Hasbro 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

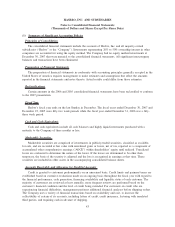

Advertising

Production costs of commercials and programming are charged to operations in the fiscal year during

which the production is first aired. The costs of other advertising, promotion and marketing programs are

charged to operations in the fiscal year incurred.

Shipping and Handling

Hasbro expenses costs related to the shipment and handling of goods to customers as incurred. For 2007,

2006, and 2005, these costs were $167,868, $145,729 and $144,953, respectively, and are included in selling,

distribution and administration expenses.

Operating Leases

Hasbro records lease expense in such a manner as to recognize this expense on a straight-line basis

inclusive of rent concessions and rent increases. Reimbursements from lessors for leasehold improvements are

deferred and recognized as a reduction to lease expense over the lease term.

Income Taxes

Hasbro uses the asset and liability approach for financial accounting and reporting of income taxes.

Deferred income taxes have not been provided on the majority of undistributed earnings of international

subsidiaries as the majority of such earnings are indefinitely reinvested by the Company.

On January 1, 2007, the Company adopted Financial Accounting Standards Board (“FASB”) Interpreta-

tion No. 48 (“FIN 48”), which applies to all tax positions accounted for under Statement of Financial

Accounting Standards No. 109, “Accounting for Income Taxes”. FIN 48 prescribes a two step process for the

measurement of uncertain tax positions that have been taken or are expected to be taken in a tax return. The

first step is a determination of whether the tax position should be recognized in the financial statements. The

second step determines the measurement of the tax position. FIN 48 also provides guidance on derecognition

of such tax positions, classification, potential interest and penalties, accounting in interim periods and

disclosure. The Company records potential interest and penalties on uncertain tax positions as a component of

income tax expense. See note 8 for further information regarding the adoption of FIN 48.

Foreign Currency Translation

Foreign currency assets and liabilities are translated into U.S. dollars at period-end rates, and revenues,

costs and expenses are translated at weighted average rates during each reporting period. Earnings include

gains or losses resulting from foreign currency transactions and, when required, translation gains and losses

resulting from the use of the U.S. dollar as the functional currency in highly inflationary economies. Other

gains and losses resulting from translation of financial statements are a component of other comprehensive

earnings.

Pension Plans, Postretirement and Postemployment Benefits

Hasbro, except for certain international subsidiaries, has pension plans covering substantially all of its

full-time employees. Pension expense is based on actuarial computations of current and future benefits. In

December 2006, the Company adopted the recognition provisions of Statement of Financial Accounting

Standards No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans”

(“SFAS 158”), which amends SFAS 87, 88, 106 and 132(R). In 2007, the Company adopted the measurement

date provisions of SFAS 158, which required the Company to change the measurement date of certain of its

defined benefit plans to the Company’s fiscal year-end date. Previously, the measurement date for certain of

46

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)