Hyundai 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

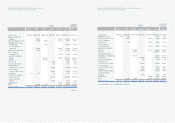

84

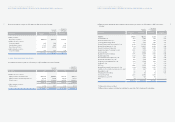

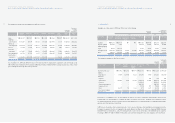

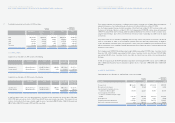

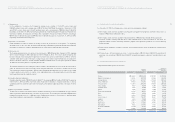

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

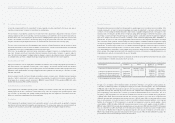

(3) Equity securities stated at acquisition cost included in long-term investment securities as of December 31, 2005 consist of the

following:

Companies Acquisition Book value Book value Ownership

cost percentage (*3)

Hyundai Motor Hungary (*1) ₩5,415 ₩5,415 $5,346 100.00

Hyundai Motor Norway AS (*1) 5,636 5,636 5,564 100.00

BONTEC America Inc. (*1) 313 44 43 100.00

Carnes Co., Ltd. (*1) 250 250 247 49.99

Seoul Metro 9th line (*2) 37,195 37,195 36,718 49.02

Mando Map & Soft Co., Ltd. (*1) 2,634 2,634 2,600 33.96

3Gcore, Inc. (*1) 225 225 222 20.86

HI Network Co., Ltd. 59 59 58 19.99

Mediazen, Inc. 329 329 325 19.95

Heesung PM Tech Corporation 1,194 1,194 1,179 19.90

MT Zone Co., Ltd. 10 10 10 19.50

Dongyong Industries Co., Ltd. 241 241 238 19.23

Hyundai RB Co., Ltd. 550 550 543 18.64

Jinil MVC Co., Ltd. 180 180 178 18.00

Clean Air Technology Inc. 500 500 494 16.13

Industri Otomotif Komersial 4,439 4,439 4,382 15.00

Hyundai ERW Co., Ltd. 150 150 148 15.00

Hyundai Technology Investment Co., Ltd. 4,490 4,490 4,432 14.97

Hyundai Research Institute 1,359 1,271 1,255 14.90

Hyundai Unicorns Co., Ltd. 5,795 137 135 14.90

Gyeongnam Credit Guarantee Foundation 2,500 2,500 2,468 13.66

WIZ Communication Co., Ltd. 345 345 341 12.98

The Sign Corporation

(Formerly Mobil.Com Co., Ltd.) 1,800 1,800 1,777 17.39

Micro Infinity 607 607 599 10.51

Kihyup Finance, Inc. 3,700 3,700 3,653 12.75

Toba Telecom 405 - - 10.02

Sang Rok Soo 1st Securitization

Specialty Co., Ltd. 1 1 1 10.00

Yonhap Capital Co., Ltd. 10,500 10,500 10,365 10.99

Wisco Co., Ltd. 348,366 348 344 9.68

Hyundai Finance Corporation 9,888 9,888 9,761 9.29

Daejoo Heavy Industry Co. Ltd. 650 650 642 9.29

Namyang Industrial Co., Ltd. 200 200 197 8.00

Badbank Harmony Co., Ltd. 13,905 - - 7.99

Korea Credit-card Electronic-settlement

Service Co., Ltd. 484 254 251 7.50

Hankyoreh Plus Inc. 4,800 284 280 7.41

Hyundai Oil Refinery Co., Ltd. 88,857 88,857 87,717 7.24

Korea Smart Card Co., Ltd. 1,628 1,628 1,607 5.31

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands) (%)

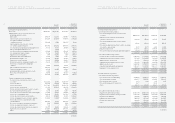

83

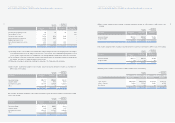

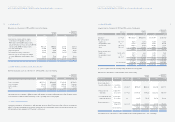

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

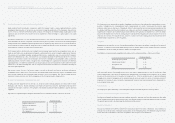

Equity securities stated at fair value included in long-term investment securities as of December 31, 2004 consist of the

following:

Companies Acquisition Book value Book value Ownership

cost percentage (*2)

INI Steel (*1) ₩137,175 ₩317,911 $313,831 25.76

Jin Heung Mutual Savings Bank 2,166 1,308 1,291 8.66

Korea Mutual Savings Bank 2,846 3,325 3,282 8.13

Saehan Media 4,933 3,499 3,454 6.52

KOENTEC 1,550 5,409 5,340 6.20

Korea Information Service, Inc. 5,252 4,140 4,087 4.41

Daewoo Engineering & Construction Co., Ltd. 42,483 64,511 63,683 3.05

Hyundai Heavy Industries Co., Ltd. 56,924 75,446 74,478 2.88

Daewoo International Corporation 9,822 24,648 24,332 2.49

Hyundai Information Technology Co., Ltd. 10,000 1,217 1,201 2.21

LG Telecom, Ltd. 19,851 14,895 14,704 1.34

Hyundai Corporation 13,626 850 839 1.08

Doosan Industrial Development Co., Ltd. 2,186 2,093 2,066 0.95

ICOLS Inc. 80 70 69 0.51

Hyundai Merchant Marine Co., Ltd. 7,329 8,432 8,324 0.55

Kanglim Co., Ltd. 347 31 31 0.38

KT Freetel 18,000 13,742 13,566 0.30

Hyundai Engineering & Construction Co., Ltd. 13,332 4,581 4,522 0.27

SeAH Besteel Co., Ltd. (Formerly Kia Steel Co., Ltd.) 2,451 602 594 0.19

Hynix Semiconductor Inc. 2,047 8,411 8,303 0.16

Wigoglobal Co., Ltd. 904 5 5 0.12

Tong Yang Investment Bank 282 36 36 0.01

Aztech WB 152 60 59 -

Treasury Stock Fund 3,425 3,498 3,453 -

Other 67 82 81 -

₩357,230 ₩558,802 $551,631

(*1) Excluded in applying the equity method since a part of ownership is restricted to voting rights in accordance with the laws,

and the Company and its subsidiaries believe there is no significant influence on the investees.

(*2) Ownership percentage is calculated by combining the ownership of the Company and its subsidiaries.

The differences between the acquisition cost and the book value stated at fair value in short-term investment securities and

long-term investment securities are recorded in capital adjustments (See Note 16).

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands) (%)