Hasbro 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

also negatively impacted by approximately $10,400 in charges related to the recall of the Company’s EASY-

BAKE oven product and by a charge of approximately $10,000 related to a restructuring and related reduction

in work force at the Company’s manufacturing facility in East Longmeadow, Massachusetts. This charge

consisted primarily of severance costs.

The Company’s gross profit margin was 58.6% for the year ended December 31, 2006 compared to

58.3% in 2005. The increase was due to increased revenues from certain core brand products that have higher

gross margins, such as LITTLEST PET SHOP products and traditional board games, such as MONOPOLY.

Gross profit in 2006 was negatively impacted by a charge of approximately $10,300 related to the Company’s

decision to transfer certain manufacturing activities from its Ireland manufacturing facility to its suppliers in

China. Gross margin in 2005 was also negatively impacted by inventory obsolescence and customer allowances

on plug and play games.

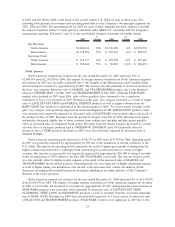

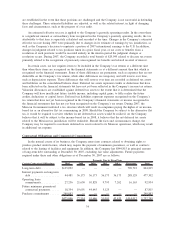

Expenses

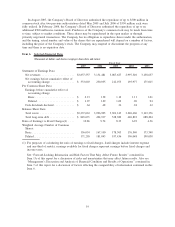

The Company’s operating expenses, stated as percentages of net revenues, are illustrated below for the

three fiscal years ended December 30, 2007:

2007 2006 2005

Amortization ................................................. 1.8% 2.5% 3.3%

Royalties .................................................... 8.2 5.4 8.0

Research and product development ................................. 4.4 5.4 4.9

Advertising .................................................. 11.3 11.7 11.8

Selling, distribution and administration .............................. 19.7 21.7 20.2

Amortization expense continued to decrease in 2007 to $67,716 from $78,934 in 2006 and $102,035 in

2005. A portion of amortization expense relates to licensing rights and is based on expected sales of products

related to those licensing rights. The decrease in amortization expense in 2007 and 2006 primarily relates to

decreased amortization of the product rights related to STAR WARS.

Royalty expense increased to $316,807 or 8.2% of net revenues in 2007 compared to $169,731 or 5.4%

of net revenues in 2006. This increase is primarily due to increased sales of entertainment-based products,

primarily MARVEL and TRANSFORMERS movie-related products due to the theatrical releases of

SPIDER-MAN 3 and TRANSFORMERS in 2007. Royalty expense decreased to $169,731 or 5.4% of net

revenues in 2006 compared to $247,283 or 8.0% of net revenues in 2005. This decrease primarily relates to

the decrease in sales of STAR WARS products in 2006 from 2005.

Research and product development expense decreased in 2007 to $167,194 or 4.4% of net revenues from

$171,358 or 5.4% of net revenues in 2006. This decrease reflects higher investments in the prior year,

primarily related to the MARVEL product lines. Research and product development expense increased in 2006

to $171,358 or 5.4% of net revenues from $150,586 or 4.9% of net revenues in 2005. This increase was the

result of development expenses related to the MARVEL line of products as well as increased investment in the

PLAYSKOOL line.

Advertising expense increased in dollars to $434,742 in 2007 from $368,996 in 2006, but decreased as a

percentage of revenues to 11.3% from 11.7% in 2006. The decrease as a percentage of revenues primarily

relates to the mix of sales in 2007, which included increased sales of entertainment-based products, which

require lower amounts of advertising and promotion. Revenues related to entertainment-based properties have

increased in 2007 with the release of the SPIDER-MAN 3 and TRANSFORMERS movies. The increase in

dollars is primarily due to continued investment in our PLAYSKOOL line as well as other core brands, and to

a lesser extent, the impact of foreign exchange. Advertising expense in 2006 was $368,996 or 11.7% of net

revenues which was consistent with the 2005 expense of $366,371 or 11.8% of net revenues.

Selling, distribution and administration expenses increased in dollars to $755,127 from $682,214 in 2006

but decreased as a percentage of revenues to 19.7% from 21.7% in 2006. The increase in dollars reflects

higher variable selling and distribution costs resulting from higher revenues in 2007, as well as higher

25