Hasbro 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

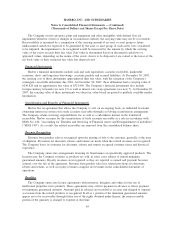

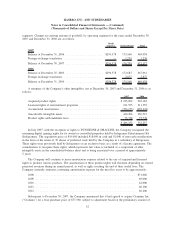

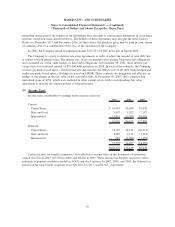

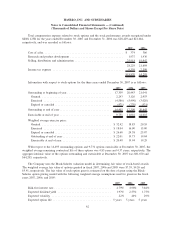

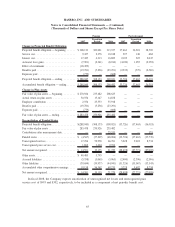

(7) Long-Term Debt

Components of long-term debt are as follows:

2007 2006

6.15% Notes Due 2008 ......................................... $135,092 135,092

6.30% Notes Due 2017 ......................................... 350,000 —

2.75% Debentures Due 2021 ..................................... 249,828 249,996

6.60% Notes Due 2028 ......................................... 109,895 109,895

Total principal amount of long-term debt ............................ 844,815 494,983

Fair value adjustment related to interest rate swaps .................... 256 (66)

Total long-term debt ........................................... 845,071 494,917

Less current portion ........................................... 135,348 —

Long-term debt excluding current portion ........................... $709,723 494,917

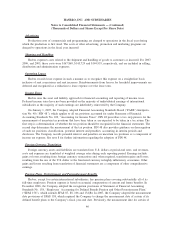

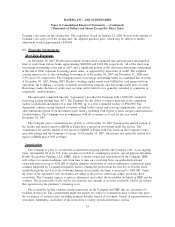

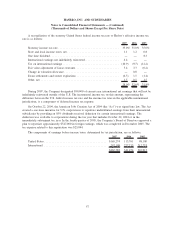

The schedule of contractual maturities of long-term debt for the next five years and thereafter is as

follows:

2008 ............................................................... $135,092

2009 ............................................................... —

2010 ............................................................... —

2011 ............................................................... —

2012 ............................................................... —

Thereafter ........................................................... 709,723

$844,815

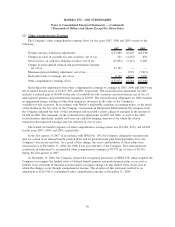

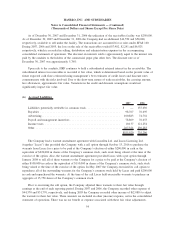

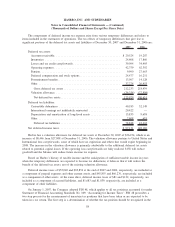

In September 2007 the Company issued $350,000 of notes that are due in 2017 (the “Notes”). The Notes

bear interest at a rate of 6.30%, which may be adjusted upward in the event that the Company’s credit rating

from Moody’s Investor Services, Inc., Standard & Poor’s Ratings Services or Fitch Ratings is decreased two

levels below the Company’s credit ratings on the date of issuance of the Notes. From the date of issuance

through December 30, 2007, the Company’s ratings from Moody’s Investor Services, Inc., Standard & Poor’s

Ratings Services and Fitch Ratings were BBB, Baa2 and BBB, respectively. The interest rate adjustment is

dependent on the degree of decrease of the Company’s ratings and could range from 0.25% to a maximum of

2%. The Company may redeem the Notes at its option at the greater of the principal amount of the Notes or

the present value of the remaining scheduled payments discounted using the effective interest rate on

applicable U.S. Treasury bills at the time of repurchase.

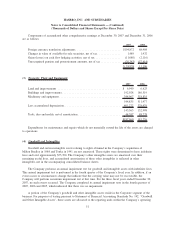

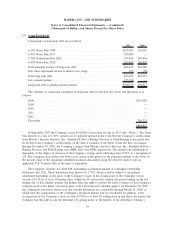

The Company currently has $249,828 outstanding in principal amount of contingent convertible

debentures due 2021. These debentures bear interest at 2.75%, which could be subject to an upward

adjustment depending on the price of the Company’s stock. If the closing price of the Company’s stock

exceeds $23.76 for at least 20 trading days, within the 30 consecutive trading day period ending on the last

trading day of the calendar quarter, the holders have the right to convert the notes to shares of the Company’s

common stock at the initial conversion price of $21.60 in the next calendar quarter. At December 30, 2007,

this contingent conversion feature was met and the debentures are convertible through March 31, 2008, at

which time the requirements of the contingent conversion feature will be reevaluated. In addition, if the

closing price of the Company’s stock exceeds $27.00 for at least 20 trading days in any thirty day period, the

Company has the right to call the debentures by giving notice to the holders of the debentures. During a

55

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)