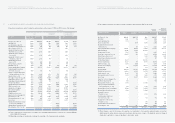

Hyundai 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

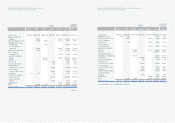

82

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

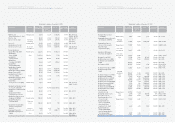

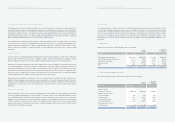

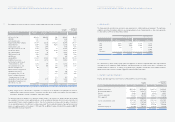

(2) Equity securities stated at fair value included in long-term investment securities as of December 31, 2005 consist of the

following:

Companies Acquisition Book value Book value Ownership

cost percentage (*2)

KOENTEC ₩1,550 ₩4,604 $4,545 6.20

Saehan Media (*1) 4,933 4,450 4,393 4.90

Korea Information Service, Inc. 5,252 4,119 4,066 4.41

Jin Heung Mutual Savings Bank 2,166 3,097 3,057 3.33

Daewoo Engineering & Construction Co., Ltd. 42,483 136,996 135,238 3.01

Hyundai Heavy Industries Co., Ltd. 56,924 168,411 166,250 2.88

Daewoo International Corporation 9,822 90,652 89,489 2.50

Hyundai Information Technology Co., Ltd. 10,000 2,790 2,754 2.21

LG Telecom, Ltd. 9,795 12,483 12,323 0.68

Hyundai Development Company 12,786 29,198 28,823 0.85

Hyundai Corporation 13,626 1,513 1,494 1.08

Doosan Industrial Development Co., Ltd. 2,186 5,723 5,650 0.58

Hyundai Merchant Marine Co., Ltd. 7,329 7,645 7,547 0.55

SsangYong Cement Industrial Co., Ltd. 6,394 5,405 5,336 0.50

Kanglim Co., Ltd. 347 55 54 0.38

KT Freetel 18,000 13,715 13,539 0.30

Hyundai Engineering & Construction Co., Ltd. 13,332 13,302 13,131 0.27

SeAH Besteel Co., Ltd. (Formerly Kia Steel Co., Ltd.) 854 1,269 1,253 0.17

Wigoglobal Co., Ltd. 904 4 4 0.12

Tong Yang Investment Bank 282 115 114 0.01

Treasury Stock Fund 22,353 22,353 22,066 -

SK Networks Co., Ltd. (*1) 363 846 834 -

Other 98 2 2 -

₩241,779 ₩528,747 $521,962

(*1) Disposal of stocks is restricted.

(*2) Ownership percentage is calculated by combining the ownership of the Company and its subsidiaries.

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands) (%)

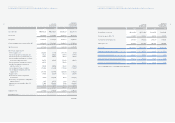

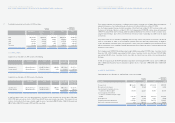

81

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

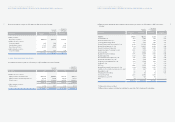

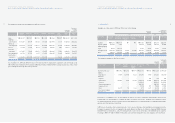

Short-term investment securities as of December 31, 2004 consist of the following:

5. LONG-TERM INVESTMENT SECURITIES:

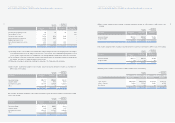

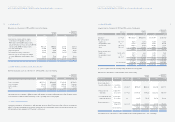

(1) Long-term investment securities as of December 31, 2005 and 2004 consist of the following:

Description Acquisition Book value Book value

cost

Trading securities:

Beneficiary certificates ₩240,436 ₩241,309 $238,212

Available-for-sale securities:

Government bonds 1,009 1,009 996

Asset backed securities 11,167 4,667 4,607

Beneficiary certificates 222,057 222,726 219,868

Held-to-maturity securities:

Government bonds 1,507 1,507 1,488

₩476,176 ₩471,218 $465,171

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description 2005 2004 2005 2004

Available-for-sale securities:

Equity securities stated at fair value ₩528,747 ₩558,802 $521,962 $551,631

Equity securities stated at acquisition cost 249,204 192,608 246,006 190,136

Debt securities 1,507,167 2,120,040 1,487,825 2,092,833

2,285,118 2,871,450 2,255,793 2,834,600

Held-to-maturity securities:

Debt securities 61,745 13,301 60,952 13,131

₩2,346,863 ₩2,884,751 $2,316,745 $2,847,731

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)