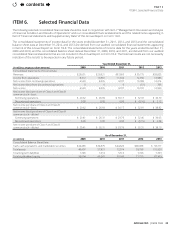

Google 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17GOOGLE INC.

ITEM1A.RiskFactors

Quarterly variations in our results of operations or those of our competitors.

Announcementsbyusorourcompetitorsofacquisitions,newproducts,signicantcontracts,commercialrelationships,

or capital commitments.

Recommendations by securities analysts or changes in earnings estimates.

Announcements about our earnings that are not in line with analyst expectations, the risk of which is enhanced because

it is our policy not to give guidance on earnings.

Announcements by our competitors of their earnings that are not in line with analyst expectations.

Commentarybyindustryandmarketprofessionalsaboutourproducts,strategies,andothermattersaectingourbusiness

and results, regardless of its accuracy.

The volume of shares of Class A common stock available for public sale.

SalesofClassAcommonstockbyusorbyourstockholders(includingsalesbyourdirectors,executiveocers,and

otheremployees).

Short sales, hedging, and other derivative transactions on shares of our Class A common stock.

In addition, following the settlement of litigation involving the authorization to distribute our non-voting Class C capital stock,

our board of directors has approved a distribution of shares of Class C capital stock as a dividend to our holders of Class A and

ClassBcommonstock.WeexpectthatthemarketpriceforthesharesofClassAcommonstockwillgenerallyreecttheeectof

a two-for-one stock split once the dividend is distributed. Although we plan to list the Class C capital stock on The Nasdaq Stock

Market, we cannot predict whether, or to what extent, a liquid trading market will develop for the Class C capital stock. If it does

not or if the Class C capital stock is not attractive to targets as an acquisition currency or to our employees as an incentive, we may

not achieve our objectives in creating this new class. As in the case of the Class A common stock, the trading price for the Class C

capitalstockmayalsobevolatileandaectedbythefactorsnotedabove,aswellasbythedierenceinvotingrightsasbetween

the Class A common stock and the Class C capital stock, the volume of Class C capital stock available for public sale and sales by

us and our stockholders of Class C capital stock, including by institutional investors that may be unwilling, unable or choose not

to hold non-voting shares they receive as part of the stock dividend. Whether or not the Class C capital stock is included in stock

indicesinthefuturemayalsoaectthetradingpricesoftheClassAcommonstockandtheClassCcapitalstock.

In addition, the stock market in general, and the market for technology companies in particular, have experienced extreme price

andvolumeuctuationsthathaveoftenbeenunrelatedordisproportionatetotheoperatingperformanceofthosecompanies.

These broad market and industry factors may harm the market price of our Class A common stock and our Class C capital Stock

regardless of our actual operating performance.

OurClassBcommonstockhas10votespershareandourClassAcommonstockhasonevotepershare.AsofDecember31,

2013,Larry,Sergey,andEricbeneciallyownedapproximately92.2%ofouroutstandingClassBcommonstock,representing

approximately61.7%ofthevotingpowerofouroutstandingcapitalstock.Larry,Sergey,andEricthereforehavesignicant

inuenceovermanagementandaairsandoverallmattersrequiringstockholderapproval,includingtheelectionofdirectors

andsignicantcorporatetransactions,suchasamergerorothersaleofourcompanyorourassets,fortheforeseeablefuture.

In addition, because our Class C capital stock carries no voting rights (except as required by applicable law), the issuance of the

Class C capital stock, including in future stock-based acquisition transactions and to fund employee equity incentive programs,

could prolong the duration of Larry and Sergey’s current relative ownership of our voting power and their ability to elect all of our

directors and to determine the outcome of most matters submitted to a vote of our stockholders. Together with Eric, they would

also continue to be able to control any required stockholder vote with respect to certain change in control transactions involving

Google (including an acquisition of Google by another company).

Thisconcentratedcontrollimitsorseverelyrestrictsourstockholders’abilitytoinuencecorporatemattersand,asaresult,we

maytakeactionsthatourstockholdersdonotviewasbenecial.Asaresult,themarketpriceofourClassAcommonstockand

ourClassCcapitalstockcouldbeadverselyaected.

Provisions in our charter documents and under Delaware law could discourage a takeover that stockholders may

consider favorable.

Provisionsinourcerticateofincorporationandbylawsmayhavetheeectofdelayingorpreventingachangeofcontrolor

changes in our management. These provisions include the following:

Ourcerticateofincorporationprovidesforatri-classcapitalstockstructure.Asaresultofthisstructure,Larry,Sergey,

andErichavesignicantinuenceoverallmattersrequiringstockholderapproval,includingtheelectionofdirectorsand

signicantcorporatetransactions,suchasamergerorothersaleofourcompanyorourassets.Thisconcentratedcontrol

could discourage others from initiating any potential merger, takeover, or other change of control transaction that other

contents