Hasbro 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

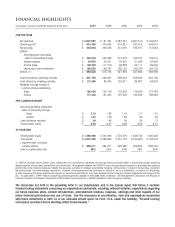

For the full-year 2007, the Company repurchased 20.8 million shares of common stock at a total cost of $587 million.

From the resumption of our share buy-back program in 2005 through the end of 2007, we have spent $1.1 billion to

repurchase more than 45.9 million shares. In addition, in 2007, we exercised our rights to purchase the Lucas warrants for

$200 million --- bringing our total reduction in shares and warrants from 2005 through 2007 to approximately 62 million

shares. Our buy-back program refl ects both our signifi cant cash generation, our expectations for the business going forward,

and our commitment to create value for our shareholders.

World-class Brands

Since 2001, we have focused on re-inventing, re-imagining, re-igniting and growing Hasbro’s world-class brands.

This commitment remained as strong as ever in 2007, and as a result, our boys, girls, preschool, games and puzzles

categories all performed well on a global basis.

The boys business was particularly strong in 2007 with TRANSFORMERS, SPIDER-MAN and STAR WARS leading the charge

as the top three boys properties in the industry. TRANSFORMERS generated approximately $480 million in revenue, while

STAR WARS and MARVEL also delivered signifi cant revenue. With several upcoming theatrical releases,

The Incredible Hulk,

Iron Man, Indiana Jones and the Kingdom of the Crystal Skull

, and

Star Wars: The Clone Wars

, and the planned release of

SPIDER-MAN television animation, we expect the boys business to remain strong in 2008.

Hasbro has emerged as a powerful player in the girls arena as well. Our girls business has grown substantially from $57

million in 2000 to $697 million in 2007, driven by strong performances from our core brands. We have consistently redefi ned

this category by delivering innovative and exciting new product, and in 2008, we plan to continue this with the introduction of

FURREAL FRIENDS BISCUIT, MY LOVIN’ PUP, the worldwide launch of LITTLEST PET SHOP VIRTUAL INTERACTIVE PETS (VIPs),

and the 25th birthday celebration of MY LITTLE PONY.

PLAYSKOOL also had a good year and is a major priority for us again in 2008 as we celebrate the brand’s 80th anniversary.

In addition to our strong continuing product line, you’ll see a number of new introductions for 2008.

As a worldwide leader in games, we saw growth in our traditional board games business in 2007, resulting from strong

performances from our core brands, as well as new introductions such as ARE YOU SMARTER THAN A 5TH GRADER?. In 2008,

we’ve added new evergreen properties to our portfolio with the acquisition of Cranium, Inc., and we are continuing to drive our

core brands with new additions like MONOPOLY HERE & NOW: THE WORLD EDITION.

We also unveiled a great adjacency business in 2007 with the introduction of TOOTH TUNES. In 2008, we will be expanding

the brand internationally and introducing TOOTH TUNES JUNIOR and TURBO TOOTH TUNES.

Digital Gaming and Marketing Initiatives

Changing consumer lifestyles have led to major opportunities in digital and casual gaming, and Hasbro is working with

Electronic Arts (EA) to become a leader in casual gaming. This partnership is helping us to extend our core brands and offer

consumers new and exciting ways to enjoy their favorite brands while on-the-go. In 2008, you’ll see a number of new digital

introductions based on Hasbro’s most popular brands, including LITTLEST PET SHOP, NERF, MONOPOLY, CLUE, OPERATION,

TRIVIAL PURSUIT and SCRABBLE.

Entertainment Experiences

Delivering new immersive entertainment experiences by expanding and contemporizing our brands continues to be a major

focus for Hasbro. Building on the success of TRANSFORMERS, we are working with DreamWorks Pictures and Paramount

Pictures on the next installment of the TRANSFORMERS story and with Paramount Pictures on G.I. JOE. Both movies are

scheduled for release in 2009. We also have a new six-year strategic partnership with Universal Pictures to produce at least

four motion pictures based on some of our world’s best-known and beloved brands. The fi rst movie is expected to be released

in 2010 or 2011, and Universal will release at least one fi lm a year thereafter. We’re also working on a new game show,

TRIVIAL PURSUIT: AMERICA PLAYS, in partnership with Debmar-Mercury for launch on television this fall.