Hasbro 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

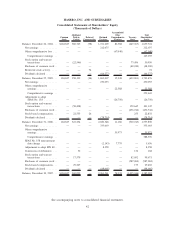

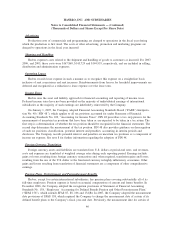

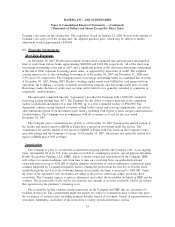

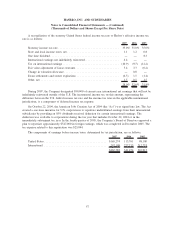

A reconciliation of net earnings and average number of shares for the three fiscal years ended

December 30, 2007 is as follows:

Basic Diluted Basic Diluted Basic Diluted

2007 2006 2005

Net earnings .............. $333,003 333,003 230,055 230,055 212,075 212,075

Change in fair value of

liabilities potentially

settleable in common

stock ................ — — — — — (2,080)

Interest expense on

contingent convertible

debentures due 2021, net

oftax................ — 4,248 — 4,262 — 4,263

$333,003 337,251 230,055 234,317 212,075 214,258

Average shares outstanding.... 156,054 156,054 167,100 167,100 178,303 178,303

Effect of dilutive securities:

Liabilities potentially

settleable in common

stock ................ — — — — — 5,339

Contingent convertible

debentures due 2021 ..... — 11,568 — 11,574 — 11,574

Options and warrants ...... — 3,583 — 2,369 — 2,220

Equivalent shares ........... 156,054 171,205 167,100 181,043 178,303 197,436

Net earnings per share ....... $ 2.13 1.97 1.38 1.29 1.19 1.09

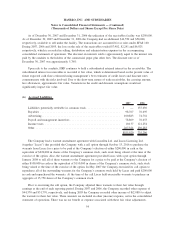

In accordance with Emerging Issues Task Force (“EITF”) Issue 04-8, “The Effect of Contingently

Convertible Instruments on Diluted Earnings per Share”, the net earnings per share calculations for the three

years ended December 30, 2007 include adjustments to add back to earnings the interest expense, net of tax,

incurred on the Company’s Senior Convertible Debentures due 2021, as well as to add back to outstanding

shares the amount of shares potentially issuable as if the contingent conversion features were met. See note 7

for further information on the contingent conversion feature.

Certain warrants containing a put feature that may be settled in cash or common stock were required to

be accounted for as a liability at fair value. These warrants were repurchased by the Company in May of

2007. Prior to their repurchase, the Company was required to assess if these warrants, classified as a liability,

had a more dilutive impact on earnings per share when treated as an equity contract. For the years ended

December 30, 2007 and December 31, 2006, the warrants had a more dilutive impact on earnings per share

assuming they were treated as a liability and no adjustments to net earnings or equivalent shares was required.

For the year ended December 25, 2005, the warrants had a more dilutive impact on earnings per share

assuming they were treated as an equity contract. Accordingly for 2005, the numerator includes an adjustment

to net earnings for the income included therein related to the fair market value adjustment and the denominator

includes an adjustment for the shares issuable as of that date.

49

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)