Hasbro 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

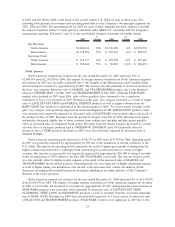

these items, potential interest and penalties in 2007 related to uncertain tax positions, and the effect of the

adjustment of certain warrants to their fair value, which has no tax effect, the 2007 effective tax rate would

have been 30.5% compared to 27.6% in 2006 and 24.9% in 2005. The increase in the adjusted rate to 30.5%

in 2007 compared to 27.6% in 2006 primarily reflects the decision to repatriate a portion of 2007 international

earnings to the U.S. The increase in the adjusted rate to 27.6% in 2006 from 24.9% in 2005 was the result of

higher earnings in jurisdictions with higher statutory tax rates.

Liquidity and Capital Resources

The Company has historically generated a significant amount of cash from operations. In 2007, the

Company primarily funded its operations and liquidity needs through cash flows from operations, and, when

needed, proceeds from its accounts receivable securitization program and borrowings under its unsecured

credit facilities. In September 2007 the Company issued $350,000 in principal amount of notes that are due in

2017 (the “Notes”). The proceeds from the sale of the Notes were primarily used to repay the Company’s

short-term borrowings while the remainder of the proceeds were used for general corporate purposes. During

2008, the Company expects to continue to fund its working capital needs primarily through cash flows from

operations and, when needed, using proceeds from its accounts receivable securitization program and

borrowings under its available lines of credit. The Company believes that the funds available to it, including

cash expected to be generated from operations and funds available through its accounts receivable securitiza-

tion program and other available lines of credit are adequate to meet its working capital needs for 2008.

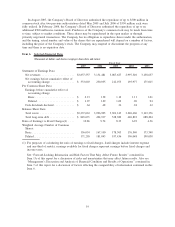

At December 30, 2007, cash and cash equivalents, net of short-term borrowings, were $764,257 compared

to $704,818 and $927,592 at December 30, 2006 and December 25, 2005, respectively. Hasbro generated

$601,794, $320,647, and $496,624 of cash from its operating activities in 2007, 2006 and 2005, respectively.

The higher cash flows from operations in 2007 compared to 2006 were primarily the result of increased

earnings as well as the mix of products in 2007 net revenues. Net earnings in 2007 included increased non-

cash royalty expenses primarily as a result of increased revenues from MARVEL products. The royalty

expense related to revenues from MARVEL products in 2007 was paid in 2006. Similarly, the higher cash

flows from operations in 2005 compared to 2006 was primarily due to the mix of products in 2005 net

revenues. Net earnings in 2005 included increased non-cash royalty expenses primarily as a result of increased

STAR WARS revenues. Increased royalty expense in 2005 related to revenues from STAR WARS products,

most of which had been paid in prior years. In 2007, 2006 and 2005, operating cash flows were impacted by

royalty advances paid of $70,000, $105,000 and $35,000 related to MARVEL in 2007 and 2006 and STAR

WARS in 2005, respectively.

Accounts receivable increased to $654,789 at December 30, 2007 from $556,287 at December 31, 2006.

The increase in accounts receivable is primarily the result of higher sales volume in 2007. Fourth quarter days

sales outstanding remained consistent at 45 days in both 2007 and 2006 compared to 44 days in 2005. The

increase in days sales outstanding from 2005 primarily reflects increases in international accounts receivable

due to the weaker U.S. dollar in 2006 and 2007. The December 30, 2007 accounts receivable balance includes

an increase of approximately $31,100 related to the currency impact of the weaker U.S. dollar. The Company

has a revolving accounts receivable securitization facility whereby the Company is able to sell undivided

fractional ownership interests in qualifying accounts receivable on an ongoing basis. At December 30, 2007

and December 31, 2006, there was $250,000 sold at each period-end under this program.

Inventories increased to $259,081 at December 30, 2007 from $203,337 at December 31, 2006. The

increase in inventory reflects the growth of the Company’s business in 2007. In addition, inventories increased

approximately $9,400 due to the weaker U.S. dollar in 2007. The increase in inventory to $203,337 at

December 31, 2006 from $179,398 at December 25, 2005 represents higher levels of inventory at

December 31, 2006 due to anticipated sales of MARVEL products in early 2007. In addition, inventories

increased approximately $6,100 due to the weaker U.S. dollar in 2006.

Prepaid expenses and other current assets decreased to $199,912 at December 30, 2007 from $243,291 at

December 31, 2006. This decrease is primarily due to utilization of MARVEL and Lucas royalty advances.

Generally when the Company enters into a licensing agreement for entertainment-based properties, an advance

27