Hasbro 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

addition to growing core brands and leveraging opportunistic toy lines and licenses, we seek to grow our

international business by continuing to expand into Eastern Europe and emerging markets in Asia and Latin

and South America. Key international brands for 2007 included TRANSFORMERS, LITTLEST PET SHOP,

MONOPOLY, MARVEL, MY LITTLE PONY, and PLAYSKOOL.

Other Segments

In our Global Operations segment, we manufacture and source production of substantially all of our toy

and game products. The Company owns and operates manufacturing facilities in East Longmeadow,

Massachusetts and Waterford, Ireland. Sourcing of our other production is done through unrelated manufactur-

ers in various Far East countries, principally China, using a Hong Kong based wholly-owned subsidiary

operation for quality control and order coordination purposes. See “Manufacturing and Importing” below for

more details concerning overseas manufacturing and sourcing.

Through our other segment we generate revenue through the out-licensing worldwide of certain of our

intellectual properties to third parties for promotional and merchandising uses in businesses which do not

compete directly with our own product offerings. During 2007, our Hasbro Products Group out-licensed our

brands primarily in apparel, publishing, home goods and electronics, and certain brands in the digital area.

One of the primary goals of our licensing segment is to further expand our brands into the digital world

through strategic licenses. As an example, in 2007 the Company entered into a long-term strategic licensing

alliance with Electronic Arts Inc. (“EA”), which provides EA with the exclusive worldwide rights to create

digital games for all platforms, including mobile phones, personal computers, and game consoles such as

XBOX, PLAYSTATION and WII, based on most of our toy and game intellectual properties. The first games

generated under this strategic alliance are expected to be introduced in 2008.

Other Information

To further extend our range of products in the various segments of our business, we sell our toy and game

products directly to retailers, primarily on a direct import basis from the Far East. These sales are reflected in

the revenue of the related segment where the customer resides.

Certain of our products are licensed to other companies for sale in selected countries where we do not

otherwise have a direct business presence.

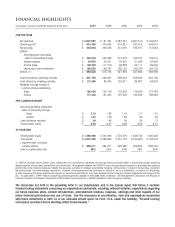

During the 2007 fiscal year, revenues generated from the sale of TRANSFORMERS products were

approximately $482,000, which was 12.6% of our consolidated net revenues in 2007. During the 2005 fiscal

year, revenues generated from the sale of STAR WARS products produced under our license with Lucas

Licensing and Lucasfilm were approximately $494,000, which was 16% of our consolidated net revenues in

2005. No other line of products constituted 10% or more of our consolidated net revenues in 2007 or 2005.

No individual line of products accounted for 10% or more of our consolidated net revenues during our 2006

fiscal year.

Working Capital Requirements

Our working capital needs are primarily financed through cash generated from operations and, when

necessary, proceeds from our accounts receivable securitization program and short-term borrowings. Our

borrowings and the use of our accounts receivable program generally reach peak levels during the fourth

quarter of each year. This corresponds to the time of year when our receivables also generally reach peak

levels as part of the production and shipment of product in preparation for the holiday shipping season. The

strategy of retailers has been to make a higher percentage of their purchases of toy and game products within

or close to the fourth quarter holiday consumer buying season, which includes Christmas. We expect that

retailers will continue to follow this strategy. Our historical revenue pattern is one in which the second half of

the year is more significant to our overall business than the first half and, within the second half of the year,

the fourth quarter is more predominant. In 2007, the second half of the year accounted for approximately 66%

of full year revenues with the third and fourth quarters accounting for 32% and 34% of full year revenues,

respectively. In years where the Company has products tied to a major motion picture release, such as in 2007

3