Bearing Co., Ltd. (Formerly

Iljin Automotive Co., Ltd.) 12,794 381 (73) 13,102 12,934

Daesung Automotive Co., Ltd. 5,619 555 (80) 6,094 6,016

Kia Service Philippines Co. 185 - (185) - -

Eukor Car Carriers Singapore Pte. 13 - - 13 13

Kia Motors Australia. Pty - - 825 825 814

Wia Automotive Parts Co., Ltd. - - 6,975 6,975 6,885

Beijing Lear Dymos Automotive

Seating and Interior Co., Ltd. - - 571 571 564

Hyundai Motor Deutschland GmbH - 5,717 6,872 12,589 12,427

Hyundai Motor Group China, Ltd. - - 1,508 1,508 1,489

Hysco America Co., Ltd. 5,690 - (5,690) - -

₩830,231 ₩284,264 ₩4,590 ₩1,119,085 $1,104,724

(*) Other changes consist of the increase of acquisition cost mainly due to the acquisition and participation in investees’

additional paid-in capital, decrease disposal of investments, decrease due to receipt of the dividends and other change of

shareholders’ equity due to change of subsidiaries’ shareholders’ equity.

The difference between the acquisition cost and the Company’s portion of an investee’s net equity at the date the Company

was considered to be able to exercise significant influence over the operating and financial policy of an investee is amortized (or

reversed) within 20 years, using the straight-line method. Also, the Company assesses any possible recognition of impairment

loss on unamortized balance of the difference considered as goodwill. The net unamortzed balance of goodwill and unreversed

balance of negative goodwill as of December 31, 2005 and 2004 are ₩328,873 million (US$ 324,653 thousand) and ₩8,721

million (US$ 8,609 thousand), respectively.

Affiliated Company Beginning Gain (loss) Other changes (*) End of year End of year

of year on valuation