Hasbro 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

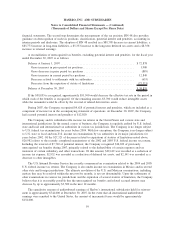

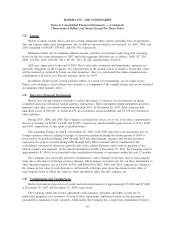

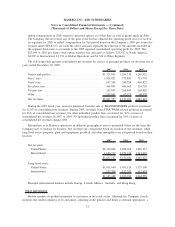

(12) Leases

Hasbro occupies certain offices and uses certain equipment under various operating lease arrangements.

The rent expense under such arrangements, net of sublease income which is not material, for 2007, 2006, and

2005 amounted to $36,897, $34,603, and $35,570, respectively.

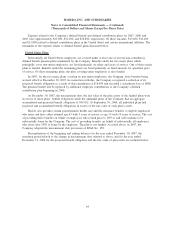

Minimum rentals, net of minimum sublease income, which is not material, under long-term operating

leases for the five years subsequent to 2007 and in the aggregate thereafter are as follows: 2008: $27,236;

2009: $21,650; 2010: $10,828; 2011: $9,793; 2012: $7,262; and thereafter: $16,165.

All leases expire prior to the end of 2018. Real estate taxes, insurance and maintenance expenses are

generally obligations of the Company. It is expected that in the normal course of business, leases that expire

will be renewed or replaced by leases on other properties; thus, it is anticipated that future minimum lease

commitments will not be less than the amounts shown for 2007.

In addition, Hasbro leases certain facilities which, as a result of restructurings, are no longer in use.

Future costs relating to such facilities were accrued as a component of the original charge and are not included

in minimum rental amounts above.

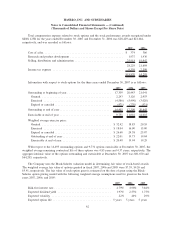

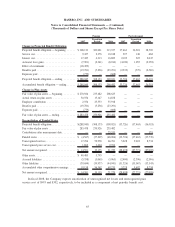

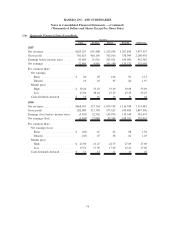

(13) Derivative Financial Instruments

Hasbro uses foreign currency forwards to reduce the impact of currency rate fluctuations on firmly

committed and projected future foreign currency transactions. These instruments hedge anticipated inventory

purchases and other cross-border transactions through 2010. At December 30, 2007, these contracts had

unrealized losses of $10,437, of which $6,679 are recorded in accrued liabilities and $3,758 are recorded in

other liabilities.

During 2007, 2006, and 2005, the Company reclassified net losses, net of tax, from other comprehensive

income to earnings of $6,887, $1,448, and $2,005, respectively, which included gains (losses) of $(37), $(68),

and $509, respectively, as the result of ineffectiveness.

The remaining balance in AOCE at December 30, 2007 of $11,080 represents a net unrealized loss on

foreign currency contracts relating to hedges of inventory purchased during the fourth quarter of 2007 or

forecasted to be purchased during 2008 through 2010 and intercompany expenses and royalty payments

expected to be paid or received during 2008 through 2010. These amounts will be transferred to the

consolidated statement of operations upon the sale of the related inventory and receipt or payment of the

related royalties and expenses. Of the amount included in AOCE at December 30, 2007, the Company expects

approximately $7,100 to be reclassified to the consolidated statement of operations within the next 12 months.

The Company also enters into derivative instruments to offset changes in the fair value of intercompany

loans due to the impact of foreign currency changes. The Company recorded a net loss on these instruments to

other (income) expense, net of $2,098, $5,501, and $60,014 in 2007, 2006, and 2005, respectively, relating to

the change in fair value of such derivatives, substantially offsetting gains from the change in fair value of

intercompany loans to which the contracts relate included in other (income) expense, net.

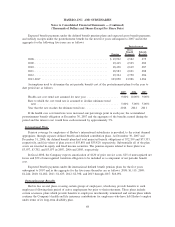

(14) Commitments and Contingencies

Hasbro had unused open letters of credit and related instruments of approximately $70,000 and $71,000

at December 30, 2007 and December 31, 2006, respectively.

The Company enters into license agreements with inventors, designers and others for the use of

intellectual properties in its products. Certain of these agreements contain provisions for the payment of

guaranteed or minimum royalty amounts. Additionally, the Company has a long-term commitment related to

69

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)