Hasbro 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

contingent interest feature represents a derivative instrument that is recorded on the balance sheet at its fair

value, with changes in fair value recognized in the statement of operations. If the closing price of the

Company’s stock exceeds $23.76 for at least 20 trading days, within the 30 consecutive trading day period

ending on the last trading day of the calendar quarter, or upon other specified events, the debentures will be

convertible at an initial conversion price of $21.60 in the next calendar quarter. At December 30, 2006,

March 31, 2007, June 30, 2007 and September 30, 2007 this conversion feature was met and the debentures

were convertible throughout 2007. During 2007, $168 of these debentures were converted and 8 shares were

issued. At December 30, 2007, this conversion feature was met again and the bonds are convertible through

March 31, 2008 at which time the requirements of the conversion feature will be reevaluated. In addition, if

the closing price of the Company’s stock exceeds $27.00 for at least 20 trading days in any 30 day period, the

Company has the right to call the debentures by giving notice to the holders of the debentures. During a

prescribed notice period, the holders of the debentures have the right to convert their debentures in accordance

with the conversion terms described above. The holders of these debentures may also put the notes back to

Hasbro in December 2011 and December 2016 at the original principal amount. At that time, the purchase

price may be paid in cash, shares of common stock or a combination of the two, at the Company’s discretion.

While the Company’s current intent is to settle in cash any puts exercised, there can be no guarantee that the

Company will have the funds necessary to settle this obligation in cash. On December 1, 2005, the holders of

these debentures had the option to put these notes back to Hasbro. On that date, the Company redeemed $4 of

these notes in cash.

The $350,000 Notes due in 2017 bear interest at a rate of 6.30%, which may be adjusted upward in the

event that the Company’s credit rating from Moody’s Investor Services, Inc., Standard & Poor’s Ratings

Services or Fitch Ratings is decreased two levels below the Company’s credit ratings on the date of issuance

of the Notes. On the date of issuance and throughout the remainder of 2007, the Company’s ratings from

Moody’s Investor Services, Inc., Standard & Poor’s Ratings Services and Fitch Ratings were BBB, Baa2 and

BBB, respectively. The interest rate adjustment is dependent on the degree of decrease of the Company’s

ratings and could range from 0.25% to a maximum of 2%. The Company may redeem the Notes at its option

at the greater of the principal amount of the Notes or the present value of the remaining scheduled payments

discounted using the effective interest rate on applicable U.S. Treasury bills at the time of repurchase.

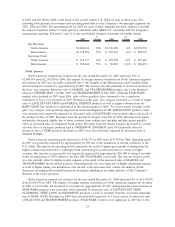

The Company has remaining principal amounts of long-term debt at December 30, 2007 of approximately

$844,815. As detailed below in Contractual Obligations and Commercial Commitments, this debt is due at

varying times from 2008 through 2028. In addition, the Company is committed to guaranteed royalty and other

contractual payments of approximately $18,354 in 2008. The Company also had letters of credit and other

similar instruments of approximately $70,000 and purchase commitments of $249,883 outstanding at

December 30, 2007. The Company believes that cash from operations, including the securitization facility,

and, if necessary, its line of credit, will allow the Company to meet these and other obligations listed.

In August 2007, the Company’s Board of Directors authorized the repurchase of up to $500,000 in

common stock after two previous authorizations dated May 2005 and July 2006 of $350,000 each were fully

utilized. Purchases of the Company’s common stock may be made from time to time, subject to market

conditions, and may be made in the open market or through privately negotiated transactions. The Company

has no obligation to repurchase shares under the authorization and the timing, actual number, and the value of

the shares which are repurchased will depend on a number of factors, including the price of the Company’s

common stock. The Company may suspend or discontinue repurchases of its stock at any time and there is no

expiration date for such repurchases. In 2007, the Company repurchased 20,795 shares at an average price of

$28.20. The total cost of these repurchases, including transaction costs, was $587,004. On February 7, 2008

the Board of Directors approved an additional $500,000 share repurchase authorization. On that date,

approximately $48,300 remained under the August 2007 repurchase authorization.

Critical Accounting Policies and Significant Estimates

The Company prepares its consolidated financial statements in accordance with accounting principles

generally accepted in the United States of America. As such, management is required to make certain

estimates, judgments and assumptions that it believes are reasonable based on information available. These

30