Google 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 GOOGLE INC.

PART II

ITEM8.Notes to Consolidated Financial Statements

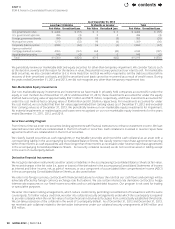

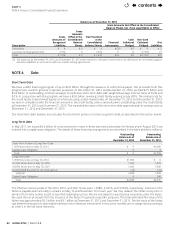

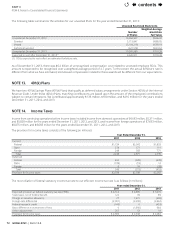

Description

Balance as of December31, 2013

Gross Amounts Not Oset in the Consolidated

Balance Sheets, but Have Legal Rights to Oset

Gross

Amounts of

Recognized

Liabilities

Gross

Amounts

Oset in the

Consolidated

Balance

Sheets

Net Presented

in the

Consolidated

Balance Sheets

Financial

Instruments

Cash

Collateral

Pledged

Non-Cash

Collateral

Pledged

Net

Liabilities

Derivatives $ 4 $ 0 $ 4 $ (2)(3) $ 0 $ 0 $ 2

Securities lending agreements 1,374 0 1,374 0 0 (1,357) 17

Total $ 1,378 $ 0 $ 1,378 $ (2) $ 0 $ (1,357) $19

(3) The balances at December 31, 2012 and December 31, 2013 were related to derivative assets which are allowed to be net settled against

derivativeliabilitiesinaccordancewithourmasternettingagreements.

Debt

Short-Term Debt

Wehaveadebtnancingprogramofupto$3.0billionthroughtheissuanceofcommercialpaper.Netproceedsfromthis

programareusedforgeneralcorporatepurposes.AtDecember31,2012andDecember31,2013,wehad$2.5billionand

$2.0billionofoutstandingcommercialpaperrecordedasshort-termdebtwithweighted-averageinterestratesof0.2%and

0.1%.Inconjunctionwiththisprogram,wehavea$3.0billionrevolvingcreditfacilityexpiringinJuly2016.Theinterestratefor

thecreditfacilityisdeterminedbasedonaformulausingcertainmarketrates.AtDecember31,2012andDecember31,2013,

wewereincompliancewiththenancialcovenantinthecreditfacility,andnoamountswereoutstandingunderthecreditfacility

atDecember31,2012andDecember31,2013.Theestimatedfairvalueoftheshort-termdebtapproximateditscarryingvalueat

December31,2012andDecember31,2013.

Ourshort-termdebtbalancealsoincludestheshort-termportionofcertainlong-termdebt,asdescribedinthesectionbelow.

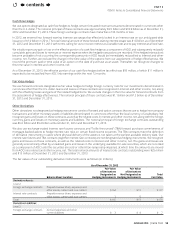

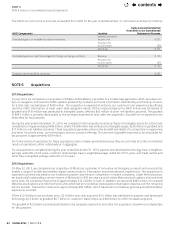

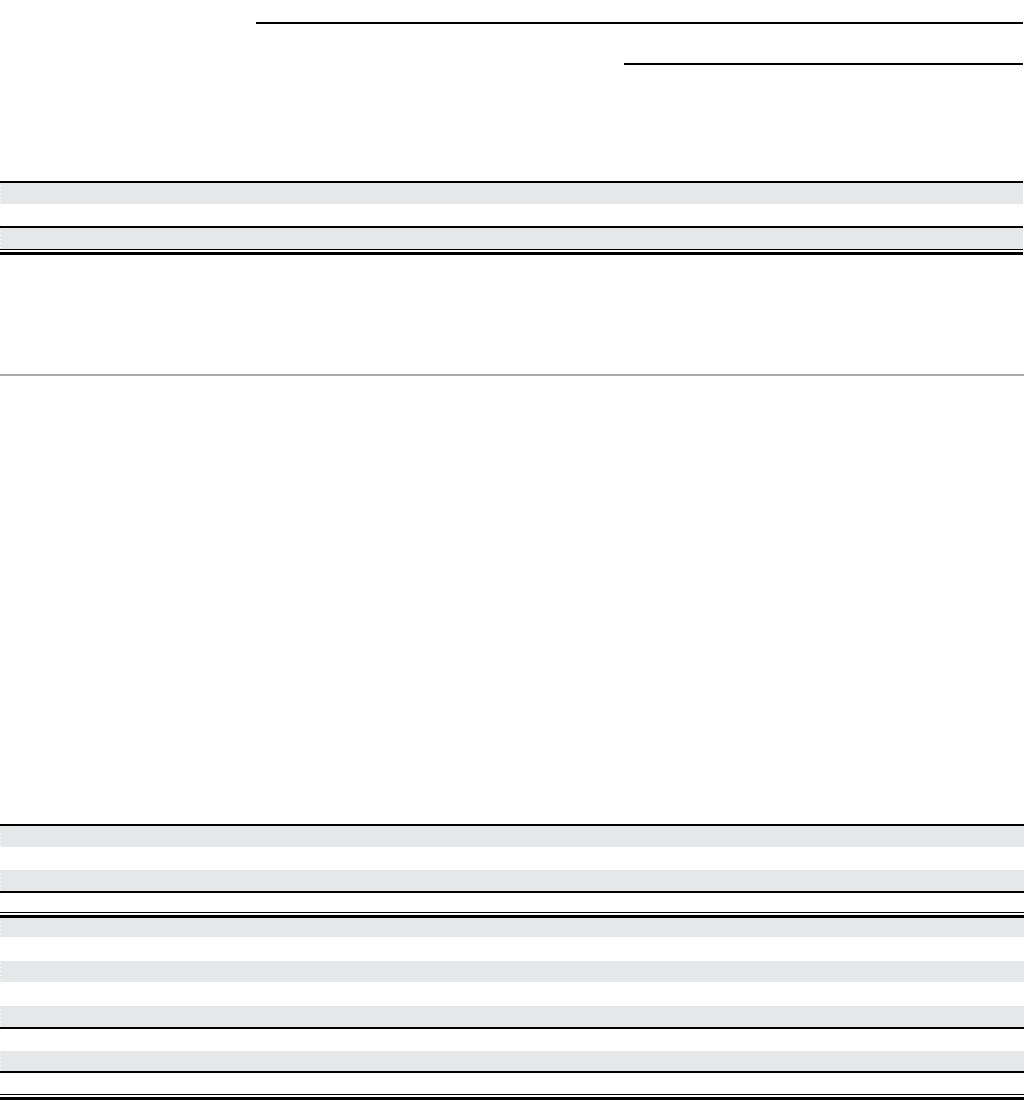

Long-Term Debt

InMay2011,weissued$3.0billionofunsecuredseniornotesinthreetranches(collectively,theNotes)andinAugust2013,we

enteredintoacapitalleaseobligation.Thedetailsofthesenancingarrangementsaredescribedinthetablebelow(inmillions):

Outstanding

Balance As of

December31, 2012

Outstanding

Balance As of

December31, 2013

Short-TermPortionofLong-TermDebt

1.25%NotesdueonMay19,2014 $ 0 $1,000

CapitalLeaseObligation 0 9

Total $ 0 $1,009

Long-TermDebt

1.25%NotesdueonMay19,2014 $1,000 $ 0

2.125%NotesdueonMay19,2016 1,000 1,000

3.625%NotesdueonMay19,2021 1,000 1,000

UnamortizeddiscountfortheNotesabove (12) (10)

Subtotal 2,988 1,990

CapitalLeaseObligation 0246

Total $2,988 $2,236

Theeectiveinterestyieldsofthe2014,2016,and2021Noteswere1.258%,2.241%,and3.734%,respectively.Interestonthe

Notesispayablesemi-annuallyinarrearsonMay19andNovember19ofeachyear.WemayredeemtheNotesatanytimein

wholeorfromtimetotimeinpartatspeciedredemptionprices.WearenotsubjecttoanynancialcovenantsundertheNotes.

WeusedthenetproceedsfromtheissuanceoftheNotesforgeneralcorporatepurposes.Thetotalestimatedfairvalueofthe

Noteswasapproximately$3.2billionand$3.1billionatDecember31,2012andDecember31,2013.ThefairvalueoftheNotes

wasdeterminedbasedonobservablemarketpricesofidenticalinstrumentsinlessactivemarketsandiscategorizedaccordingly

asLevel2inthefairvaluehierarchy.

contents