Hasbro 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

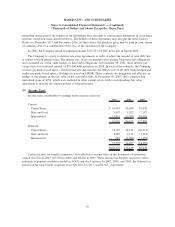

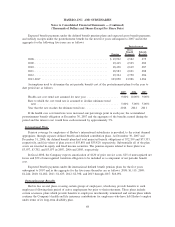

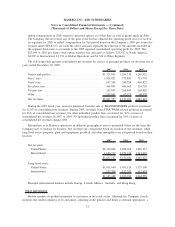

Assumptions used to determine the year-end benefit obligation are as follows:

2007 2006

Weighted average discount rate ................................... 6.34% 5.75%

Rate of future compensation increases .............................. 4.00% 4.00%

Long-term rate of return on plan assets ............................. 8.75% 8.75%

Mortality table . . . ............................................ RP-2000 RP-2000

The assumptions used to remeasure the benefit obligation using a December 31, 2006 measurement date,

as well as those used to determine the expense for the transition period, were not significantly different than

the 2006 assumptions.

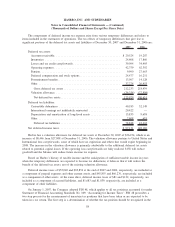

The assets of the funded plans are managed by investment advisors and consist of the following:

Asset Category 2007 2006

Equity:

Large Cap Equity .................................................. 5% 30%

Small Cap Equity .................................................. 8 14

International Equity ................................................. 14 20

Other Equity ...................................................... 17 —

Fixed Income ....................................................... 40 20

Total Return Fund .................................................... 16 16

100% 100%

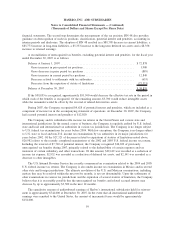

Hasbro’s two major funded plans (the “Plans”) are defined benefit pension plans intended to provide

retirement benefits to participants in accordance with the benefit structure established by Hasbro, Inc. The

Plans’ investment managers, who exercise full investment discretion within guidelines outlined in the Plans’

Investment Policy, are charged with managing the assets with the care, skill, prudence and diligence that a

prudent investment professional in similar circumstance would exercise. Investment practices, at a minimum,

must comply with the Employee Retirement Income Security Act (ERISA) and any other applicable laws and

regulations.

The Plans’ asset allocations are structured to meet a long-term targeted total return consistent with the

ongoing nature of the Plans’ liabilities. The shared long-term total return goal, presently 8.75%, includes

income plus realized and unrealized gains and/or losses on the Plans’ assets. Utilizing generally accepted

diversification techniques, the Plans’ assets, in aggregate and at the individual portfolio level, are invested so

that the total portfolio risk exposure and risk-adjusted returns best meet the Plans’ long-term liabilities to

employees. In 2007, the Company reevaluated its investment strategy and, as a result, decided to change the

asset allocation in order to more closely align changes in the value of plan assets with changes in the value of

plan liabilities. This change in strategy resulted in a transfer of assets into alternative investments designed to

achieve a modest absolute return in addition to the return on an underlying asset class such as bond or equity

indices. These alternative investments may use derivatives to gain market returns in an efficient and timely

manner; however derivatives are not used to leverage the portfolio beyond the market value of the underlying

assets. These alternative investments are included in other equity and fixed income at December 30, 2007.

Plan asset allocations are reviewed at least quarterly and rebalanced to achieve target allocation among the

asset categories when necessary.

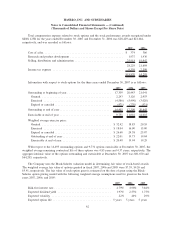

The Plans’ investment managers are provided specific guidelines under which they are to invest the assets

assigned to them. In general, investment managers are expected to remain fully invested in their asset class

66

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)