Hasbro 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

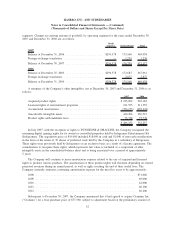

prescribed notice period, the holders of the debentures have the right to convert their debentures in accordance

with the conversion terms described above. The holders of these debentures may also put the notes back to

Hasbro in December 2011 and December 2016. At these times, the purchase price may be paid in cash, shares

of common stock or a combination of the two, at the discretion of the Company.

In 2006, the Company repaid in principal amount $32,743 of 8.50% notes due in March 2006.

The Company is a party to interest rate swap agreements in order to adjust the amount of total debt that

is subject to fixed interest rates. The interest rate swaps are matched with specific long-term debt obligations

and accounted for as fair value hedges of those debt obligations. At December 30, 2007, these interest rate

swaps had a total notional amount of $75,000 with maturities in 2008. In each of the contracts, the Company

receives payments based upon a fixed interest rate that matches the interest rate of the debt being hedged and

makes payments based upon a floating rate based on LIBOR. These contracts are designated and effective as

hedges of the change in the fair value of the associated debt. At December 30, 2007, these contracts had

unrealized gains of $256, which were included in other current assets, with a corresponding fair value

adjustment to increase the current portion of long-term debt.

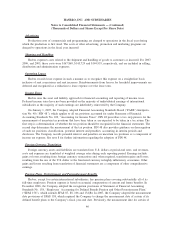

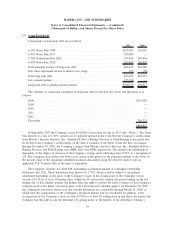

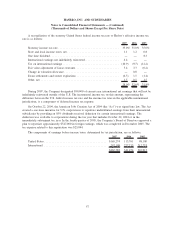

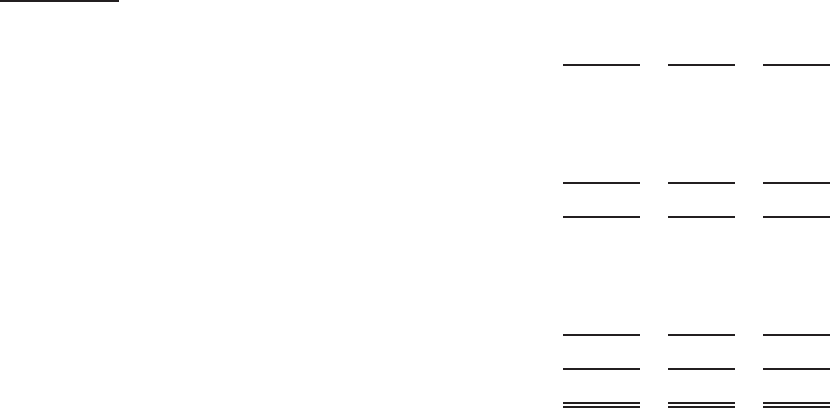

(8) Income Taxes

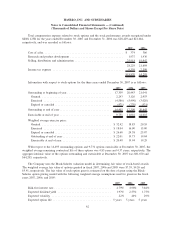

Income taxes attributable to earnings before income taxes are:

2007 2006 2005

Current

United States ...................................... $ 34,443 34,049 76,642

State and local ..................................... 5,497 3,203 7,147

International....................................... 51,861 49,200 39,081

91,801 86,452 122,870

Deferred

United States ...................................... 33,707 24,912 (20,611)

State and local ..................................... 2,889 2,135 (1,767)

International....................................... 982 (2,080) (1,654)

37,578 24,967 (24,032)

$129,379 111,419 98,838

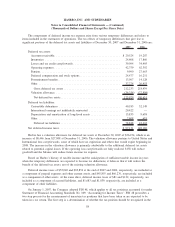

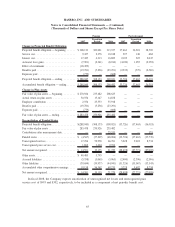

Certain income tax benefits (expenses), not reflected in income taxes in the statements of operations

totaled ($2,542) in 2007, $27,876 in 2006, and $8,426 in 2005. These income tax benefits (expenses) relate

primarily to pension amounts recorded in AOCE and stock options. In 2007, 2006, and 2005, the deferred tax

portion of the total benefit (expense) was ($20,163), $12,917, and $4,563, respectively.

56

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)