Hasbro 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

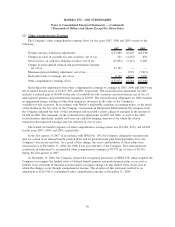

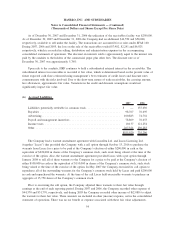

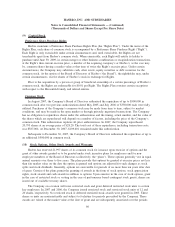

(9) Capital Stock

Preference Share Purchase Rights

Hasbro maintains a Preference Share Purchase Rights Plan (the “Rights Plan”). Under the terms of the

Rights Plan, each share of common stock is accompanied by a Preference Share Purchase Right (“Right”).

Each Right is only exercisable under certain circumstances and, until exercisable, the Rights are not

transferable apart from Hasbro’s common stock. When exercisable, each Right will entitle its holder to

purchase until June 30, 2009, in certain merger or other business combination or recapitalization transactions,

at the Right’s then current exercise price, a number of the acquiring company’s or Hasbro’s, as the case may

be, common shares having a market value at that time of twice the Right’s exercise price. Under certain

circumstances, the Company may substitute cash, other assets, equity securities or debt securities for the

common stock. At the option of the Board of Directors of Hasbro (“the Board”), the rightholder may, under

certain circumstances, receive shares of Hasbro’s stock in exchange for Rights.

Prior to the acquisition by a person or group of beneficial ownership of a certain percentage of Hasbro’s

common stock, the Rights are redeemable for $0.01 per Right. The Rights Plan contains certain exceptions

with respect to the Hassenfeld family and related entities.

Common Stock

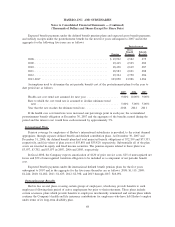

In August 2007, the Company’s Board of Directors authorized the repurchase of up to $500,000 in

common stock after two previous authorizations dated May 2005 and July 2006 of $350,000 each were fully

utilized. Purchases of the Company’s common stock may be made from time to time, subject to market

conditions, and may be made in the open market or through privately negotiated transactions. The Company

has no obligation to repurchase shares under the authorization and the timing, actual number, and the value of

the shares which are repurchased will depend on a number of factors, including the price of the Company’s

common stock. This authorization replaces all prior authorizations. In 2007, the Company repurchased

20,795 shares at an average price of $28.20. The total cost of these repurchases, including transaction costs,

was $587,004. At December 30, 2007, $109,601 remained under this authorization.

Subsequent to December 30, 2007, the Company’s Board of Directors authorized the repurchase of up to

an additional $500,000 in common stock.

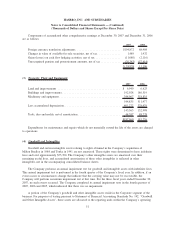

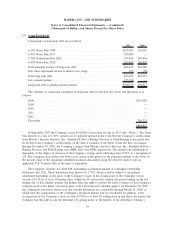

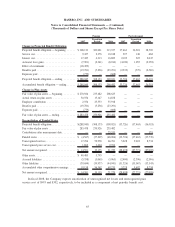

(10) Stock Options, Other Stock Awards and Warrants

Hasbro has reserved 21,997 shares of its common stock for issuance upon exercise of options and the

grant of other awards granted or to be granted under stock incentive plans for employees and for non-

employee members of the Board of Directors (collectively, the “plans”). These options generally vest in equal

annual amounts over three to five years. The plans provide that options be granted at exercise prices not less

than fair market value on the date the option is granted and options are adjusted for such changes as stock

splits and stock dividends. Generally, options are exercisable for periods of no more than ten years after date

of grant. Certain of the plans permit the granting of awards in the form of stock options, stock appreciation

rights, stock awards and cash awards in addition to options. Upon exercise in the case of stock options, grant

in the case of restricted stock or vesting in the case of performance based contingent stock grants, shares are

issued out of available treasury shares.

The Company on occasion will issue restricted stock and grant deferred restricted stock units to certain

key employees. In 2007 and 2006, the Company issued restricted stock and restricted stock units of 12 and

20 shares, respectively. No restricted stock or deferred restricted stock awards were granted in 2005. These

shares or units are nontransferable and subject to forfeiture for periods prescribed by the Company. These

awards are valued at the market value at the date of grant and are subsequently amortized over the periods

60

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)