Hasbro 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

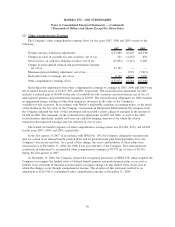

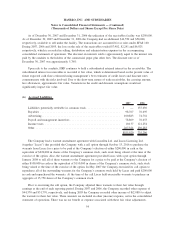

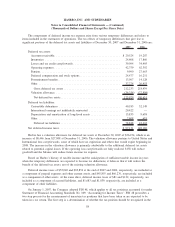

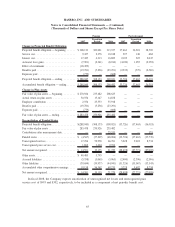

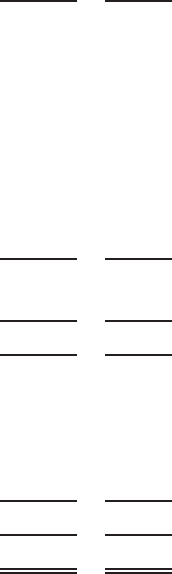

The components of deferred income tax expense arise from various temporary differences and relate to

items included in the statements of operations. The tax effects of temporary differences that give rise to

significant portions of the deferred tax assets and liabilities at December 30, 2007 and December 31, 2006 are:

2007 2006

Deferred tax assets:

Accounts receivable.......................................... $ 20,524 19,287

Inventories ................................................ 24,608 17,860

Losses and tax credit carryforwards .............................. 39,094 34,405

Operating expenses .......................................... 42,759 62,392

Pension ................................................... 9,990 27,663

Deferred compensation and stock options .......................... 24,477 16,251

Postretirement benefits........................................ 13,507 14,128

Other .................................................... 37,274 26,453

Gross deferred tax assets .................................... 212,233 218,439

Valuation allowance.......................................... (36,254) (27,808)

Net deferred tax assets ...................................... 175,979 190,631

Deferred tax liabilities:

Convertible debentures ....................................... 40,185 32,149

International earnings not indefinitely reinvested .................... 20,422 —

Depreciation and amortization of long-lived assets ................... 15,833 9,658

Other .................................................... 2,408 655

Deferred tax liabilities ...................................... 78,848 42,462

Net deferred income taxes ....................................... $ 97,131 148,169

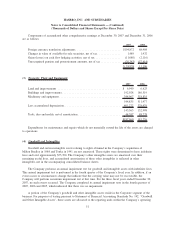

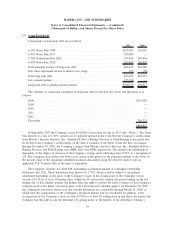

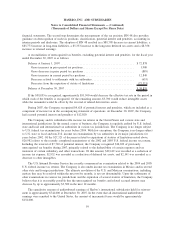

Hasbro has a valuation allowance for deferred tax assets at December 30, 2007 of $36,254, which is an

increase of $8,446 from $27,808 at December 31, 2006. The valuation allowance pertains to United States and

International loss carryforwards, some of which have no expiration and others that would expire beginning in

2008. The increase in the valuation allowance is primarily attributable to the additional deferred tax assets

related to potential capital losses. If the operating loss carryforwards are fully realized, $158 will reduce

goodwill and the balance will reduce future income tax expense.

Based on Hasbro’s history of taxable income and the anticipation of sufficient taxable income in years

when the temporary differences are expected to become tax deductions, it believes that it will realize the

benefit of the deferred tax assets, net of the existing valuation allowance.

Deferred income taxes of $53,040 and $83,854 at the end of 2007 and 2006, respectively, are included as

a component of prepaid expenses and other current assets, and $45,855 and $66,276, respectively, are included

as a component of other assets. At the same dates, deferred income taxes of $81 and $122, respectively, are

included as a component of accrued liabilities, and $1,683 and $1,839, respectively, are included as a

component of other liabilities.

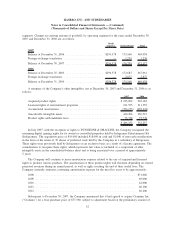

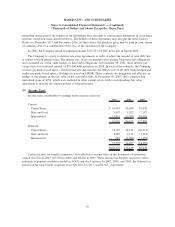

On January 1, 2007, the Company adopted FIN 48, which applies to all tax positions accounted for under

Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes”. FIN 48 prescribes a

two step process for the measurement of uncertain tax positions that have been taken or are expected to be

taken in a tax return. The first step is a determination of whether the tax position should be recognized in the

58

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)