Google 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GOOGLE INC.

PART II

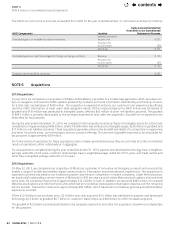

ITEM8.Notes to Consolidated Financial Statements

AsofDecember31,2013,ourfederalandstatecapitallosscarryforwardsforincometaxpurposeswereapproximately$349million

and$560million.Wealsohavedeferredtaxassetsforimpairmentlossesthat,ifrecognized,willbecapitalinnature.Webelieve

thatitismorelikelythannotthatourdeferredtaxassetsforcapitallossesandimpairmentlosseswillnotberealized.Therefore,

wehaverecordedavaluationallowanceonbothourfederalandstatedeferredtaxassetsfortheseitems.Wewillreassessthe

valuationallowancequarterlyandiffutureevidenceallowsforapartialorfullreleaseofthevaluationallowance,ataxbenet

willberecordedaccordingly.

InDecember2012,weenteredintoanagreementwithArrisGroupInc.(Arris)forthedispositionoftheMotorolaHomesegment.

AdeferredtaxassetwasestablishedforthebooktotaxbasisdierenceinourinvestmentintheMotorolaHomesegmentupon

signingtheagreementbecausethebasisdierencewasgoingtoberecognizedintheforeseeablefuture.InApril2013,upon

thedispositionoftheHomesegmenttoArris,ourbasisdierenceintheHomesegmentbecameabasisdierenceinGoogle’s

investmentinArrissharesreceivedinthedispositionandwasadjustedbytheamountofcashreceivedaspartofthetransaction.

SinceanyfuturelossestoberecognizeduponthedispositionofArrisshareswillbecapitallossesandwealreadyhaveanexcess

capitallosscarryforward,afullvaluationallowancewasrecordedagainstthisdeferredtaxasset.Wewillreassessthevaluation

allowancequarterlyandiffutureevidenceallowsforapartialorfullreleaseofthevaluationallowance,ataxbenetwillbe

recordedaccordingly.

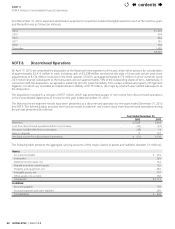

Uncertain Tax Positions

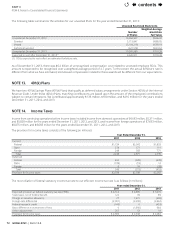

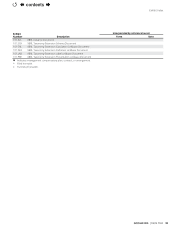

ThefollowingtablesummarizestheactivityrelatedtoourgrossunrecognizedtaxbenetsfromJanuary1,2011toDecember31,

2013(inmillions):

BalanceasofJanuary1,2011 $1,140

Increasesrelatedtoprioryeartaxpositions 77

Decreasesrelatedtoprioryeartaxpositions (9)

Decreasesrelatedtosettlementwithtaxauthorities (5)

Increasesrelatedtocurrentyeartaxpositions 361

BalanceasofDecember31,2011 1,564

Increasesrelatedtoprioryeartaxpositions 43

Decreasesrelatedtoprioryeartaxpositions (40)

Decreasesrelatedtosettlementwithtaxauthorities (62)

Increasesrelatedtoacquisition 17

Increasesrelatedtocurrentyeartaxpositions 411

BalanceasofDecember31,2012 1,933

Increasesrelatedtoprioryeartaxpositions 158

Decreasesrelatedtoprioryeartaxpositions (37)

Decreasesrelatedtosettlementwithtaxauthorities (78)

Increasesrelatedtocurrentyeartaxpositions 595

BalanceasofDecember31,2013 $2,571

Ourtotalunrecognizedtaxbenetsthat,ifrecognized,wouldaectoureectivetaxratewere$1,350million,$1,749million,and

$2,378millionasofDecember31,2011,2012,and2013.

AsofDecember31,2012and2013,wehadaccrued$139millionand$181millionforpaymentofinterestandpenalties.Interest

andpenaltiesincludedinourprovisionforincometaxeswerenotmaterialinalltheperiodspresented.

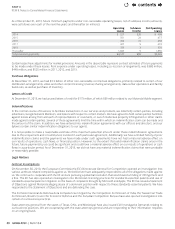

Weandoursubsidiariesareroutinelyexaminedbyvarioustaxingauthorities.AlthoughweleU.S.federal,U.S.state,andforeign

taxreturns,ourtwomajortaxjurisdictionsaretheU.S.andIreland.DuringthequarterendedDecember31,2007,theIRS

completeditsexaminationofour2003and2004taxyears.WehaveledanappealwiththeIRSforcertainissuesrelatedtothis

auditandsettlementswerereachedin2012onallbutoneissuewhichweplantolitigateincourt.Asaresultwereleasedthe

relatedreservesinthequarterendedDecember31,2012.TheIRSiscurrentlyinexaminationofour2007,2008,and2009tax

years.Weexpecttheexaminationtobecompletedwithinthenext12months,butwedonotanticipateanysignicantimpactto

ourunrecognizedtaxbenetbalanceasofDecember31,2013,relatedtoour2007,2008,and2009taxyears.

Our2010,2011,2012and2013taxyearsremainsubjecttoexaminationbytheIRSforU.S.federaltaxpurposes,andour2006

through2013taxyearsremainsubjecttoexaminationbytheappropriategovernmentalagenciesforIrishtaxpurposes.There

arevariousotherongoingauditsinvariousotherjurisdictionsthatarenotmaterialtoournancialstatements.

contents