Hasbro 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

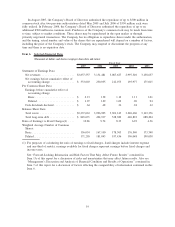

incentive compensation provisions, the impact of foreign currency, and general inflationary increases. The

decrease as a percentage of revenues reflects the fixed nature of certain of these expenses. Selling, distribution

and administration expenses were $682,214 or 21.7% of net revenues in 2006 compared to $624,560 or 20.2%

in 2005. Approximately $20,000 of this increase related to the Company’s adoption of SFAS 123R in 2006

which required that the Company measure all stock-based compensation awards using a fair value method and

record such expense in its financial statements. The remainder of the increase primarily related to increased

sales and marketing expense in 2006 associated with the higher level of sales and increased bonus and

incentive provisions due to the strong performance of the Company in 2006.

Interest Expense

Interest expense increased to $34,618 in 2007 from $27,521 in 2006. The increase in interest expense was

primarily the result of higher average borrowings in 2007. In September 2007, the Company issued $350,000

of Notes that are due in 2017. The majority of the proceeds from the issuance of these Notes were used to

repay short-term debt resulting from increased repurchases of common stock as well as the repurchase of the

Lucas warrants for $200,000.

Interest expense decreased to $27,521 in 2006 from $30,537 in 2005. The decrease in interest expense

mainly reflected the reduction in the Company’s long-term debt over that period. The Company repurchased or

repaid principal amounts of long-term debt of $32,743 in 2006 and $93,303 in 2005.

Interest Income

Interest income was $29,973 in 2007 compared to $27,609 in 2006 and $24,157 in 2005. Interest income

includes $5,200 in 2006 related to a long-term deposit that was refunded during 2006 and approximately

$4,100 in 2005 related to an IRS settlement. The increase in interest income in 2007 primarily reflects higher

average rates of return in 2007. To a lesser extent, the increase reflects higher average invested balances in

2007. During a portion of 2007 and 2006, the Company invested excess cash in auction rate securities, which

generated a higher rate of return and contributed to the increases in interest income in 2007 and 2006. The

Company had no investments in auction rate securities at December 30, 2007.

Other (Income) Expense, Net

Other (income) expense, net of $52,323 in 2007 compares to $34,977 in 2006 and $(6,772) in 2005. The

major component of other (income) expense is non-cash (income) expense related to the change in fair value

of certain warrants required to be classified as a liability. These warrants were required to be adjusted to their

fair value each quarter through earnings. For 2007, 2006 and 2005, expense (income) related to the change in

fair value of these warrants was $44,370, $31,770 and $(2,080), respectively. In May 2007, the Company

exercised the call option on these warrants and repurchased the warrants for $200,000 in cash, which

approximated fair value at that date. As these warrants have been repurchased there will be no further fair

value adjustments.

In addition to the above, other (income) expense, net in 2006 also included $2,629 representing a write-

down of the value of common stock of Infogrames, held by the Company as an available-for-sale investment.

This write-down resulted from an other-than-temporary decline in the fair value of this investment.

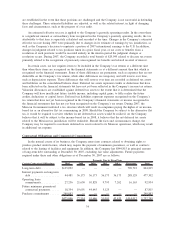

Income Taxes

Income tax expense totaled 28.0% of pretax earnings in 2007 compared with 32.6% in 2006 and 31.8%

in 2005. Income tax expense for 2007 is net of a benefit of $29,999 of discrete tax events, primarily relating

to the recognition of previously unrecognized tax benefits. Income tax expense for 2006 includes a charge of

approximately $7,800 of discrete tax events, primarily relating to the settlement of various tax exams in

multiple jurisdictions. Income tax expense for 2005 includes a charge of approximately $25,800 related to the

repatriation of $547,000 of foreign earnings pursuant to the special incentive provided by the American Jobs

Creation Act of 2004. Income tax expense for 2005 was also reduced by approximately $4,000, due primarily

to the settlement of an Internal Revenue Service examination of tax years ending in December 2001. Absent

26