Hasbro 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

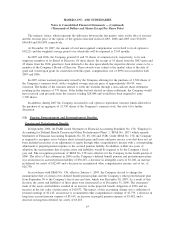

promotional and marketing activities at a U.S. based theme park. Under terms of existing agreements as of

December 30, 2007, Hasbro may, provided the other party meets their contractual commitment, be required to

pay amounts as follows: 2008: $18,354; 2009: $19,691; 2010: $44,645; and 2011: $5,125.

In addition to the above commitments, certain of the above contracts impose minimum marketing

commitments on the Company.

The Company has $94,616 of prepaid royalties included as a component of prepaid expenses and other

current assets in the balance sheet. The long-term portion of advances paid of $43,343 is included in other

assets. Advanced royalties paid and guaranteed or minimum royalties to be paid relate to anticipated revenues

in the years 2008 through 2018.

At December 30, 2007, the Company had approximately $249,883 in outstanding purchase commitments.

Hasbro is party to certain legal proceedings, none of which, individually or in the aggregate, is deemed to

be material to the financial condition of the Company.

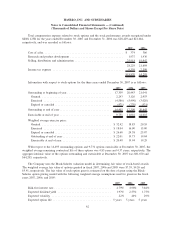

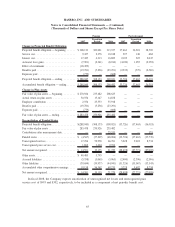

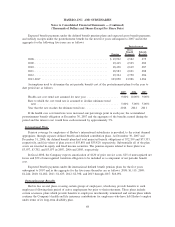

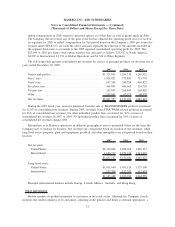

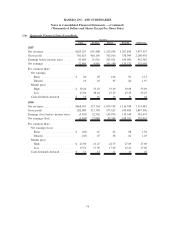

(15) Segment Reporting

Segment and Geographic Information

The Company has two main operating segments, North America and International. In addition, the

Company has two other segments, Global Operations and an other segment that licenses out certain toy and

game properties.

The North American segment includes the development, marketing and selling of boys’ action figures,

vehicles and playsets, girls’ toys, electronic toys and games, plush products, preschool toys and infant

products, electronic interactive products, tween electronic products, toy-related specialty products, traditional

board games and puzzles, DVD- based games, fiction books, and trading card and role-playing games within

the United States, Canada and Mexico. Within the International segment, the Company develops, markets and

sells both toy and certain game products in non-North American markets, primarily the European, Asia

Pacific, and Latin and South American regions. The Global Operations segment is responsible for manufactur-

ing and sourcing finished product for the Company’s North American and International segments. The

Company’s other segment licenses out certain toy and game properties.

Segment performance is measured at the operating profit level. Included in Corporate and eliminations

are certain corporate expenses, the elimination of intersegment transactions and certain assets benefiting more

than one segment. Intersegment sales and transfers are reflected in management reports at amounts

approximating cost. Certain shared costs are allocated to segments based upon foreign exchange rates fixed at

the beginning of the year, with adjustment to actual foreign exchange rates included in Corporate and

eliminations.

In 2006 the Company adopted SFAS 123R, which requires the Company to record expense related to

stock options in its consolidated financial statements. Consistent with management’s approach in evaluating

segment results, the 2005 segment operating profit (loss) has been adjusted to include stock-based compensa-

tion as disclosed under SFAS 123. The amount of 2005 stock option expense is subtracted from the total

segment operating profit (loss) in order to reconcile to the operating profit in the consolidated financial

statements.

With the exception of the treatment of stock-based compensation expense for 2005 management financial

statements, the accounting policies of the segments are the same as those referenced in Note 1.

Results shown for fiscal years 2007, 2006 and 2005 are not necessarily those which would be achieved

were each segment an unaffiliated business enterprise.

70

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)