Google 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GOOGLE INC.

PART II

ITEM8.Notes to Consolidated Financial Statements

Acquisition of Nest

InJanuary2014,weenteredintoanagreementtoacquire100%ofNestLabs,Inc.(Nest),acompanywhosemissionistoreinvent

devicesinthehomesuchasthermostatsandsmokealarms,foratotalpurchasepriceof$3.2billionincash,subjecttoadjustments.

Priortothistransaction,wehadanapproximately12%ownershipinterestinNest,whichwasnetagainstthetotalconsideration.

WeexpectthattheacquisitionwillenhanceGoogle’ssuiteofproductsandservicesandallowNesttocontinuetoinnovate

upondevicesinthehome,makingthemmoreuseful,intuitive,andthoughtful,andtoreachmoreusersinmorecountries.The

transactionclosedonFebruary7,2014.

Thistransactionisconsidereda“stepacquisition”underGAAPwherebyourownershipinterestinNestheldbeforetheacquisition

isrequiredtoberemeasuredtofairvalueatthedateoftheacquisition.Thegainasaresultofremeasurementwillbeincluded

in“interestandotherincome,net”onourConsolidatedStatementofIncomeintherstquarterof2014.

Wearecurrentlyintheprocessofvaluingtheassetsacquiredandliabilitiesassumedinthetransaction,anddeterminingthe

fairvalueofourpreviouslyheldownershipinterestattheacquisitiondate.Wewillprovideallrequireddisclosuresuponthe

completionofthevaluationintherstquarterof2014.

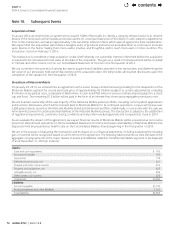

Divestiture of Motorola Mobile

OnJanuary29,2014,weenteredintoanagreementwithLenovoGroupLimited(Lenovo)providingforthedispositionofthe

MotorolaMobilesegmentforatotalpurchasepriceofapproximately$2.9billion(subjecttocertainadjustments),including

$1.4billiontobepaidatclose,comprisedof$660millionincashand$750millioninLenovoordinaryshares(subjecttoashare

capandoor).Theremaining$1.5billionwillbepaidintheformofaninterest-free,three-yearprepayablepromissorynote.

WewillmaintainownershipofthevastmajorityoftheMotorolaMobilepatentportfolio,includingcurrentpatentapplications

andinventiondisclosures,whichwillbelicensedbacktoMotorolaMobileforitscontinuedoperations.Lenovowillreceiveover

2,000patentassets,aswellastheMotorolaMobilitybrandandtrademarkportfolio.Additionally,inconnectionwiththesale,we

willindemnifyLenovoforcertainpotentialliabilitiesoftheMotorolaMobilebusiness.Thetransactionissubjecttothesatisfaction

ofregulatoryrequirements,customaryclosingconditionsandanyotherneededapprovalsandisexpectedtoclosein2014.

Asweevaluatetheimpactofthisagreement,weexpectnancialresultsofMotorolaMobilewillbepresentedasnetincome

(loss)fromdiscontinuedoperationsontheConsolidatedStatementofIncomeandassetsandliabilitiesofMotorolaMobiletobe

disposedofwillbepresentedasheldforsaleontheConsolidatedBalanceSheetsbeginningintherstquarterof2014.

Weareintheprocessofevaluatingthetransactionanditsimpactonournancialstatements,includingevaluatingtheresulting

gainorlossthatwillberecognized,basedonallthetermsoftheagreement.Thefollowingtablepresentsourbestestimateofthe

aggregatecarryingamountsofthemajorclassesofassetsandliabilitiesrelatedtotheMotorolaMobilesegmenttobedisposed

ofasofDecember31,2013(inmillions):

Assets:

Cashandcashequivalents $160

Accountsreceivable 783

Inventories 178

Deferredincometaxes,net 241

Prepaidandothercurrentassets 919

Propertyandequipment,net 425

Intangible assets, net 959

Otherassets,non-current 325

Total assets $ 3,990

Liabilities:

Accountspayable $ 1,132

Accruedexpensesandotherliabilities 1,531

Total liabilities $2,663

contents