Hasbro 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

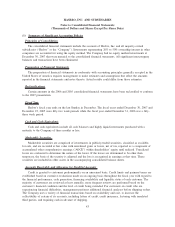

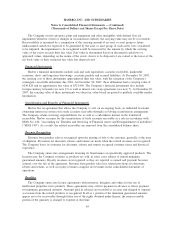

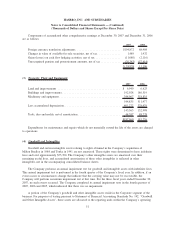

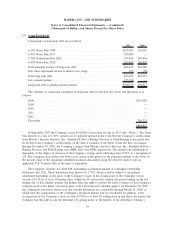

agreements are recorded at their fair value as an asset or liability. Gains and losses on these contracts are

included currently in the consolidated statements of operations and are wholly offset by changes in the fair

value of the related long-term debt. These hedges are considered to be perfectly effective under Statement of

Financial Accounting Standards No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as

amended by Statement of Financial Accounting Standards No. 138 (collectively “SFAS 133”). The interest

rate swap contracts are with major financial institutions in order to minimize counterparty credit risk. The

Company believes that any default by a counterparty would not have a material adverse effect on the financial

condition of the Company.

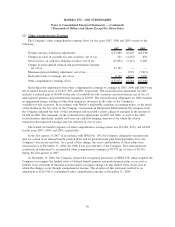

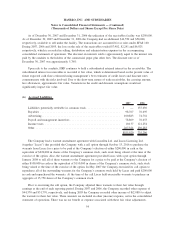

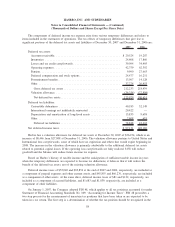

Accounting for Stock-Based Compensation

At December 30, 2007, the Company had stock-based employee compensation plans and plans for non-

employee members of the Company’s Board of Directors, which are described more fully in note 10. Effective

December 26, 2005, the first day of fiscal 2006, the Company adopted Statement of Financial Accounting

Standards No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123R”), which amends Statement of

Financial Accounting Standards No. 123, as amended by No. 148, and Statement of Financial Accounting

Standards No. 95, “Statement of Cash Flows” (collectively “SFAS 123”). The Company adopted SFAS 123R

under the modified prospective basis as defined in the statement. In 2006, the Company recorded stock option

expense based on all unvested stock options as of the adoption date as well as all stock-based compensation

awards granted subsequent to the adoption date. See footnote 10 for further information related to the adoption

of this statement. Prior to 2006, as permitted by SFAS 123, Hasbro accounted for those plans under the

recognition and measurement principles of Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees”, and related interpretations. As required by the Company’s existing stock plans,

stock options are granted at or above the fair market value of the Company’s common stock and, accordingly,

no compensation expense was recognized for these grants in the consolidated statements of operations prior to

fiscal 2006. Had compensation expense been recorded under the fair value method as set forth in the

provisions of SFAS 123 for stock options awarded, the Company’s 2005 net earnings would have decreased by

$15,078 to $196,997 and basic and diluted EPS would have been $1.10 and $1.01, respectively.

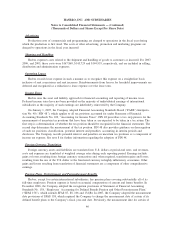

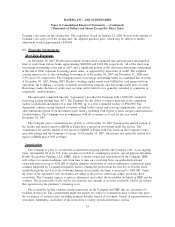

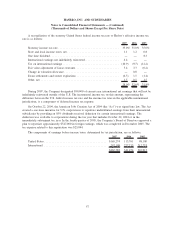

Net Earnings Per Common Share

Basic net earnings per share is computed by dividing net earnings by the weighted average number of

shares outstanding for the year. Diluted net earnings per share is similar except that the weighted average

number of shares outstanding is increased by dilutive securities, and net earnings are adjusted for certain

amounts related to dilutive securities. Dilutive securities include shares issuable under convertible debt, as well

as shares issuable upon exercise of stock options and warrants for which market price exceeds exercise price,

less shares which could have been purchased by the Company with the related proceeds. Dilutive securities

may also include shares potentially issuable to settle liabilities. Options and warrants totaling 3,250, 5,148 and

6,018 for 2007, 2006 and 2005, respectively, were excluded from the calculation of diluted earnings per share

because to include them would have been antidilutive.

48

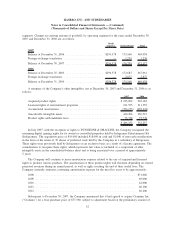

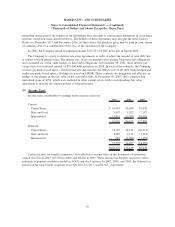

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)