Hasbro 2007 Annual Report Download - page 37

Download and view the complete annual report

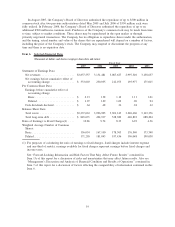

Please find page 37 of the 2007 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company is party to an accounts receivable securitization program whereby the Company sells, on

an ongoing basis, substantially all of its U.S. trade accounts receivable to a bankruptcy remote special purpose

entity, Hasbro Receivables Funding, LLC (“HRF”). HRF is consolidated with the Company for financial

reporting purposes. The securitization program then allows HRF to sell, on a revolving basis, an undivided

fractional ownership interest of up to $250,000 in the eligible receivables it holds to certain bank conduits.

During the period from the first day of the October fiscal month through the last day of the following January

fiscal month, this limit is increased to $300,000. The program provides the Company with a cost-effective

source of working capital. Based on the amount of eligible accounts receivable as of December 30, 2007, the

Company had $266,550 available to sell under this program of which $250,000 was utilized.

The Company has a revolving credit agreement (the “Agreement”) which provides it with a $300,000

committed borrowing facility. The Company has the ability to request increases in the committed facility in

additional increments of at least $50,000, up to a total committed facility of $500,000. The Agreement

contains certain financial covenants setting forth leverage and coverage requirements, and certain other

limitations typical of an investment grade facility, including with respect to liens, mergers and incurrence of

indebtedness. The Company was in compliance with all covenants as of and for the fiscal year ended

December 30, 2007. The Company had no borrowings outstanding under its committed revolving credit

facility at December 30, 2007. The Company also has other uncommitted lines from various banks, of which

approximately $37,833 was utilized at December 30, 2007. Amounts available and unused under the

committed line at December 30, 2007 were approximately $298,200.

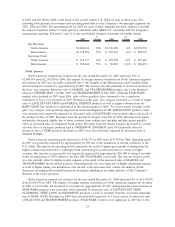

Net cash utilized by financing activities was $433,917 in 2007. Of this amount, $584,349, which includes

transaction costs, was used to repurchase shares of the Company’s common stock. In August 2007, the

Company’s Board of Directors authorized the repurchase of an additional $500,000 in common stock after two

previous authorizations dated May 2005 and July 2006 of $350,000 each were fully utilized. During 2007, the

Company repurchased 20,795 shares at an average price of $28.20. In addition, the Company purchased

certain warrants in May 2007 for $200,000 in accordance with the terms of the call provision of the amended

Lucas warrant agreement. Dividends paid were $94,097 in 2007 reflecting the increase in the Company’s

quarterly dividend rate to $0.16 per share in 2007 compared to $0.12 per share in 2006. These uses of cash

were partially offset by net proceeds of $346,009 from the issuance of $350,000 of Notes that are due in 2017.

The proceeds from the Notes were primarily used to repay short-term borrowings. The uses of cash were also

partially offset by cash receipts of $82,661 from the exercise of employee stock options.

Net cash utilized by financing activities was $467,279 in 2006. Of this amount, $456,744, which includes

transaction costs, was used to repurchase shares of the Company’s common stock. In July 2006, the

Company’s Board of Directors authorized the repurchase of $350,000 in common stock subsequent to the full

utilization of the Board of Director’s May 2005 authorization of $350,000. During 2006, the Company

repurchased 22,767 shares at an average price of $20.03. In addition, $32,743 was used to repay long-term

debt. Dividends paid were $75,282 in 2006 reflecting the increase in the Company’s quarterly dividend rate to

$0.12 per share in 2006 compared to $0.09 per share in 2005. These uses of cash were partially offset by cash

receipts of $86,257 from the exercise of employee stock options.

Net cash utilized by financing activities was $158,641 in 2005. This amount included repayments in

principal amount of long-term debt totaling $93,303. These amounts primarily related to $71,970 of bonds that

matured in November of 2005. The remaining amount related to repayment of long-term debt associated with

the Company’s former manufacturing facility in Spain. Dividends paid increased to $58,901 as a result of the

increase of the quarterly dividend rate to $0.09 in 2005 from $0.06. In 2005, the Company repurchased 2,386

of its common shares on the open market at an average price of $20.10 under the Board of Director’s

May 2005 authorization. The total cost of these repurchases, including transaction costs, was $48,030. The

Company received $45,278 in 2005 in proceeds from the exercise of employee stock options.

At December 30, 2007, the Company has outstanding $249,828 in principal amount of senior convertible

debentures due 2021. The senior convertible debentures bear interest at 2.75%, which could be subject to an

upward adjustment in the rate, not to exceed 11%, should the price of the Company’s stock trade at or below

$9.72 per share for 20 of the 30 trading days preceding the fifth day prior to an interest payment date. This

29