Hasbro 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

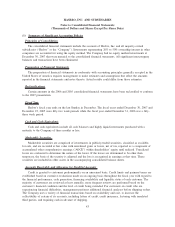

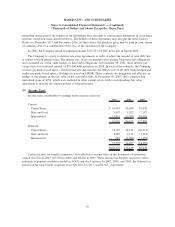

the Company’s defined benefit plans was September 30. See notes 2 and 11 for the impact of adopting of this

statement.

The Company’s policy is to fund amounts which are required by applicable regulations and which are tax

deductible. In 2008, the Company expects to contribute approximately $9,200 to its pension plans. The

estimated amounts of future payments to be made under other retirement programs are being accrued currently

over the period of active employment and are also included in pension expense.

Hasbro has a contributory postretirement health and life insurance plan covering substantially all

employees who retire under any of its United States defined benefit pension plans and meet certain age and

length of service requirements. It also has several plans covering certain groups of employees, which may

provide benefits to such employees following their period of employment but prior to their retirement. The

Company measures the costs of these obligations based on actuarial computations.

Risk Management Contracts

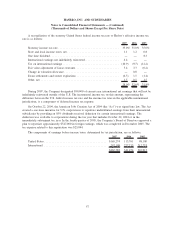

Hasbro uses foreign currency forward contracts to mitigate the impact of adverse currency rate

fluctuations on firmly committed and projected future foreign currency transactions. These over-the-counter

contracts, which hedge future purchases of inventory and other cross-border currency requirements not

denominated in the functional currency of the unit, are primarily denominated in United States and Hong

Kong dollars, Euros and United Kingdom pound sterling and are entered into with counterparties who are

major financial institutions. The Company believes that any default by a counterparty would not have a

material adverse effect on the financial condition of the Company. Hasbro does not enter into derivative

financial instruments for speculative purposes.

At the inception of the contracts, Hasbro designates its derivatives as either cash flow or fair value

hedges. The Company formally documents all relationships between hedging instruments and hedged items as

well as its risk management objectives and strategies for undertaking various hedge transactions. All hedges

designated as cash flow hedges are linked to forecasted transactions and the Company assesses, both at the

inception of the hedge and on an on-going basis, the effectiveness of the derivatives used in hedging

transactions in offsetting changes in the cash flows of the forecasted transaction. The ineffective portion of a

hedging derivative, if any, is immediately recognized in the consolidated statements of operations.

The Company records all derivatives, such as foreign currency exchange contracts, on the balance sheet

at fair value. Changes in the derivative fair values that are designated effective and qualify as cash flow hedges

are deferred and recorded as a component of AOCE until the hedged transactions occur and are then

recognized in the consolidated statements of operations. The Company’s foreign currency contracts hedging

anticipated cash flows are designated as cash flow hedges. When it is determined that a derivative is not

highly effective as a hedge, the Company discontinues hedge accounting prospectively. Any gain or loss

deferred through that date remains in AOCE until the forecasted transaction occurs, at which time it is

reclassified to the consolidated statements of operations. To the extent the transaction is no longer deemed

probable of occurring, hedge accounting treatment is discontinued and amounts deferred would be reclassified

to the consolidated statements of operations. In the event hedge accounting requirements are not met, gains

and losses on such instruments are included currently in the consolidated statements of operations. The

Company uses derivatives to economically hedge intercompany loans denominated in foreign currencies. Due

to the short-term nature of the derivative contracts involved, the Company does not use hedge accounting for

these contracts.

The Company also uses interest rate swap agreements to adjust the amount of long-term debt subject to

fixed interest rates. The interest rate swaps are matched with specific long-term debt obligations and are

designated and effective as fair value hedges of the change in fair value of those debt obligations. These

47

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)