Google 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

PART II

ITEM8.NotestoConsolidatedFinancialStatements

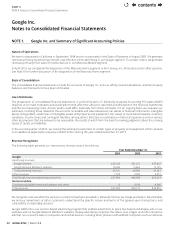

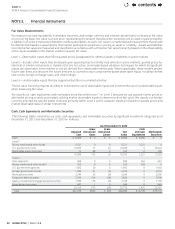

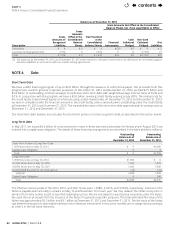

As of December 31, 2013

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Cash and

Cash

Equivalents

Marketable

Securities

Cash $9,909 $0$0$9,909 $9,909 $0

Level1:

Moneymarketandotherfunds 4,428 0 0 4,428 4,428 0

U.S.governmentnotes 18,276 23 (37) 18,262 2,501 15,761

Marketableequitysecurities 197 167 0 364 0 364

22,901 190 (37) 23,054 6,929 16,125

Level2:

Timedeposits(1) 1,207 0 0 1,207 790 417

Moneymarketandotherfunds(2) 1,270 0 0 1,270 1,270 0

U.S.governmentagencies 4,575 3 (3) 4,575 0 4,575

Foreigngovernmentbonds 1,502 5 (26) 1,481 0 1,481

Municipal securities 2,904 9 (36) 2,877 0 2,877

Corporatedebtsecurities 7,300 162 (67) 7,395 0 7,395

Agencyresidentialmortgage-backedsecurities 5,969 27 (187) 5,809 0 5,809

Asset-backedsecurities 1,142 0 (2) 1,140 0 1,140

25,869 206 (321) 25,754 2,060 23,694

Total $58,679 $396 $(358) $58,717 $18,898 $39,819

(1) Majorityofourtimedepositsareforeigndeposits.

(2) ThebalancesatDecember31,2012andDecember31,2013wererelatedtocashcollateralreceivedinconnectionwithoursecurities

lendingprogram,whichwasinvestedinreverserepurchaseagreementsmaturingwithinthreemonths.Seebelowforfurtherdiscussionof

thisprogram.

Duringthesecondquarterof2013,wereceivedapproximately$175millioninArris’commonstock(10.6millionshares)in

connectionwiththedispositionoftheMotorolaHomesegment(seedetailsinNote8).Thesesharesareaccountedforas

available-for-salemarketableequitysecurities.

Wedeterminerealizedgainsorlossesonthesaleofmarketablesecuritiesonaspecicidenticationmethod.Werecognizedgross

realizedgainsof$383millionand$460millionfortheyearsendedDecember31,2012andDecember31,2013.Werecognized

grossrealizedlossesof$101millionand$259millionfortheyearsendedDecember31,2012andDecember31,2013.Wereect

thesegainsandlossesasacomponentofinterestandotherincome,net,intheaccompanyingConsolidatedStatementsofIncome.

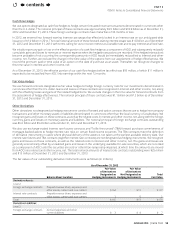

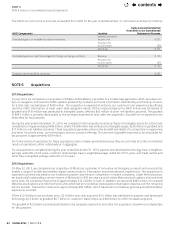

Thefollowingtablesummarizestheestimatedfairvalueofourinvestmentsinmarketabledebtsecurities,accountedforas

available-for-salesecuritiesandclassiedbythecontractualmaturitydateofthesecurities(inmillions):

As of

December31,2013

Duein1year $11,583

Duein1yearthrough5years 15,601

Duein5yearsthrough10years 6,405

Dueafter10years 5,866

Total $39,455

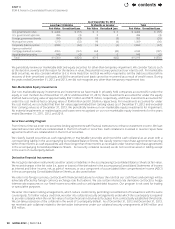

Thefollowingtablespresentgrossunrealizedlossesandfairvaluesforthoseinvestmentsthatwereinanunrealizedlossposition

asofDecember31,2012andDecember31,2013,aggregatedbyinvestmentcategoryandthelengthoftimethatindividual

securitieshavebeeninacontinuouslossposition(inmillions):

As of December31, 2012

Less than 12 Months 12 Months or Greater Total

Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss

U.S.governmentnotes $842 $(1) $0$0$842 $(1)

Foreigngovernmentbonds 509 (2) 12 (1) 521 (3)

Municipal securities 686 (6) 9 0 695 (6)

Corporatedebtsecurities 820 (10) 81 (4) 901 (14)

Agencyresidential

mortgage-backedsecurities 1,300 (6) 0 0 1,300 (6)

Total $4,157 $(25) $102 $(5) $4,259 $(30)

contents