Hasbro 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

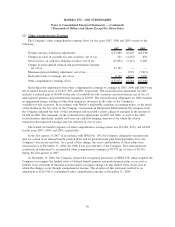

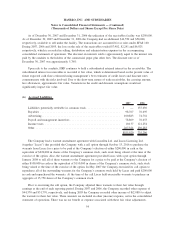

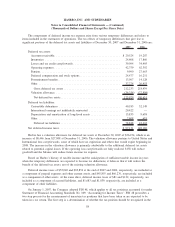

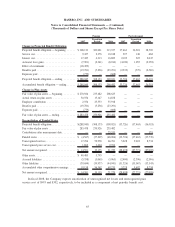

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax

rate is as follows:

2007 2006 2005

Statutory income tax rate . ...................................... 35.0% 35.0% 35.0%

State and local income taxes, net ................................. 1.1 1.2 0.8

One time dividend ............................................ — — 8.3

International earnings not indefinitely reinvested...................... 4.4 — —

Tax on international earnings .................................... (10.9) (9.7) (12.2)

Fair value adjustment of Lucas warrants ............................ 3.4 3.3 (0.2)

Change in valuation allowance ................................... — 0.8 —

Exam settlements and statute expirations ........................... (6.5) 1.5 (1.4)

Other, net .................................................. 1.5 0.5 1.5

28.0% 32.6% 31.8%

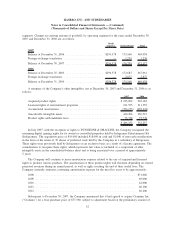

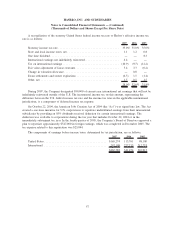

During 2007, the Company designated $90,000 of current year international net earnings that will not be

indefinitely reinvested outside of the U.S. The incremental income tax on this amount, representing the

difference between the U.S. federal income tax rate and the income tax rates in the applicable international

jurisdictions, is a component of deferred income tax expense.

On October 22, 2004, the American Jobs Creation Act of 2004 (the “Act”) was signed into law. The Act

created a one-time incentive for U.S. corporations to repatriate undistributed earnings from their international

subsidiaries by providing an 85% dividends-received deduction for certain international earnings. The

deduction was available to corporations during the tax year that includes October 22, 2004 or in the

immediately subsequent tax year. In the fourth quarter of 2005, the Company’s Board of Directors approved a

plan to repatriate approximately $547,000 in foreign earnings, which was completed in December 2005. The

tax expense related to this repatriation was $25,844.

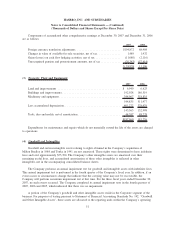

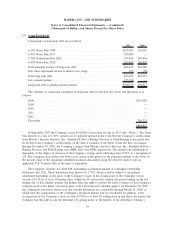

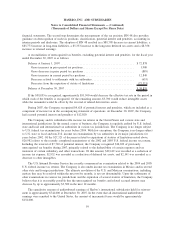

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2007 2006 2005

United States ........................................ $165,274 113,761 98,180

International ........................................ 297,108 227,713 212,733

$462,382 341,474 310,913

57

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)