Hasbro 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

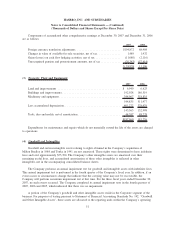

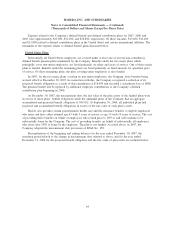

during which the restrictions lapse, generally 3 years. Compensation expense recognized relating to the

outstanding restricted stock and deferred restricted stock was $183, $158, and $74 in fiscal 2007, 2006, and

2005, respectively. At December 30, 2007, the amount of total unrecognized compensation cost related to

restricted stock is $431 and the weighted average period over which this will be expensed is 25 months.

In 2007 and 2006, as part of its annual equity grant to executive officers and certain other employees, the

Company’s Board of Directors approved the issuance of contingent stock performance awards (the “Stock

Performance Awards”). These awards provide the recipients with the ability to earn shares of the Company’s

Common Stock based on the Company’s achievement of stated cumulative diluted earnings per share and

cumulative net revenue targets over the three fiscal years ended December 2009 for the 2007 award, and over

a ten quarter period beginning July 3, 2006 and ending December 2008 for the 2006 award. Each Stock

Performance Award has a target number of shares of Common Stock associated with such award which may

be earned by the recipient if the Company achieves the stated diluted earnings per share and revenue targets.

The ultimate amount of the award may vary, depending on actual results, from 0% to 125% of the target

number of shares. The Compensation Committee of the Company’s Board of Directors has discretionary power

to reduce the amount of the award regardless of whether the stated targets are met. If the Company achieves

100% of the stated targets, it would expect to issue 1,194 shares under these awards.

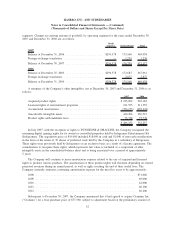

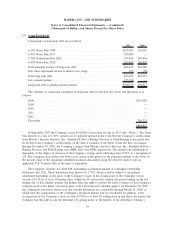

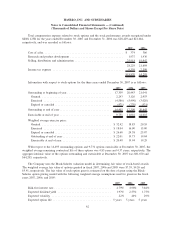

Information with respect to Stock Performance Awards for 2007 and 2006 is as follows, assuming the

Company achieves 100% of the stated targets:

2007 2006

Outstanding at beginning of year ...................................... 738 —

Granted ....................................................... 537 762

Forfeited ...................................................... (81) (24)

Outstanding at end of year ........................................... 1,194 738

Weighted average grant-date fair value:

Granted ....................................................... 28.74 19.00

Forfeited ...................................................... 22.89 18.82

Outstanding at end of year ......................................... 23.12 19.01

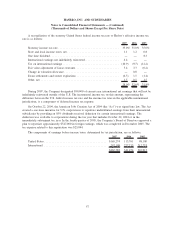

During 2007 and 2006, the Company recognized $11,122 and $2,390, respectively, of expense relating to

these awards. If minimum targets, as detailed under the award, are not met, no additional compensation cost

will be recognized and any previously recognized compensation cost will be reversed. These awards were

valued at the market value at the dates of grant and are being amortized over the three fiscal years ending

December 2009 and over the 10 quarter period from July 3, 2006 through December 2008 for the 2007 and

2006 awards, respectively. At December 30, 2007, the amount of total unrecognized compensation cost related

to these awards is approximately $16,664 and the weighted average period over which this will be expensed is

19.42 months.

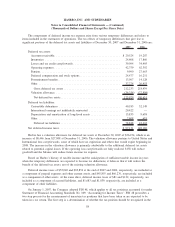

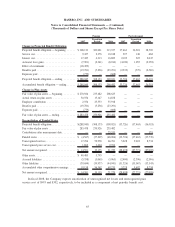

Prior to fiscal 2006, Hasbro used the intrinsic-value method of accounting for stock options granted to

employees and non-employee members of the Board of Directors. Effective December 26, 2005, the first day

of fiscal 2006, the Company adopted SFAS 123R under the modified prospective transition method as defined

in the statement. Under this adoption method, the Company recorded stock option expense in 2006 based on

all unvested stock options as of the adoption date and any stock option awards made subsequent to the

adoption date. Stock-based compensation is recognized on a straight-line basis over the requisite service period

of the award. In accordance with the modified prospective transition method, the Company’s consolidated

financial statements for prior years have not been restated to reflect, and do not include, the impact of

SFAS 123R.

61

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)