Hyundai 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

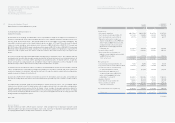

Vehicle Sales

HMI Total Sales and

Market Share in India

Market Share

* (Complete Body Unit / Percent)

2003 2004 2005

150,724

215,630

252,851

18.5% 17.4% 18.2%

20

15

25

10

5

200,000

150,000

250,000

100,000

50,000

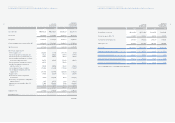

Vehicle Sales

HAOS Total Sales and

Market Share in Turkey

Market Share

* (Complete Body Unit / Percent)

2003 2004 2005

38,939 88,262 93,402

5.8%

9.3% 9.9%

20

15

25

10

5

200,000

150,000

250,000

100,000

50,000

42

Hyundai Motor Company

Annual Report 2005

>>Sublime Drive

41

Global Management

Hyundai Motor India (HMI)

In anticipation of unprecedented economic growth in India, Hyundai invested

heavily in one of the world’s fastest growing economies in the mid 1990’s,

culminating in the opening of the giant manufacturing plant in Tamil Nadu.

India is a central part of the BRIC’s (Brazil, Russia, India and China) developing

countries that will play a major global role as key economic centers of the future.

HMI has been targeted as one of the key bases for Hyundai Motor Company’s

globalization efforts in the Indian, South-West Asian and Central and South

American markets.

Being located in Chennai, its close proximity to infrastructure and supplier bases

has allowed Hyundai Motor Company a smooth transition into the Indian

automotive market. In addition, Chennai’s geographical location as a port city,

along with international airport facilities allow for cost efficiency and environmentally

friendly logistics.

HMI’s production facility in Chennai sprawls over 531 acres (2.149 million square

meters), with a total production capacity of 250,000 vehicles per year. The plant

produces Santro, Accent, Getz, Sonata and Elantra vehicles.

Since its inception, HMI has become the second top selling motor company in India.

Hyundai Motor Company’s Santro fought against a local manufacturer who boasted

an 80 percent market share in its class. After just three years in competition, the

Santro overtook the local competitor and remains the front runner in its class.

In the five years to December 2003, HMI sold over 500,000 vehicles to the Indian

market.

India: Emerging Markets

Hyundai Assan Otomotive Sanayi Ve Ticaret A.S (HAOS)

Beginning in 1997, Hyundai Motor Company’s joint venture with the local KIBAR

group become the first international joint venture in Hyundai Motor Company’s his-

tory. Located two hours from Istanbul, the HAOS plant is located within a 20 kilo-

meter radius of other major automobile manufacturing plants. The area was specifi-

cally chosen for its close proximity to trading infrastructure.

Residing over 245 acres (1 million square meters), the plant includes the largest

proving ground in Turkey and produces 60,000 vehicles each year. The Hyundai

Accent, H-1 and H100 vehicles roll out of the HAOS Istanbul plant.

Unlike other Complete Knock Down (CKD) plants, HAOS is independent and has

improved logistics systems to minimize adverse environmental impact.

HAOS implements a quality control reporting system for all models and a

double-check system to ensure quality assurance in all its processes.

Turkey: Producing For All People