Hasbro 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

financial statements. The second step determines the measurement of the tax position. FIN 48 also provides

guidance on derecognition of such tax positions, classification, potential interest and penalties, accounting in

interim periods and disclosure. The adoption of FIN 48 resulted in a $88,798 decrease in current liabilities, a

$85,773 increase in long-term liabilities, a $5,333 increase to the long-term deferred tax assets and a $8,358

increase to retained earnings.

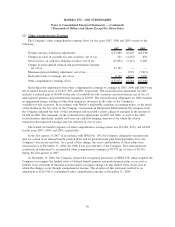

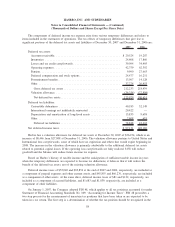

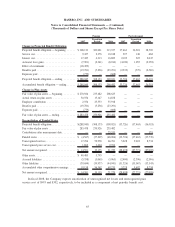

A reconciliation of unrecognized tax benefits, excluding potential interest and penalties, for the fiscal year

ended December 30, 2007 is as follows:

Balance at January 1, 2007 ............................................... $72,878

Gross increases in prior period tax positions................................. 1,980

Gross decreases in prior period tax positions . . . ............................. (889)

Gross increases in current period tax positions . . ............................. 12,840

Decreases related to settlements with tax authorities ........................... (633)

Decreases from the expiration of statute of limitations ......................... (27,321)

Balance at December 30, 2007 ............................................ $58,855

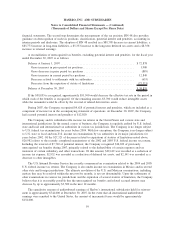

If the $58,855 is recognized, approximately $51,500 would decrease the effective tax rate in the period in

which each of the benefits is recognized. Of the remaining amount, $5,700 would reduce intangible assets

while the remainder would be offset by the reversal of related deferred tax assets.

During 2007, the Company recognized $4,628 of potential interest and penalties, which are included as a

component of income tax in the accompanying statement of operations. At December 30, 2007, the Company

had accrued potential interest and penalties of $12,020.

The Company and its subsidiaries file income tax returns in the United States and various state and

international jurisdictions. In the normal course of business, the Company is regularly audited by U.S. federal,

state and local and international tax authorities in various tax jurisdictions. The Company is no longer subject

to U.S. federal tax examinations for years before 2004. With few exceptions, the Company is no longer subject

to U.S. state or local and non-U.S. income tax examinations by tax authorities in its major jurisdictions for

years before 2002. Of the $27,321 of decreases related to expirations of statutes of limitations noted above,

$26,982 relates to the recently completed examinations of the 2002 and 2003 U.S. federal income tax returns.

Including the reversal of $7,710 of potential interest, the Company recognized $34,692 of previously

unrecognized tax benefits during 2007, primarily related to the deductibility of certain expenses and tax

treatment of certain subsidiary and other transactions. Of this amount, $29,619 was recorded as a reduction of

income tax expense, $2,932 was recorded as a reduction of deferred tax assets, and $2,141 was recorded as a

decrease to other intangibles.

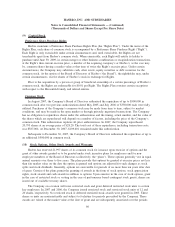

The U.S. Internal Revenue Service has recently commenced an examination related to the 2004 and 2005

U.S. federal income tax returns. The Company is also under income tax examination in Mexico and in several

other state and foreign jurisdictions. The ultimate resolution of the U.S. and Mexican examinations, including

matters that may be resolved within the next twelve months, is not yet determinable. Upon the settlements of

other examinations in various tax jurisdictions and the expiration of several statutes of limitation, the Company

believes that it is reasonably possible that the unrecognized tax benefits and related accrued interest may

decrease by up to approximately $3,500 in the next 12 months.

The cumulative amount of undistributed earnings of Hasbro’s international subsidiaries held for reinvest-

ment is approximately $744,000 at December 30, 2007. In the event that all international undistributed

earnings were remitted to the United States, the amount of incremental taxes would be approximately

$154,000.

59

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)