Google 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GOOGLE INC.

PART II

ITEM8.Notes to Consolidated Financial Statements

Class A and Class B Common Stock

Ourboardofdirectorshasauthorizedtwoclassesofcommonstock,ClassAandClassB.AtDecember31,2013,therewere

9,000,000,000and3,000,000,000sharesauthorizedandtherewere279,325,564and56,506,728sharesoutstandingofClassA

andClassBcommonstock,$0.001parvalue.TherightsoftheholdersofClassAandClassBcommonstockareidentical,except

withrespecttovoting.EachshareofClassAcommonstockisentitledtoonevotepershare.EachshareofClassBcommonstock

isentitledto10votespershare.SharesofClassBcommonstockmaybeconvertedatanytimeattheoptionofthestockholder

andautomaticallyconvertuponsaleortransfertoClassAcommonstock.WerefertoClassAandClassBcommonstockas

commonstockthroughoutthenotestothesenancialstatements,unlessotherwisenoted.

InApril2012,ourboardofdirectorsapprovedamendmentstoourcerticateofincorporationthatwould,amongotherthings,

createanewclassofnon-votingcapitalstock(ClassCcapitalstock).Theamendmentsauthorized3billionsharesofClassC

capitalstockandalsoincreasedtheauthorizedsharesofClassAcommonstockfrom6billionto9billion.Theamendmentsare

reectedinourFourthAmendedandRestatedCerticateofIncorporation(NewCharter),theadoptionofwhichwasapprovedby

stockholdersatour2012AnnualMeetingofStockholdersheldonJune21,2012.InJanuary2014,ourboardofdirectorsconsidered

andapprovedadistributionofsharesoftheClassCcapitalstockasadividendtoourholdersofClassAandClassBcommon

stock(Dividend).TheDividendwillhavearecorddateofMarch27,2014andapaymentdateofApril2,2014.TheClassCcapital

stockwillhavenovotingrights,exceptasrequiredbyapplicablelaw.ExceptasexpresslyprovidedintheNewCharter,sharesof

ClassCcapitalstockwillhavethesamerightsandprivilegesandrankequally,shareratablyandbeidenticalinallotherrespects

tothesharesofClassAcommonstockandClassBcommonstockastoallmatters.

InaccordancewiththesettlementoflitigationinvolvingtheauthorizationtodistributetheClassCcapitalstock,wemaybe

obligatedtomakeapaymenttoholdersoftheClassCstockif,onaverage,ClassCtradesbelowClassAintherstyearfollowing

theClassCissuance,payableincash,ClassAstock,ClassCstock,oracombinationthereof,atthediscretionoftheBoardof

Directors.BecausetheClassCshareshavenotyetbeenissuedorcommencedtrading,wecannotreliablypredictwhat,ifany,

patternswillemergeovertimewithrespecttotherelativetradingpricesofClassAandClassCshares.

TheparvaluepershareofoursharesofClassAcommonstockandClassBcommonstockwillremainunchangedat$0.001per

shareaftertheDividend.OntheeectivedateoftheDividend,therewillbeatransferbetweenretainedearningsandcommon

stockandtheamounttransferredwillbeequaltothe$0.001parvalueoftheClassCcapitalstockthatisissued.Wewillgive

retroactiveeecttopriorperiodshareandpershareamountsinourconsolidatednancialstatementsfortheeectofthe

Dividend,suchthatpriorperiodsarecomparabletocurrentperiodpresentation.

Stock Plans

Wemaintainthe1998StockPlan,the2000StockPlan,the2003StockPlan,the2003StockPlan(No.2),the2003StockPlan

(No.3),the2004StockPlan,the2012StockPlan,andplansassumedthroughacquisitions,allofwhicharecollectivelyreferred

toasthe“StockPlans.”UnderourStockPlans,incentiveandnon-qualiedstockoptionsorrightstopurchasecommonstock

maybegrantedtoeligibleparticipants.Optionsaregenerallygrantedforatermof10years.UndertheStockPlans,wehavealso

issuedRSUs.AnRSUawardisanagreementtoissuesharesofourstockatthetimetheawardvests.Exceptforoptionsgranted

pursuanttoourstockoptionexchangeprogramcompletedinMarch2009(theExchange),optionsgrantedandRSUsissuedto

participantsundertheStockPlansgenerallyvestoverfouryearscontingentuponemploymentorservicewithusonthevestingdate.

AsofDecember31,2012andDecember31,2013,therewere15,833,050and9,455,085sharesofcommonstockreservedfor

futureissuanceunderourStockPlans.

WeestimatedthefairvalueofeachoptionawardonthedateofgrantusingtheBSMoptionpricingmodel.Ourassumptions

aboutstock-pricevolatilityhavebeenbasedexclusivelyontheimpliedvolatilitiesofpubliclytradedoptionstobuyourstockwith

contractualtermsclosesttotheexpectedlifeofoptionsgrantedtoouremployees.Weestimatetheexpectedtermbasedupon

thehistoricalexercisebehaviorofouremployees.Therisk-freeinterestrateforperiodswithinthecontractuallifeoftheaward

isbasedontheU.S.Treasuryyieldcurveineectatthetimeofgrant.

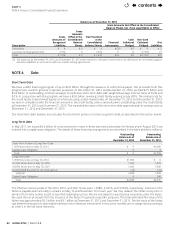

Thefollowingtablepresentstheweighted-averageassumptionsusedtoestimatethefairvaluesofthestockoptionsgrantedin

theperiodspresented:

Year Ended December31,

2011 2012 2013

Risk-freeinterestrate 2.3% 1.0% 0.9%

Expectedvolatility 33% 29% 29%

Expectedlife(inyears) 5.9 5.2 5.8

Dividendyield 0 0 0

Weighted-averageestimatedfairvalueofoptionsgrantedduringtheyear $210.07 $194.27 $214.39

contents