Google 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM8.Notes to Consolidated Financial Statements

Aretroactiveextensionofthe2012federalresearchanddevelopmentcreditwassignedintolawonJanuary2,2013inaccordance

withTheAmericanTaxpayerActof2012.Thebenetof$189millionrelatedtothe2012federalresearchanddevelopmentcredit

isincludedintheyearendedDecember31,2013.

WehavenotprovidedU.S.incometaxesandforeignwithholdingtaxesontheundistributedearningsofforeignsubsidiariesas

ofDecember31,2013becauseweintendtopermanentlyreinvestsuchearningsoutsidetheU.S.Iftheseforeignearningswere

toberepatriatedinthefuture,therelatedU.S.taxliabilitymaybereducedbyanyforeignincometaxespreviouslypaidonthese

earnings.AsofDecember31,2013,thecumulativeamountofearningsuponwhichU.S.incometaxeshavenotbeenprovided

isapproximately$38.9billion.Determinationoftheamountofunrecognizeddeferredtaxliabilityrelatedtotheseearningsis

notpracticable.

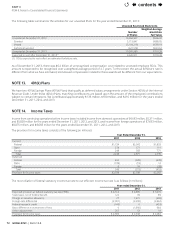

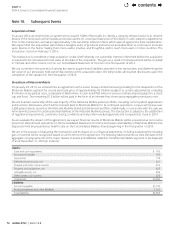

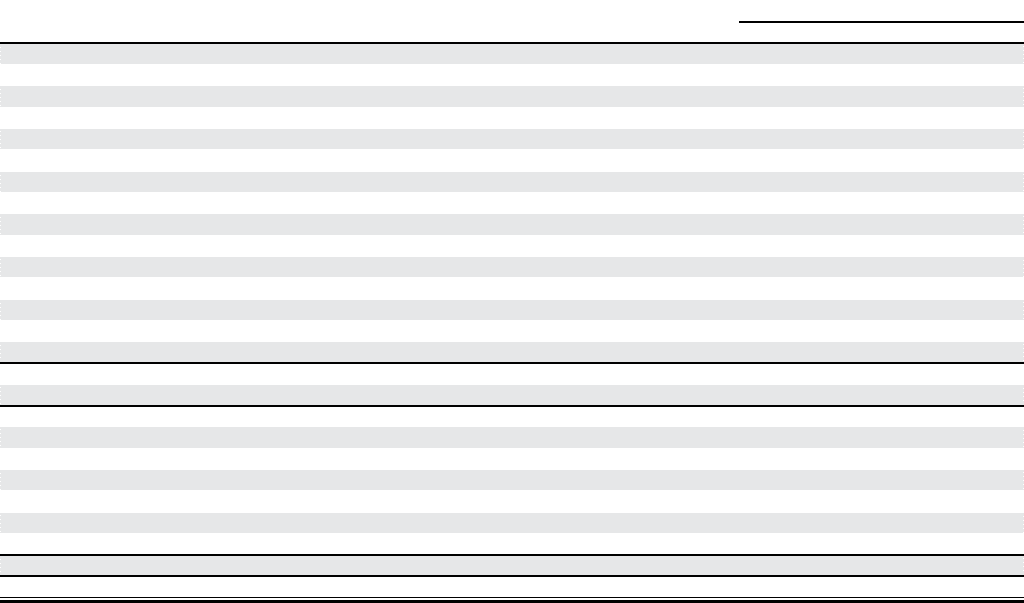

Deferred Tax Assets

Deferredincometaxesreecttheneteectsoftemporarydierencesbetweenthecarryingamountsofassetsandliabilitiesfor

nancialreportingpurposesandtheamountsusedforincometaxpurposes.Signicantcomponentsofourdeferredtaxassets

andliabilitiesareasfollows(inmillions):

As of December31,

2012 2013

Deferredtaxassets:

Stock-basedcompensationexpense $ 311 $ 283

Statetaxes 184 204

Capitallosscarryforward 236 215

SettlementwiththeAuthorsGuildandAAP 28 45

Vacationaccruals 67 94

Deferredrent 50 59

Accruedemployeebenets 323 383

Accrualsandreservesnotcurrentlydeductible 365 390

Unrealizedgain/lossoninvestmentsandothers 0 57

Netoperatinglosses 505 279

Taxcredit 274 394

BasisdierenceininvestmentofArris 2,043 1,372

Inventorywritedown 063

Other 128 128

Totaldeferredtaxassets 4,514 3,966

Valuationallowance (2,629)(1,899)

Totaldeferredtaxassetsnetofvaluationallowance 1,885 2,067

Deferredtaxliabilities:

Depreciationandamortization (761) (537)

Identiedintangibles (1,496) (1,479)

Unrealized gains on investments and other (105) 0

Otherprepaids (118) (125)

Other (133) (283)

Totaldeferredtaxliabilities (2,613) (2,424)

Netdeferredtaxliabilities $(728) $ (357)

AsofDecember31,2013,ourfederal,stateandforeignnetoperatinglosscarryforwardsforincometaxpurposeswereapproximately

$440million,$1,247millionand$824million.Ifnotutilized,thefederalnetoperatinglosscarryforwardswillbegintoexpirein

2019andthestatenetoperatinglosscarryforwardswillbegintoexpirein2014.Theforeignnetoperatinglosscanbecarried

forwardindenitely,howeveritismorelikelythannotthatitwillnotberealized,thereforewehaverecordedavaluationallowance

againstallmaterialforeignnetoperationlosses.Thenetoperatinglosscarryforwardsaresubjecttovariousannuallimitations

underthetaxlawsofthedierentjurisdictions.

AsofDecember31,2013,ourCaliforniaresearchanddevelopmentcreditcarryforwardsforincometaxpurposeswereapproximately

$450millionthatcanbecarriedoverindenitely.Webelieveitismorelikelythannotthataportionofthestatetaxcreditwill

notberealized.Therefore,wehaverecordedafullvaluationallowanceonthestatetaxcreditcarryforward.Wewillreassessthe

valuationallowancequarterlyandiffutureevidenceallowsforapartialorfullreleaseofthevaluationallowance,ataxbenet

willberecordedaccordingly.

AsofDecember31,2013,ourforeigntaxcreditcarryforwardsforincometaxpurposeswereapproximately$228millionthat

willstarttoexpirein2023.Webelieveitismorelikelythannotthatalloftheforeigntaxcreditwillberealized.Wewillreassess

theneedforavaluationallowanceonaquarterlybasisandiffutureevidencesupportsaneedtoestablishavaluationallowance,

thenataxexpensewillberecordedaccordingly.

contents