Google 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

PART II

ITEM8.NotestoConsolidatedFinancialStatements

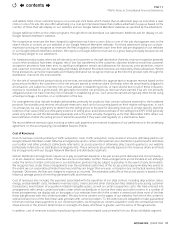

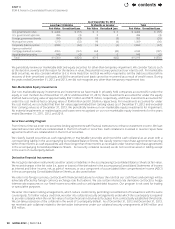

Cash Flow Hedges

Weuseoptionsdesignatedascashowhedgestohedgecertainforecastedrevenuetransactionsdenominatedincurrenciesother

thantheU.S.dollar.Thenotionalprincipalofthesecontractswasapproximately$9.5billionand$10.0billionasofDecember31,

2012andDecember31,2013.Theseforeignexchangecontractshavematuritiesof36monthsorless.

In2012,weenteredintoforward-startinginterestrateswapsthateectivelylockedinaninterestrateonouranticipateddebt

issuanceof$1.0billionin2014.Thetotalnotionalamountoftheseforward-startinginterestswapswas$1.0billionasofDecember

31,2012andDecember31,2013withtermscallingforustoreceiveinterestatavariablerateandtopayinterestataxedrate.

WeinitiallyreportanygainorlossontheeectiveportionofacashowhedgeasacomponentofAOCIandsubsequentlyreclassify

cumulativegainsandlossestorevenuesorinterestexpensewhenthehedgedtransactionsarerecorded.Ifthehedgedtransactions

becomeprobableofnotoccurring,thecorrespondingamountsinAOCIwouldbeimmediatelyreclassiedtointerestandother

income,net.Further,weexcludethechangeinthetimevalueoftheoptionsfromourassessmentofhedgeeectiveness.We

recordthepremiumpaidortimevalueofanoptiononthedateofpurchaseasanasset.Thereafter,werecognizechangesto

thistimevalueininterestandotherincome,net.

AsofDecember31,2013,theeectiveportionofourcashowhedgesbeforetaxeectwas$93million,ofwhich$11millionis

expectedtobereclassiedfromAOCIintoearningswithinthenext12months.

Fair Value Hedges

Weuseforwardcontractsdesignatedasfairvaluehedgestohedgeforeigncurrencyrisksforourinvestmentsdenominatedin

currenciesotherthantheU.S.dollar.Gainsandlossesonthesecontractsarerecognizedininterestandotherincome,net,along

withtheosettinglossesandgainsoftherelatedhedgeditems.Weexcludechangesinthetimevalueforforwardcontractsfrom

theassessmentofhedgeeectiveness.Thenotionalprincipalofthesecontractswas$1.1billionand$1.2billionasofDecember

31,2012andDecember31,2013.

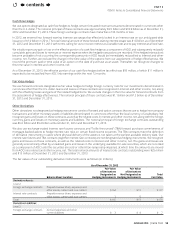

Other Derivatives

Otherderivativesnotdesignatedashedginginstrumentsconsistofforwardandoptioncontractsthatweusetohedgeintercompany

transactionsandothermonetaryassetsorliabilitiesdenominatedincurrenciesotherthanthelocalcurrencyofasubsidiary.We

recognizegainsandlossesonthesecontracts,aswellastherelatedcostsininterestandotherincome,net,alongwiththeforeign

currencygainsandlossesonmonetaryassetsandliabilities.Thenotionalprincipalofforeignexchangecontractsoutstanding

was$6.6billionand$9.4billionatDecember31,2012andDecember31,2013.

Wealsouseexchange-tradedinterestratefuturescontractsand“ToBeAnnounced”(TBA)forwardpurchasecommitmentsof

mortgage-backedassetstohedgeinterestraterisksoncertainxedincomesecurities.TheTBAcontractsmeetthedenition

ofderivativeinstrumentsincaseswherephysicaldeliveryoftheassetsisnottakenattheearliestavailabledeliverydate.Our

interestratefuturesandTBAcontracts(togetherinterestratecontracts)arenotdesignatedashedginginstruments.Werecognize

gainsandlossesonthesecontracts,aswellastherelatedcostsininterestandotherincome,net.Thegainsandlossesare

generallyeconomicallyosetbyunrealizedgainsandlossesintheunderlyingavailable-for-salesecurities,whicharerecorded

asacomponentofAOCIuntilthesecuritiesaresoldorother-than-temporarilyimpaired,atwhichtimetheamountsaremoved

fromAOCIintointerestandotherincome,net.Thetotalnotionalamountsofinterestratecontractsoutstandingwere$25million

and$13millionatDecember31,2012andDecember31,2013.

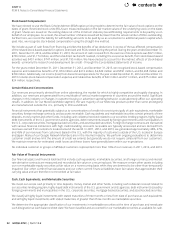

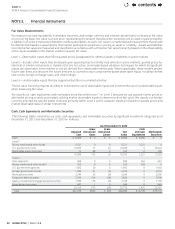

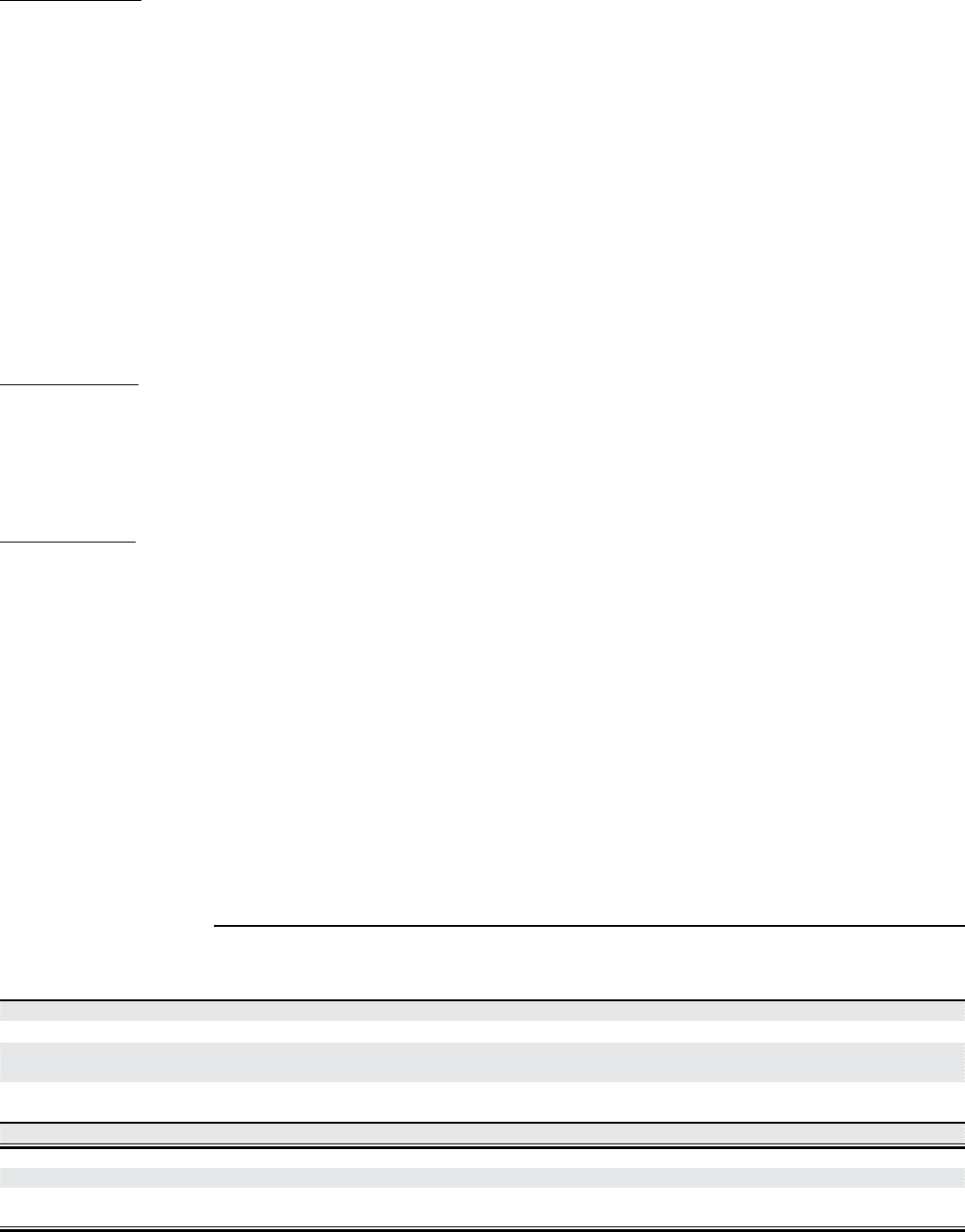

Thefairvaluesofouroutstandingderivativeinstrumentswereasfollows(inmillions):

As of December31, 2012

Balance Sheet Location

Fair Value

ofDerivatives

Designated as

HedgingInstruments

Fair Value

ofDerivatives

NotDesignated as

Hedging Instruments

Total

FairValue

Derivative Assets:

Level2:

Foreignexchangecontracts Prepaidrevenueshare,expensesand

otherassets,currentandnon-current $164 $13 $177

Interestratecontracts Prepaidrevenueshare,expensesand

otherassets,currentandnon-current 1 0 1

Total $165 $13 $178

Derivative Liabilities:

Level2:

Foreignexchangecontracts Accruedexpensesandother

currentliabilities $3$4$7

contents