Hasbro 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

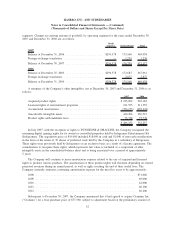

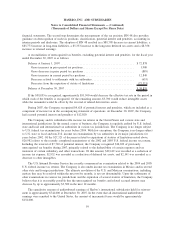

As of December 30, 2007 and December 31, 2006 the utilization of the receivables facility was $250,000.

As of December 30, 2007 and December 31, 2006 the Company had an additional $16,550 and $50,000,

respectively, available to sell under the facility. The transactions are accounted for as sales under SFAS 140.

During 2007, 2006 and 2005, the loss on the sale of the receivables totaled $7,982, $2,241 and $6,925,

respectively, which is recorded in selling, distribution and administration expenses in the accompanying

consolidated statements of operations. The discount on interests sold is approximately equal to the interest rate

paid by the conduits to the holders of the commercial paper plus other fees. The discount rate as of

December 30, 2007 was approximately 5.78%.

Upon sale to the conduits, HRF continues to hold a subordinated retained interest in the receivables. The

subordinated interest in receivables is recorded at fair value, which is determined based on the present value of

future expected cash flows estimated using management’s best estimates of credit losses and discount rates

commensurate with the risks involved. Due to the short-term nature of trade receivables, the carrying amount,

less allowances, approximates fair value. Variations in the credit and discount assumptions would not

significantly impact fair value.

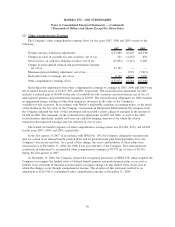

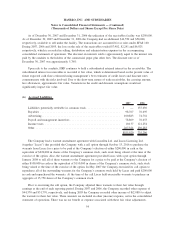

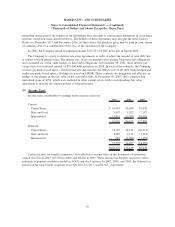

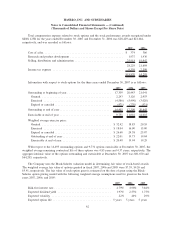

(6) Accrued Liabilities

2007 2006

Liabilities potentially settleable in common stock ...................... $ — 155,630

Royalties ................................................... 98,767 76,695

Advertising .................................................. 100,883 74,781

Payroll and management incentives ................................ 78,809 76,653

Income taxes................................................. 10,137 121,254

Other ...................................................... 267,324 230,283

$555,920 735,296

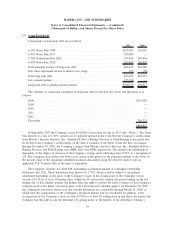

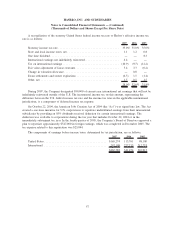

The Company had a warrant amendment agreement with Lucasfilm Ltd. and Lucas Licensing Ltd.

(together “Lucas”) that provided the Company with a call option through October 13, 2016 to purchase the

warrants from Lucas for a price to be paid at the Company’s election of either $200,000 in cash or the

equivalent of $220,000 in shares of the Company’s common stock, such stock being valued at the time of the

exercise of the option. Also, the warrant amendment agreement provided Lucas with a put option through

January 2008 to sell all of these warrants to the Company for a price to be paid at the Company’s election of

either $100,000 in cash or the equivalent of $110,000 in shares of the Company’s common stock, such stock

being valued at the time of the exercise of the option. In May 2007 the Company exercised its call option to

repurchase all of the outstanding warrants for the Company’s common stock held by Lucas and paid $200,000

in cash and repurchased the warrants. At the time of the call Lucas held exercisable warrants to purchase an

aggregate of 15,750 shares of the Company’s common stock.

Prior to exercising the call option, the Company adjusted these warrants to their fair value through

earnings at the end of each reporting period. During 2007 and 2006, the Company recorded other expense of

$44,370 and $31,770, respectively, and during 2005 the Company recorded other income of $(2,080) to adjust

the warrants to their fair value. These amounts are included in other (income) expense, net in the consolidated

statement of operations. There was no tax benefit or expense associated with these fair value adjustments.

54

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)